The Bay Area’s economy is now rooted in a diverse, competitive industry set. Whereas peer regions such as New York City and Houston tend to have their largest companies focused in one sector (e.g., finance and energy, respectively), the Bay Area has companies distributed across all major sectors.

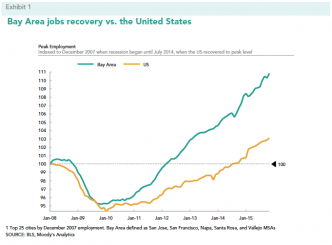

This report, the ninth in a series of Bay Area Economic Profile reports produced since 1997 by the Bay Area Council Economic Institute and McKinsey & Company, examines the region’s economy as it has emerged from the Great Recession to enter a new period of growth and innovation. As previous reports have done, it benchmarks the Bay Area’s performance against other knowledge-based economies to assess the region’s national and global competitiveness. It also examines the economic and policy challenges that continue to confront the region even in a period of extraordinary growth.