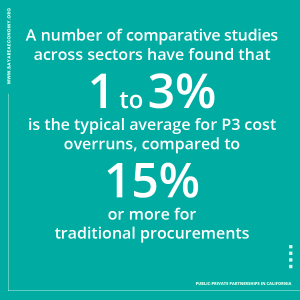

Definitions of P3 vary widely, but most commonly refer to long-term (typically 25+ years) performance-based contracts with public-sector entities in which the private sector takes or shares responsibility and risk for the design-build-finance-operate-maintain (DBFOM) elements of a public infrastructure project. P3s are not appropriate for every project and will not by themselves solve the state’s infrastructure funding challenges, but properly-structured P3s have a demonstrated track record of reducing the risk of cost overruns, accelerating project delivery, and providing contractual guarantees for proper operations and maintenance over the life of a public asset.

Public-private partnerships have played a modest but important and growing role in infrastructure delivery in California to date. California was one of the first states to adopt P3 legislation and has been home to some of the country’s most innovative projects. This report highlights seven of the most high-profile projects in the state over the past five years, primarily in water and social infrastructure. Public agencies in the state can look to these experiences and a substantial body of global literature to understand both the limitations and the substantial potential of P3s to deliver value to the public through improved cost and operational performance.

California is also developing a significant pipeline of P3 projects in the years ahead. This report identifies 23 projects that are in active procurement or in the planning stages across a range of sectors, as well as longer-term, large-scale projects that lend themselves to consideration as P3 procurements.

Despite this growing pipeline and its demonstrated benefits, the use of P3s is much less widespread than it could be. The lessons from the past five years of experience in California and elsewhere suggest the following best practices and innovations.

P3 Offices and Programs »

Rather than considering just one-off projects, public agencies can develop broader P3 initiatives to build procurement expertise and consequentially larger, more impactful pipelines.

Progressive P3 »

The number of progressive P3s in California is growing. In a progressive delivery procurement, the private partner is selected early in the process, based on qualifications, and develops the contract and ongoing design collaboratively with the public partner so as to maximize public input and opportunity for innovation.

Unsolicited Proposals »

Public agencies such as LA Metro are accepting unsolicited project proposals, increasing the number and diversity of P3 projects that are considered and incorporating technology solutions that agencies are not well placed to consider in their traditional project development processes.

Public Sector Leadership »

Projects benefit when public agencies recognize the importance of having a political champion and dedicated staff that can advance P3 projects through the inevitable political, financial, and technical challenges. This is critical to fostering the needed internal cultural changes when adopting a new form of procurement. Access to transaction-oriented advisors with a track record of bringing P3 projects to close is also important.

Stakeholder Engagement »

Early engagement of the public, decision makers, and the labor community, among others, is important to identifying and proactively addressing challenges that could stall a project during the procurement or delivery phase.

Policy changes at the state and federal levels can incentivize project delivery and life-cycle asset management. Adopting these changes does not mean that every capital project in the state will be delivered as a P3. Such changes would, however, provide public agencies with additional tools that may allow them to deliver major projects in a manner that is more cost-effective for the public.

State-Level Authorizing Legislation »

Currently Caltrans and regional transportation agencies do not have the authority to enter into P3 contracts for road and highway projects. (That authority expired in 2017.) A permanent extension of P3 authority for all transportation projects would give California’s public agencies additional flexibility for meeting the state’s growing transportation needs.

State-Level CEQA Reform »

CEQA plays a vital role in protecting California’s environment. It has also become an obstacle to delivering infrastructure in a timely and cost-effective manner under any procurement approach. Reforms that limit legal challenges and accelerate agreed categories of projects with minimal environmental impacts could help the state reduce costs and uncertainty.

State-Level Public Resources »

The state could provide expertise and limited financial assistance to public agencies in order to build their capacity in P3 procurement. A California center of excellence could provide standardized procurement documents, skills transfer, and vetting of third party advisors as a way to accelerate procurement and provide public sector agencies with greater comfort in utilizing a new delivery model. Limited predevelopment funding would help public agencies accelerate the earliest, highest-risk phases of projects. The state could also require that life-cycle costs and performance in the project design, operations, and selection of procurement approach must be considered for any project over a certain size that receives state funding.

Federal-Level Tax-Exempt Financing »

There is a need to level the playing field on the cost of capital for P3 projects. While there are currently federal programs that provide low-cost capital to P3 projects, they apply only to certain types of projects or have limited capacity. Ensuring that all public infrastructure projects have access to tax-exempt financing, regardless of how they are delivered, would provide public agencies with greater flexibility. Congress could do this by removing the volume cap on private activity bonds (PABs), eliminating the Alternative Minimum Tax penalty, expanding the types of projects eligible for PABs (as proposed in the Public Buildings Renewal Act of 2017, H.R. 960/S. 326—which would enable tax-exempt finance for public-private partnerships used to develop public buildings), and providing additional options for addressing existing tax-exempt debt.

Federal-Level Flexibility and Incentives »

New federal grant programs and incentives could encourage state and local agencies to accelerate needed infrastructure projects. This could take the form of the Trump Administration’s proposed Infrastructure Incentives Program, which would provide grant assistance to selected projects, or another proposal in the Administration’s infrastructure plan which would streamline review for projects that do not rely significantly on federal funding.