April 7, 2025

Recent political and economic decisions, particularly tariffs, have strained relationships with allies like Canada, Mexico, Australia, and European countries, causing diplomatic fallout and economic uncertainty. In this article on Medium.com, Sean Randolph, Senior Director of the Institute, reflects on the declining strength of U.S. global alliances and emphasizes the long-term impacts of dismantling institutions and relationships.

February 25, 2024

AI is fueling economic recovery in the Bay Area. Chinese AI startup DeepSeek’s open-source R1 model has raised concerns about AI investment, but its energy-efficient and low-cost innovations could accelerate AI adoption. In this San Francisco Business Times article, Sean Randolph, Senior Director of the Institute, highlights how AI’s growing impact across industries, combined with California’s emphasis on workforce training and innovation, will help the region maintain its leadership in the sector.

November 11, 2024

The Trump presidency will reshape the United States relationship with the rest of the world. Changes from the current administration will be abrupt, with a long list of campaign promises revolving around ending the war in Ukraine, immigration reform, tariffs, and much more. In this article in the Silicon Valley Business Journal, Sean Randolph, Senior Director of the Institute, puts aside the strategic issues and details early takeaways on the economic side of the incumbent administration.

Explore the traffic tracker here.

Each month, the Bay Area Council Economic Institute compiles data from the region’s 7 state-owned toll bridges, as well as ridership data from AC Transit, BART, Caltrain, Golden Gate Ferry, Muni, WETA, and VTA, to better understand how transit agencies are faring compared to bridge crossings.

Last update: February 2025

Note: Updates are made at the end of each month for the prior month’s data. Additionally, most transit agencies (aside from BART) are lagged by one month in their public data release schedule.

On October 22nd the Institute previewed the biennial release of the Bay Area Economic Profile. This 11th edition focuses on understanding the key economic indicators as the regional economy recovers from the COVID-19 recession. The Bay Area Council Economic Institute also launched a new website (BayAreaProfile.com) that will be updated continuously with data on employment, housing markets, population change, and transportation flows. The October 22 webinar featured panels of prominent economists from the private sector and local universities: Jeff Korzenik, Chief Investment Strategist, Fifth Third Bank; Sarah Bohn, Senior Fellow, Public Policy Institute of California; and Mark Duggan, Director, Stanford Institute for Economic Policy Research, as they provide their outlooks for the national and local economies.

Please check back in at BayAreaProfile.com for economic profile updates that will be released through the end of the year.

This report shares the learnings from the BAYEP project and provides recommendations for improving how the region’s business and civic leaders can create an inclusive economy through offering better supports and opportunities for young men of color and others systematically disadvantaged by our economic system. Our findings are informed by a rich literature in collaboration with LeadersUp as well as companion analyses by PolicyLink and Urban Strategies Council. Crucially, the voices of the young men themselves helped guide our conclusions as we incorporate the findings of surveys and focus groups conducted throughout this effort.

The program will feature a roundtable discussion with key stakeholders in inclusive economy efforts. This includes employers, political leaders, community based organizations, talent development partners, policy advocacy organziations and other stakeholders in the workforce development system.

Closed for RSVPs, please contact Estevan Lopez, Research Analyst for more information.

The Bay Area economy has been the envy of the world for fifty years running. Our business leaders have revolutionized industries from semiconductors to personal computers to the internet to social media and in healthcare, biotechnology, environmental science and many other fields. Today’s challenge is to preserve the growth and resilience of our economy and to share our prosperity more broadly, particularly through the creation of more middle wage jobs. In order to ensure the Bay Area’s economic vitality and resilience despite increasing boom and bust cycles, public and private sector leaders must come together around pragmatic solutions to persistent issues and barriers to success.

Institute Senior Director Sean Randolph offers initial analysis of the historic vote in Britain to exit the European Union and its impact on the Bay Area economically.

The full implications of Britain’s decision to leave the European Union remain uncertain, but some are foreseeable. In the short term equity markets – particularly financials – will be hit, with new uncertainty in global financial markets. Economists predict that Britain’s departure will cloud the prospects for its economy, leading to a recession. If this occurs Bay Area companies may be impacted, since Britain is one of the region’s leading trade and investment partners. A significant devaluation of the pound and strengthening of the dollar could negatively impact exports in particular.

The long term implications are less predictable, but could be large. London – where a number of Bay Area banks base their European operations – will see its status as a global financial center diminished, as institutions doing business in Europe shift their operations. Other US companies with European headquarters in London will also shift resources to the continent. This could benefit other European centers, such as Germany. Companies located in the UK will find it more difficult to attract European and other talent, with significant implications not only for large companies but for startups as well.

By raising a border between Britain and Europe, the regulatory cost and complexity for Bay Area companies conducting business in Europe will increase, as the efficiency of what is now a single market in Europe for trade in goods is reduced. Business and leisure travelers between Europe and the UK will likely face new visa requirements.

Within the EU, Britain has been a voice for market policies similar to those in the US, but will no longer be at the table. This could impact future policy direction in the EU in ways that are not helpful to Bay Area technology and other global companies.

At the political level, anti-EU and separatist movements across Europe will be encouraged. Britain’s exit will encourage sub-national entities seeking independence from their countries to make a break. Scotland, where an independence referendum only narrowly failed in 2014, may move first, and Catalonia in Spain may not be far behind. The creation of a border between Northern Ireland (which is part of the UK) and the Republic of Ireland raises further issues.

In the end, Britain’s departure points toward a less integrated, more divided Europe, and increased business costs. The growing strength of populist movements in both Europe and the US will add to the growing political pushback against trade agreements such as the Trans-Pacific Partnership with Asia and the Trans-Atlantic Trade and Investment Partnership (TTIP) with Europe. Many of the issues that Brexit raises will be worked out in Britain’s negotiations with the EU, and Britain will remain an important long term partner for the United States. What is also clear, however, is that in the post-Brexit environment the economic globalization on which much of our recent prosperity has been based is open to question.

(Image from Flickr used Davide D’Amico)

On Monday January 18, 2016, Institute President Micah Weinberg appeared as a guest speaker on Inside Silicon Valley, a radio program presented by Joint Venture Silicon Valley hosted by Russell Hancock. During the program — which can be heard on the show’s iTunes Channel here — Micah discussed the pressing issues the Bay Area’s economy and infrastructure faces today and possible solutions outlined in the Economic Institute’s A Roadmap for Economic Resilience report published in November 2015.

Weinberg emphasizes that while the Bay Area has seen great economic success following the Great Recession, the region is not immune to a possible future economic downturn. The Bay Area currently faces relatively unique issues when compared to the rest of the nation; limited affordable housing, lack of a strong regional transportation infrastructure, and high living costs threaten the region’s continued success. Micah expresses his concern for the increasing levels of poverty, as prosperity is not equally shared among the region’s residents.

In order to solve these issues the Bay Area Council and the Bay Area Council Economic Institute propose that the governance of the Bay Area is treated as a locality rather than on a county-by-county and city-by-city basis, thus facilitating the implementation of solutions that benefit all residents as they navigate through the nine county Bay Area. By allowing decisions to be made on a broader platform while city and county agencies continue to oversee their implementation, the Bay Area will foreseeably be able to overcome future challenges. Additionally, education and workforce development are presented as key aspects in the improvement and stability of the economy, and as a consequence, people’s livelihoods.

by Tracey Grose & Patrick Kallerman

Last Tuesday, a U.S. District judge in San Francisco granted class-action status to a lawsuit brought by three California Uber drivers. The case could ultimately decide one of the biggest unanswered questions of the so-called “1099 economy”: do we have an independent contractor problem? Are all participants (in this case, Uber drivers), independent contractors, or do some qualify as actual employees? Are 1099 jobs inherently subpar, or do some models offer new flexibility to the benefit of both worker and employer?

The new technology platforms that bring greater flexibility to the marketplace by enabling short-term and task-based work are diverse, as are the business and earnings models underlying them. During an era of wage stagnation and growing income disparity, and with increasing numbers of businesses and services relying on independent contractors, how the courts decide on this matter could have immense consequences for work and business models in the future. At the same time, we know surprisingly little about this segment of the economy: how big it is, or how fast it’s growing. Better understanding the changing nature of work is essential to informing any policy action targeting an increasingly diverse field of new work models.

The 1099 Economy: Hot or Not?

The recent growth of the segment of the labor force made up of contract workers — sometimes known as freelancers, gig-workers, supertemps, or 1099 workers (“1099” refers to the IRS Form 1099-MISC used by independent contractors) — was initially described as a tidal wave. Reports speculated on a massive rise of individuals choosing contract work over traditional arrangements, an increasing reliance on this work by businesses of all sizes, and how the dependence on contract work will reshape the economy and careers.

A second wave of commentary asked whether this trend was of any consequence at all. Recent reports have questioned the sustainability of the gig economy, raised concerns about the implications for individuals of on-demand work, and even suggested that individuals are less likely than ever to be self-employed or to hold multiple jobs.

However, both narratives are oversimplifications inconsistent with close analysis of the data.

The Contingent Workforce Goes Underground

Originally known as “contingent workers” — a term coined in 1985 by labor economist Audrey Freedman — part-time, on-call, and self-employed individuals have consistently represented a sizable portion of the labor force. Census estimates from the 1990s and early 2000s put its share at a steady one-third of workers.

When the source of these data — the Contingent Work Supplement — was discontinued in 2005, statistics on this workforce became surprisingly difficult to find. So much so that Senator Mark Warner — who is emerging as the leading champion of policy reform in this area — has requested that the Census Bureau, the Bureau of Labor Statistics, and the IRS produce additional data to help inform the debate.

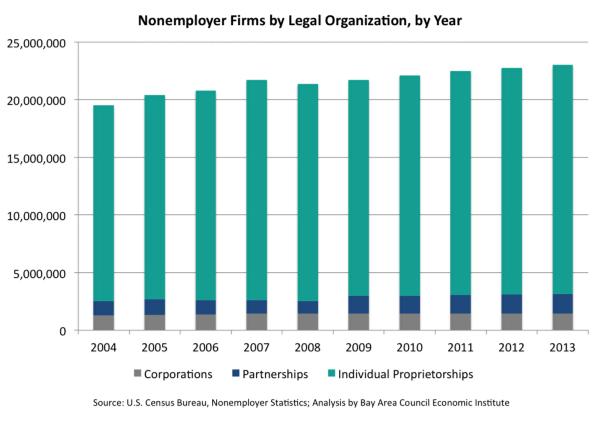

In the absence of more detailed data, many have pointed to the sharp rise in the Census Bureau’s Nonemployer Statistics as evidence of the growing 1099 economy. Defined as individual proprietorships, partnerships, or corporations with no employees, the number of nonemployer firms has increased by nearly 18 percent since 2004, compared to a 3.5 percent increase in payroll employment. Patterns vary by industry sector with Utilities, Transportation and Warehousing, and Real Estate topping growth in nonemployer firms last year. This story becomes even more interesting when broken down by occupation.

While the Nonemployer Statistics may be a reasonable measure, they do exclude certain individuals and aspects of the 1099 economy. For example, firms and individuals only show up in the Nonemployer Statistics once they have earned over $1,000 in a year on the theory that these activities are more likely to be hobbies rather than businesses. These data also lack insight into the volume of gigs being performed. A more reliable way to gauge the size of this segment of the labor force and the number of gigs worked is through Internal Revenue Service data.

An Explosion in 1099s?

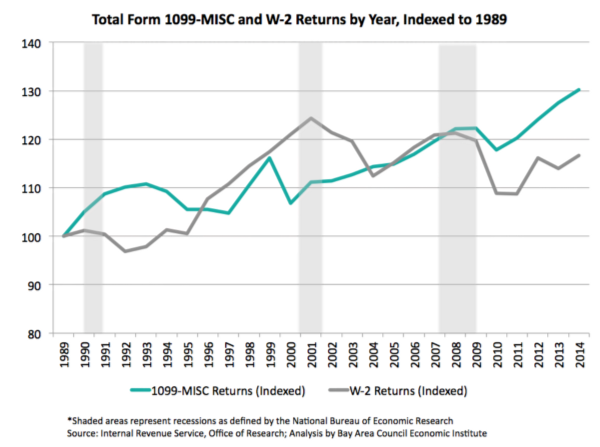

The chart below uses previously unanalyzed data obtained from the IRS’s Office of Research and reflects the growth in 1099s vs. W-2s, indexed to their levels in 1989. Interestingly, we see that growth in the number of issued 1099s had previously been very strong primarily following the recessions of 1990, 2001, and 2007. However, since the end of the latest recession in 2009, the growth has steadily continued, whereas the rise in W-2s has come in fits and starts.

So why are so many more 1099s being issued? While it is true that any single individual can receive multiple 1099s, the rising number of 1099s means either the same number of individuals is taking on more “gigs,” more individuals are joining the 1099 economy, or both. Again, the story is mixed. Coming out of the last downturn, the San Francisco Federal Reserve points out that involuntary part-time employment has remained stubbornly high, and individuals aren’t finding as much work as they need. Platforms like Lyft, Uber, TaskRabbit, and Instacart have made participating in the 1099 economy much easier, a trend that has also shown up in the Nonemployer Statistics. The new flexibility that these platforms offer also enables new earning models for people with limited availability or who are between pursuits.

Technology continues to be a formidable driver of economic change, and the tools we have for tracking change will always lag behind. There is more to learn, and what we learn about the nature of the contingent economy and the changing nature of work generally must drive our policy responses. Precipitous legal and regulatory responses risk squelching innovation and growth without the knowledge of whether these interventions will have positive outcomes.

Join the Economic Institute and Bank of the West Wealth Management Advisors for a reception and panel discussion celebrating the launch of BACEI’s newest report, “Investing with Purpose: Unlocking the Economic Potential of Impact Investments.” The panel discussion will highlight different perspectives on impact investing from panelists Silda Wall Spitzer (NewWorld Capital Group), Mark Perutz (DBL Partners), and Alice Yu (Palantir Technologies).

Made for Trade

The revenues of Bay Area companies increasingly come from global markets, and the Bay Area economy is intricately linked with global trade and financial flows. The Bay Area is on the cutting edge of technology, innovation and finance, handling $25 billion in exports in 2013. As technology continues to increase as a percentage of global trade, the Bay Area is well positioned to export to expanding future and emerging markets, especially in Asia. A report commissioned by HSBC in 2014 looks at international trade activity in the Bay Area, with a particular focus on technology, China, and the internationalization of China’s currency.