Payroll Job Growth Slumps but That is Not the Whole Story

June 27, 2022

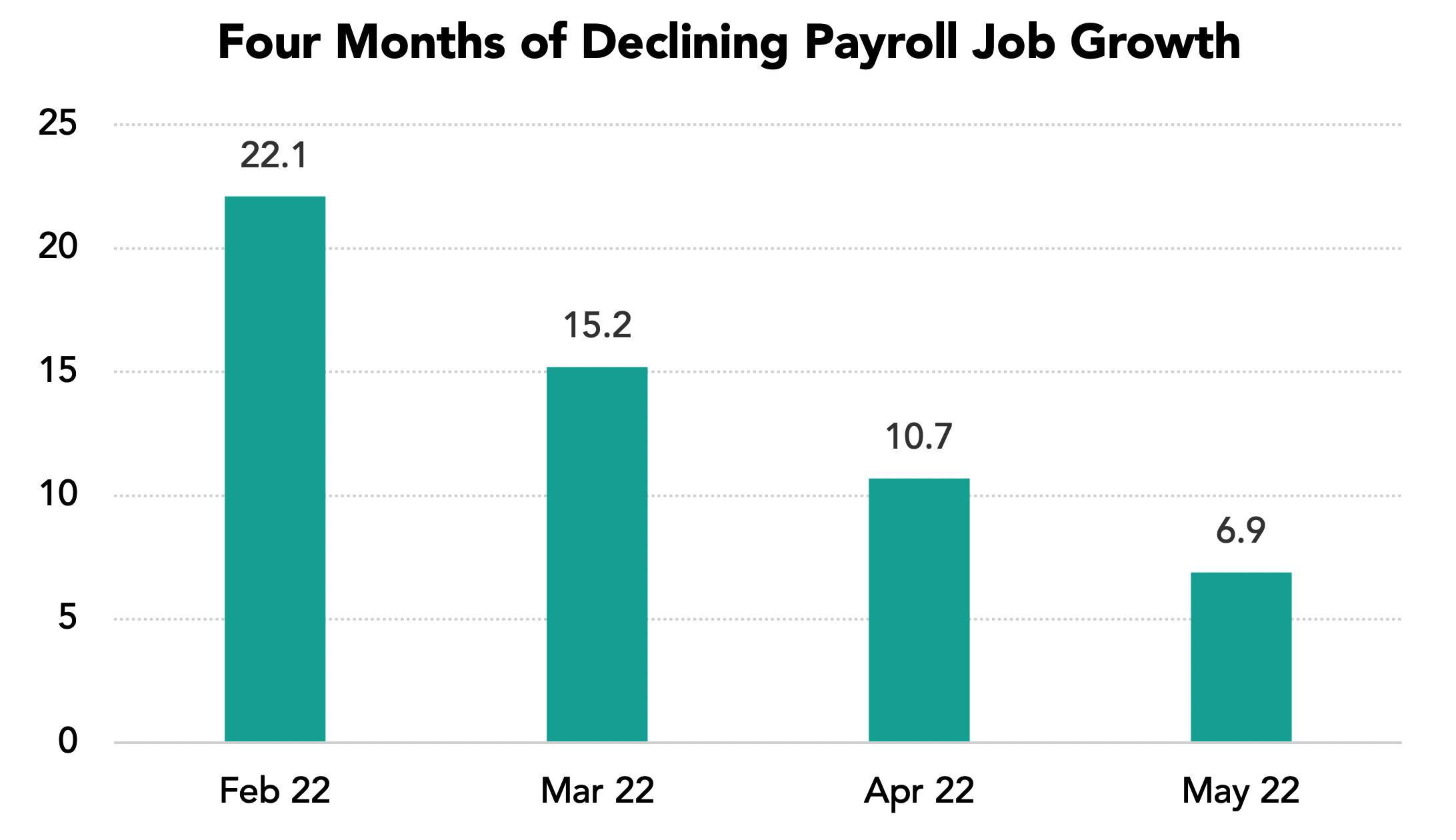

The Bay Area added 6,900 payroll jobs in May with substantial payroll declines in added jobs for each of the past four months. But this is not the full story of what happened in the Bay Area economy in recent months.

The highlights:

• Payroll job growth declined from 22,100 in February to 6,900 in May for a four month gain of 59,900 payroll jobs.

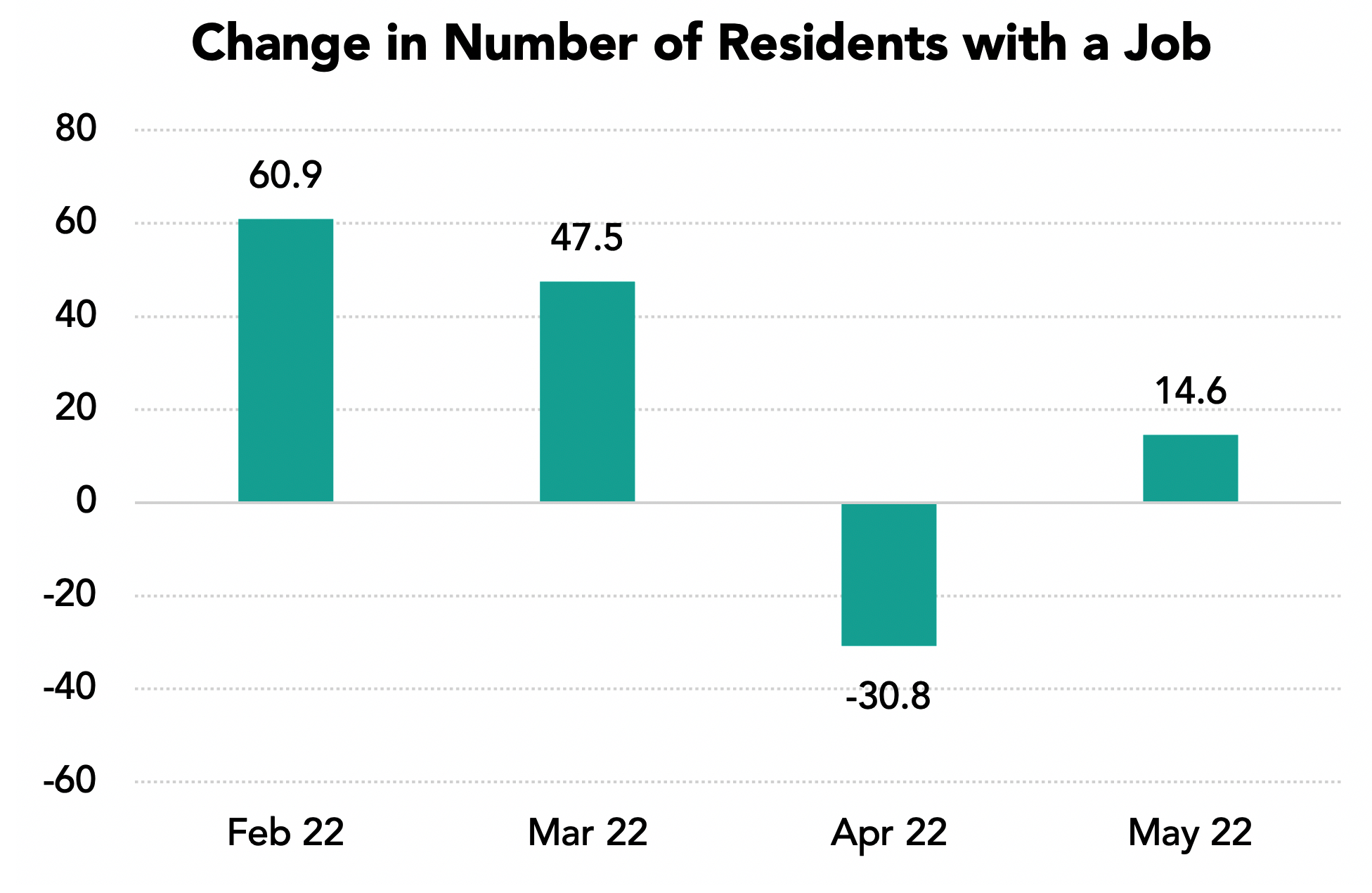

• During this period the number of residents with jobs of all kinds increased by 92,200.

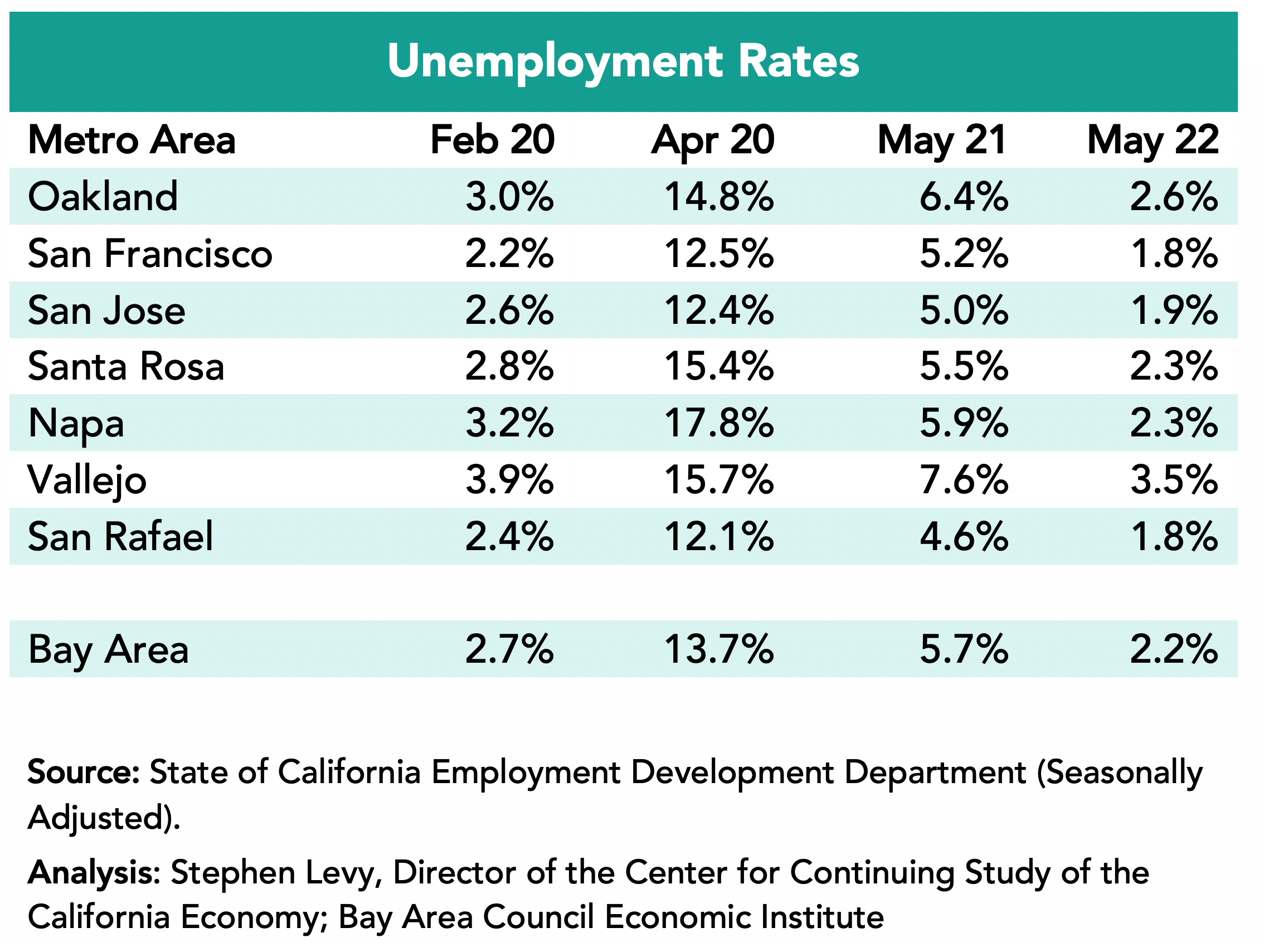

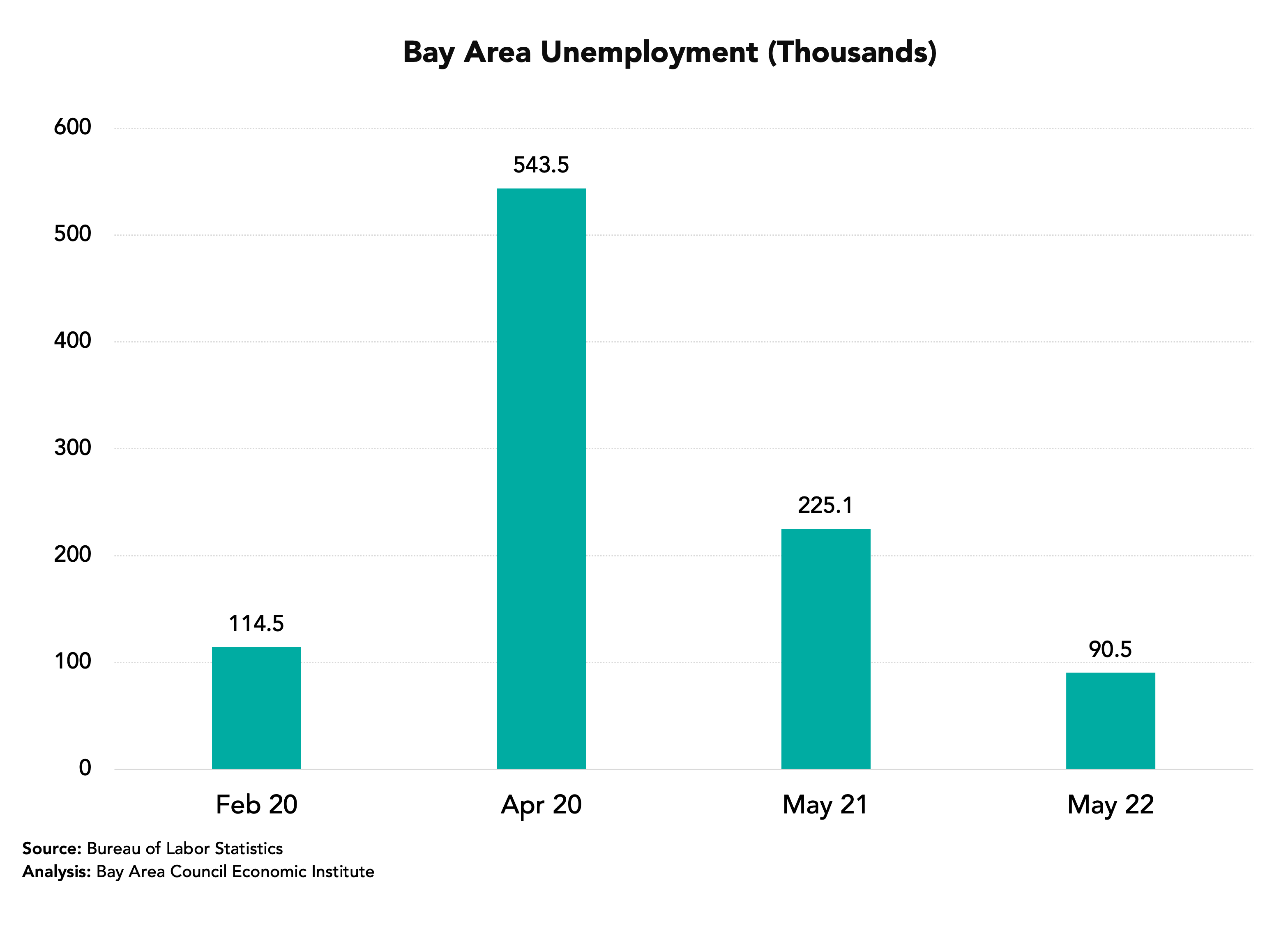

• In May Bay Area unemployment levels and unemployment rates fell to record lows.

• April 2022 brings major crosscurrents to the global, national and regional economy with the Russian invasion of Ukraine, rising interest rates amidst continuing high inflation and the ongoing Bay Area challenges of housing, transportation and competitiveness.

• June 2022 brings major challenges to the global, national and regional economy with the Russian invasion of Ukraine, large increases in interest rates amidst continuing high inflation, the recent spike in Bay Area COVID cases and the ongoing Bay Area challenges of housing, transportation and competitiveness.

Four Months of Declining Payroll Job Growth

This is the chart shown in media around the region last weekend and it is accurate. Payroll job growth has declined substantially.

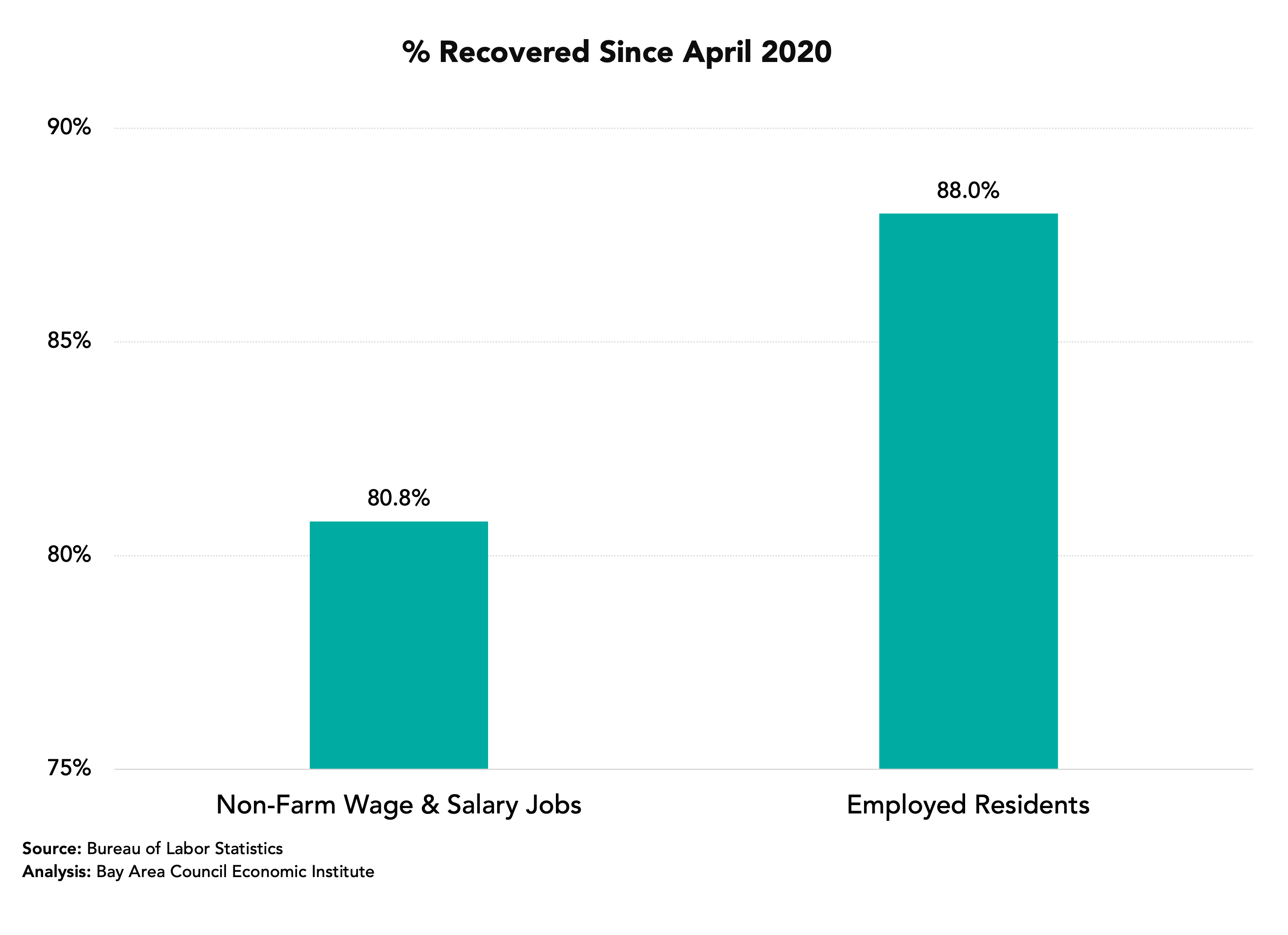

But the Number of Residents with a Job Grew More

These data come from the household survey, which is smaller than the payroll survey and more volatile month to month. But it is accurate over time. The inference is that workers are finding jobs in traditional self-employment and gig work. The discrepancy between payroll job and employed worker growth (59,200 versus 92,200 for the past four months) could be for many reasons. One is the difficulty in hiring in some industries from our high cost of housing. One could be a decline is jobs at tech startups. Workers unable to find jobs in declining sectors may be switching to self-employment.

But these data offer a counterpoint to the disappointing payroll job trends.

Unemployment Rates Fell to 2.2 in the Region in May 2022 from 5.7% in May 2021 and is now below the pre-pandemic level in February 2020

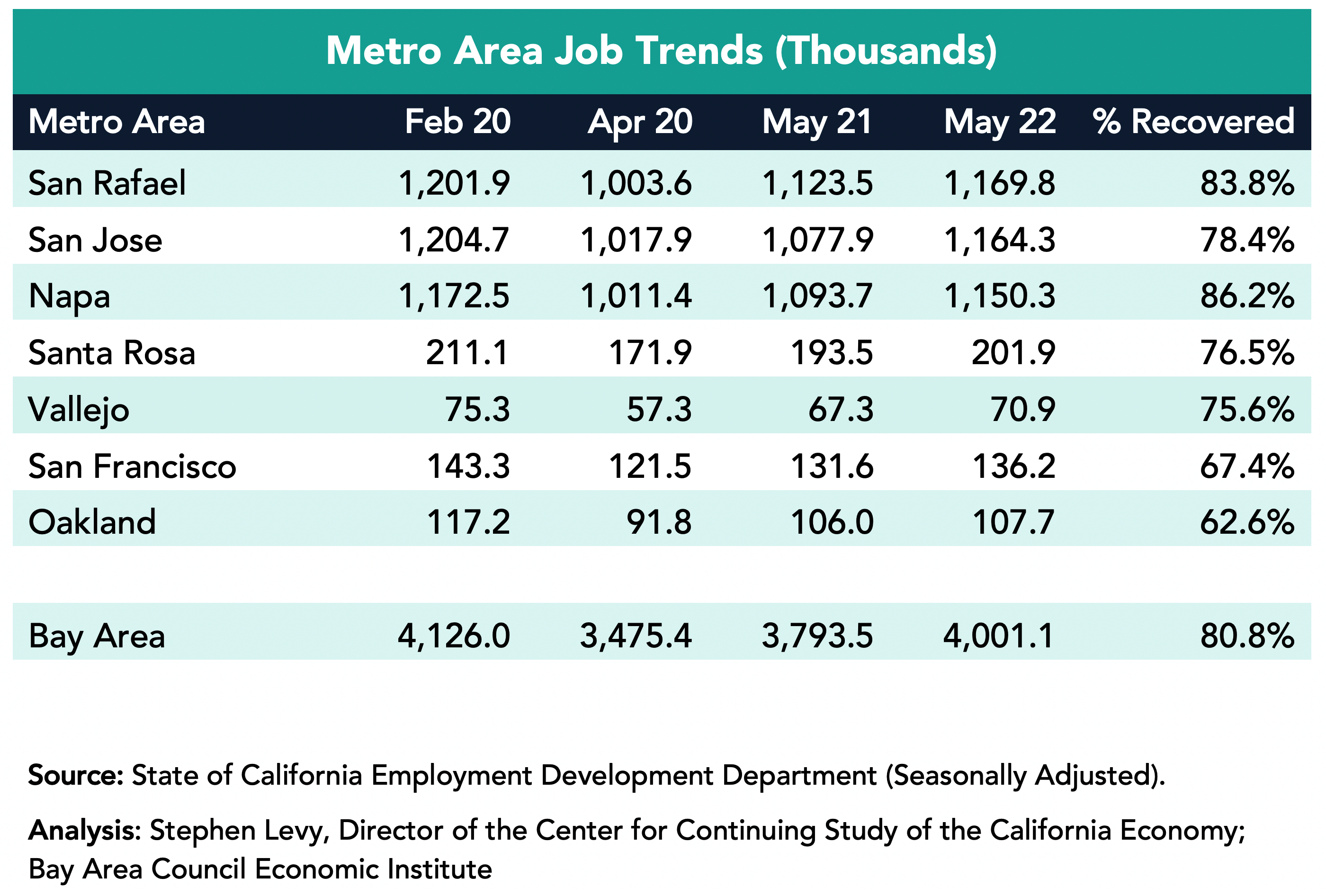

The lowest rates were in the San Rafael and San Francisco metro areas (1.8%) followed by the San Jose metro areas (1.9%) in May 2022.

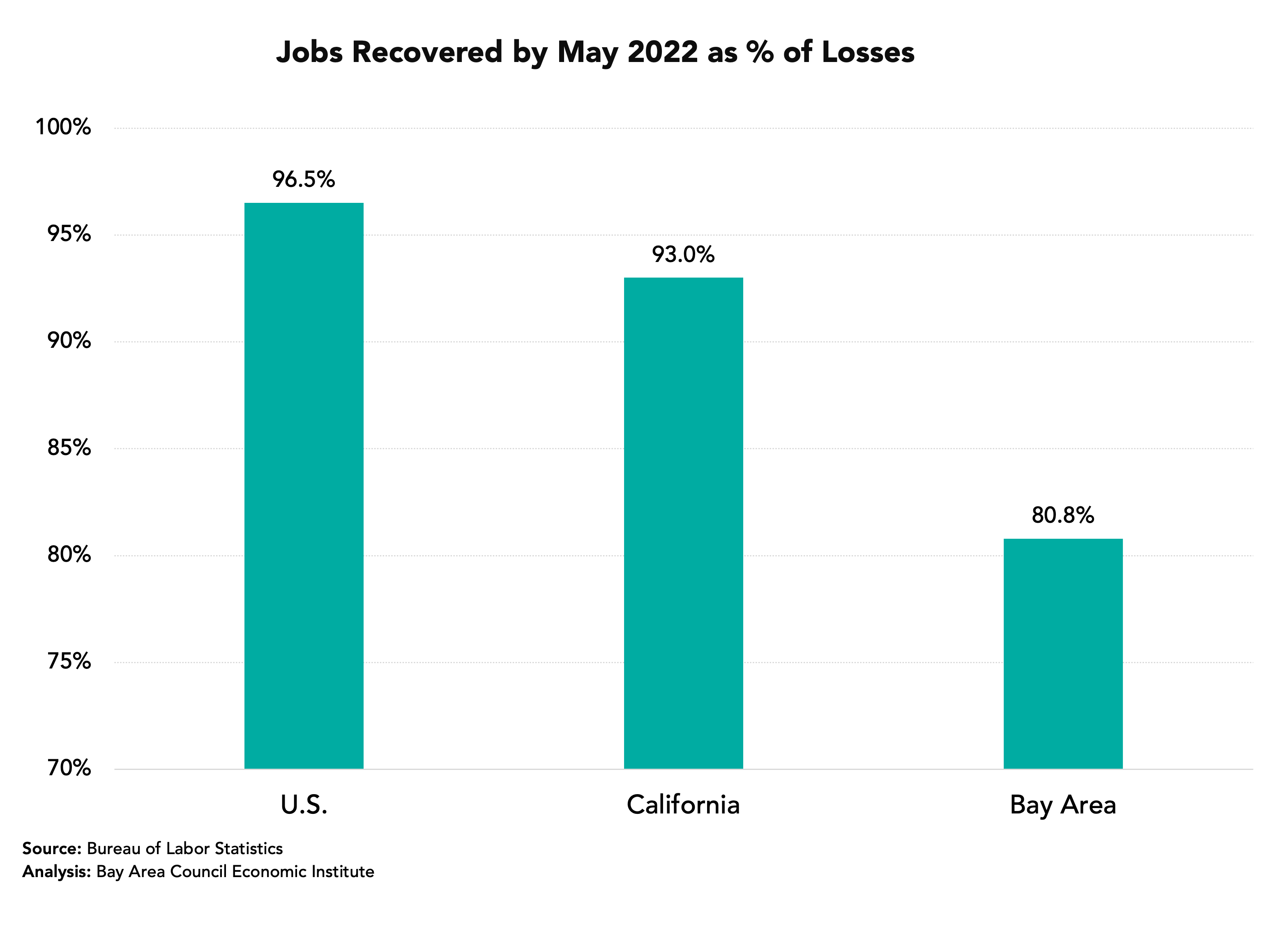

By May 2022 the region had recovered 80.8% of the payroll jobs lost between February and April 2020. This is a lower recovery rate than the state and nation, though the region has closed the gap in recent months.

While the region has recovered just 80.8% of the non-farm payroll jobs lost between February and April 2020, it has recovered 88.0% of the decline in the number of residents with jobs. The explanation for the gap between the two measures is an increase in self-employment jobs, most likely gig work jobs.

Payroll Job Growth Strong for the Year Though Lagging Recently

The Bay Area added 207,600 jobs in the past year (+5.5%) led by a gain of 86,400 in the San Francisco metro area though SF has recovered just 78.4% of the jobs lost between February and April 2020. The San Jose metro area added 56,600 jobs and by May 2022 had recovered 86.2% of the payroll jobs lost between February and April 2020. The Oakland metro area added 46,300 jobs during the past year.

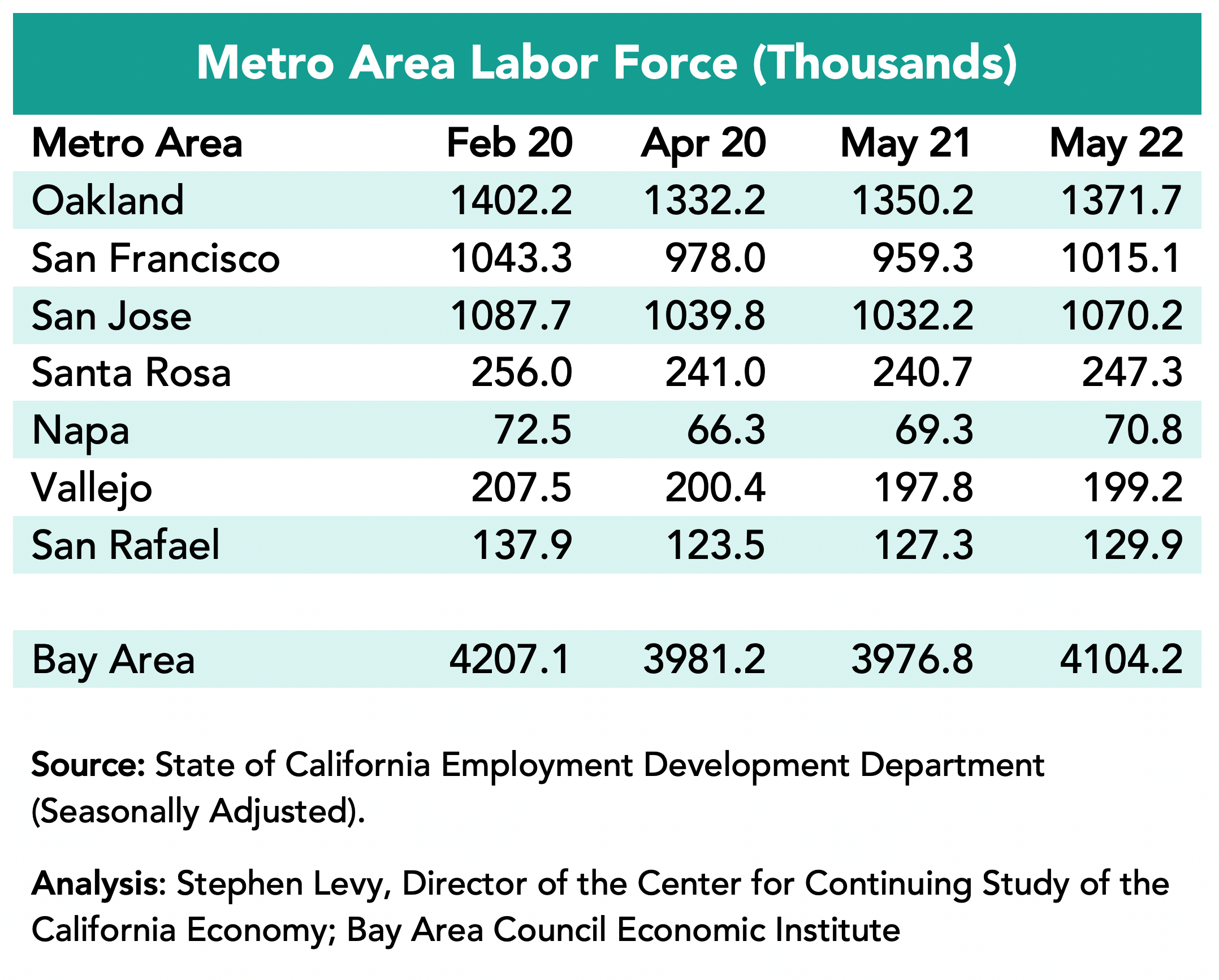

But 102,900 Workers Have Not Rejoined the Workforce Since February 2020

Residents who are not in the labor force are not counted as unemployed. As a result, the number of unemployed residents can decline while some are still prevented by choice or lack of child care or work in industries that have not fully recovered. The number of residents not in the labor force has increased recently, perhaps in response to the rise of COVID cases in the region.

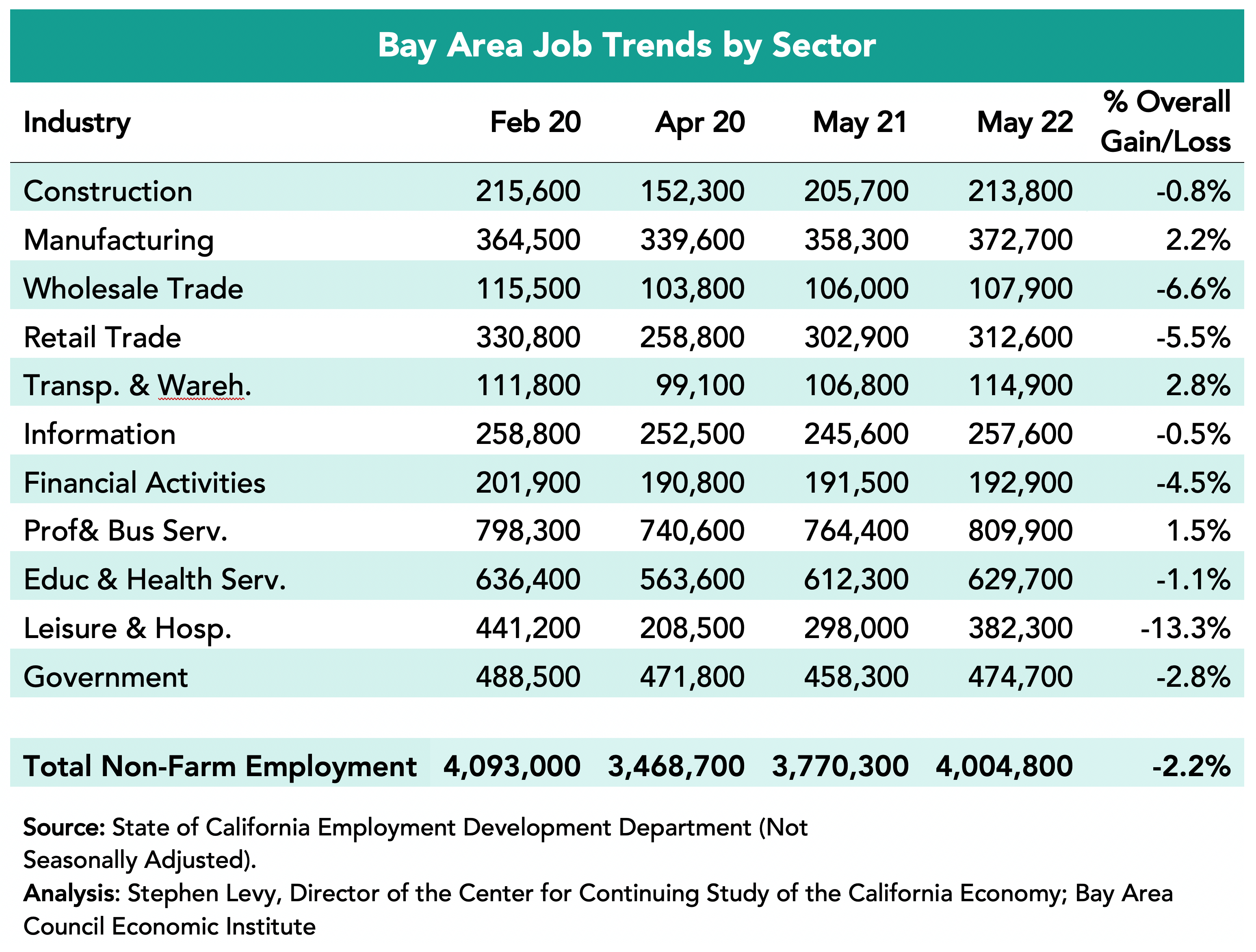

Industries Were Affected Differently

Four sectors—Manufacturing, Transportation and Warehousing, Information and Professional and Business Services—exceeded pre-pandemic job levels in May 2022 and Construction and Education and Health Care Services were close to full recovery. On the other hand, the Leisure and Hospitality sector recovered only 74.7% of lost jobs by May 2022, though travel and tourism jobs are now in a strong recovery. The Government sector is now slowly recovering the jobs lost between February and April 2020.

In the past two months Leisure and Hospitality and Government have shown the largest job growth.

Note that these data are not seasonally adjusted.