Some Good News After Large Job Losses in 2020

January 6, 2021

Bay Area job losses in 2020 were a larger percent than in the state and nation. But in 2021 Bay Area and state job growth has outpaced the nation accompanied by large declines in unemployment. At the same time VC funding has reached record levels, housing permits have begun to rebound, the Governor signed several housing bills and the region is a leader in vaccinations and lowering COVID cases. Congress passed an infrastructure bill and international travel restrictions have been eased. The Bay Area still faces challenges in housing, transportation and other areas that affect our economic competitiveness and, in doing so, reduce our ability to meet equity and environmental goals.

The highlights:

• The Bay Area added 188,900 jobs between January and November 2021 (+5.2%) outpacing U.S. gains (4.1%) for this period. The regional unemployment rate fell from 6.6% to 3.8%. Job gains were led by the San Francisco and San Jose metro areas

• The U.S. economy is recovering even as inflation and supply chain challenges remain and COVID cases are rising again. At the same time immigration and tourism are on pace to increase and some infrastructure spending could start next year.

• The region is a state and national leader in vaccinations and reducing COVID cases that is allowing a return to more normal living here.

• The UCLA December 2021 forecast has the Bay Area and state outpacing the nation in job growth in 2022 and 2023.

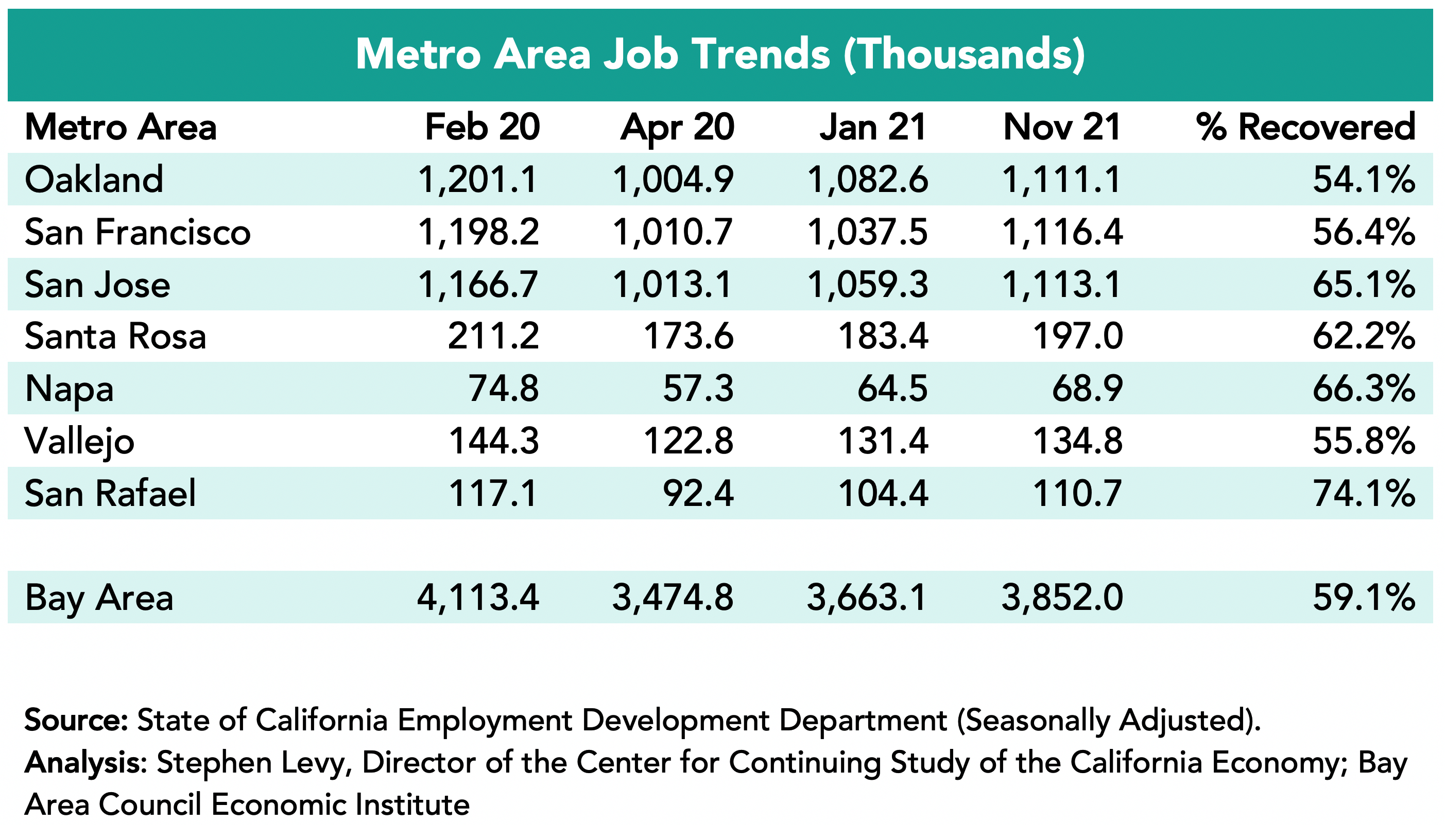

Job Growth Continues But 2020 Losses Constrain the Rate of Recovery

The Bay Area added 188,900 jobs since January 2021 led by a gain of 78,900 in the San Francisco metro area though SF has recovered just 56.4% of the jobs lost between February and April 2020. The San Jose metro area added 53,800 jobs but by November had recovered 65.1% of the jobs lost between February and April 2020. The San Jose, Napa, and San Rafael metro areas had the largest % job recovery by November 2021.

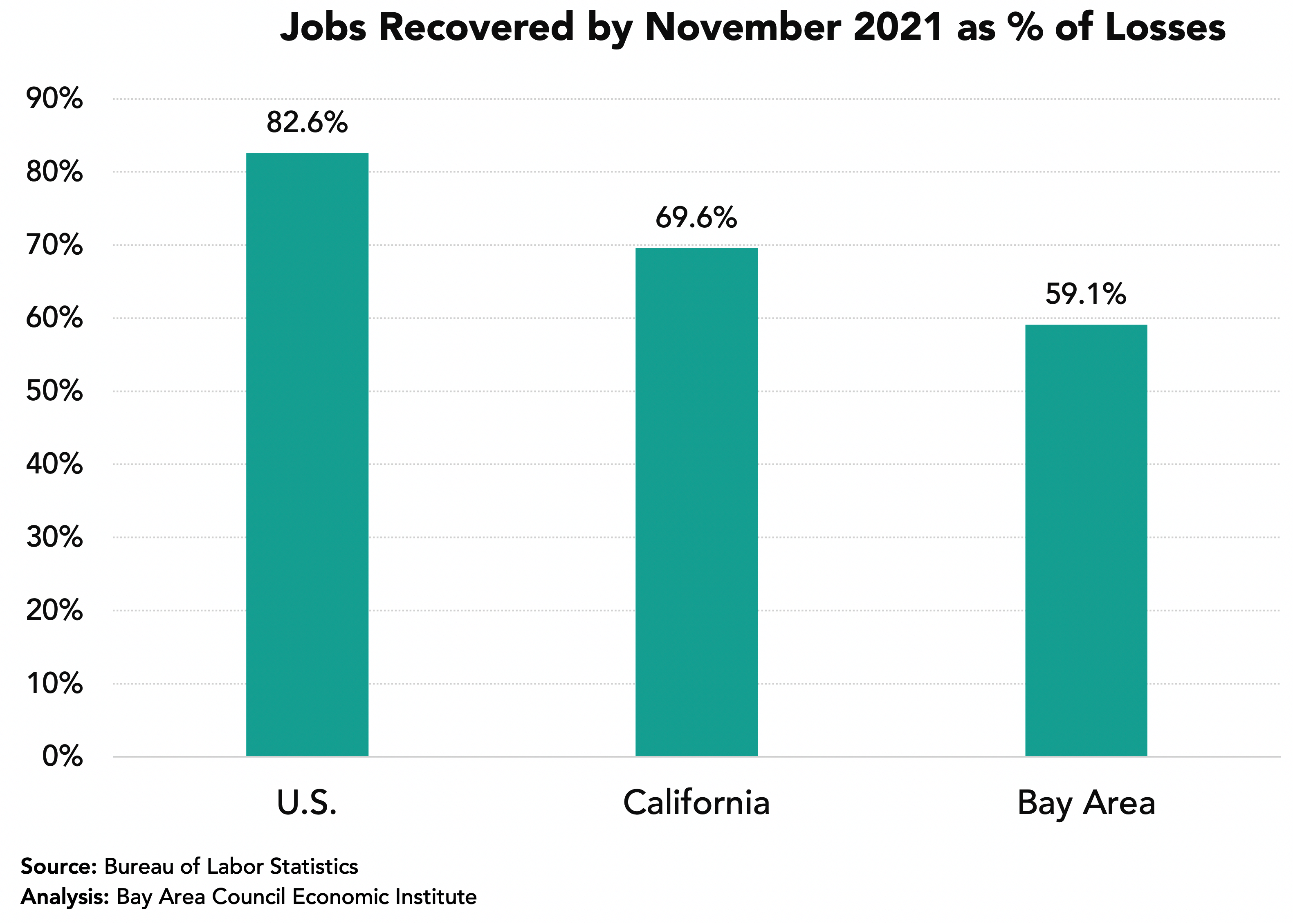

The Bay Area Had Recovered Just 59.1% of Lost Jobs by November 2021 Yet VC Funding is Surging and Tech Jobs Are Above Pre-Pandemic Levels

In November 2021 the Bay Area had recovered 59.1% of the jobs lost between February and April 2020 up from 29.4% in January. The state had recovered 69.6% up from 34.0% while the nation had recovered 82.2% of lost jobs up from 55.4%. At the same time VC funding in the first three quarters of 2021 was the highest on record. The Bay Area lagged the nation in 2020 job performance but has outpaced the nation in job growth so far in 2021 (5.2% versus 4.1%).

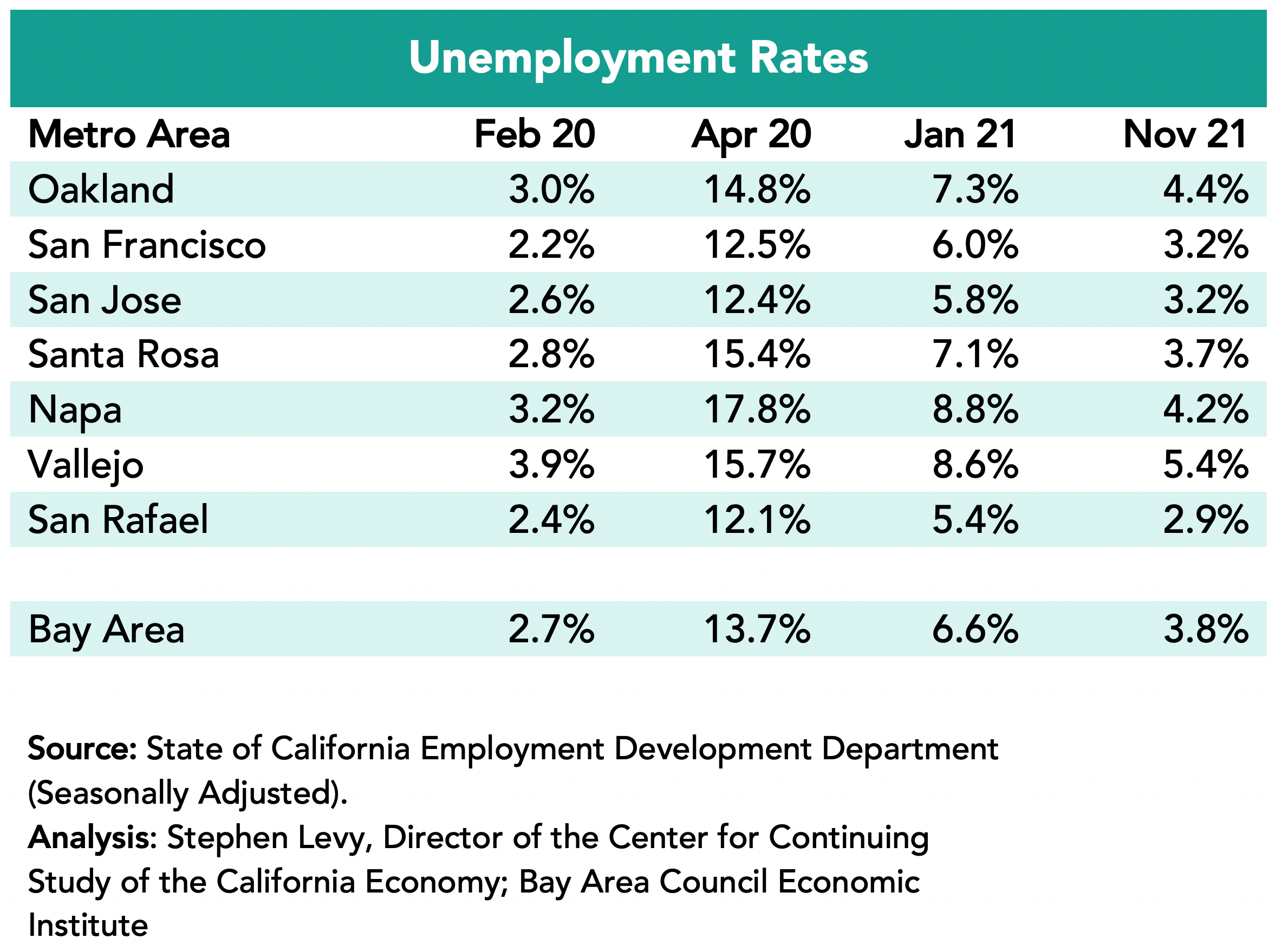

Unemployment Rates Fell to 3.8% in the Region in November 2021 from 6.6% in January 2021

The lowest rates were in the San Rafael metro area (2.9%) followed by the San Francisco and San Jose metro areas (3.2%) in November 2021.

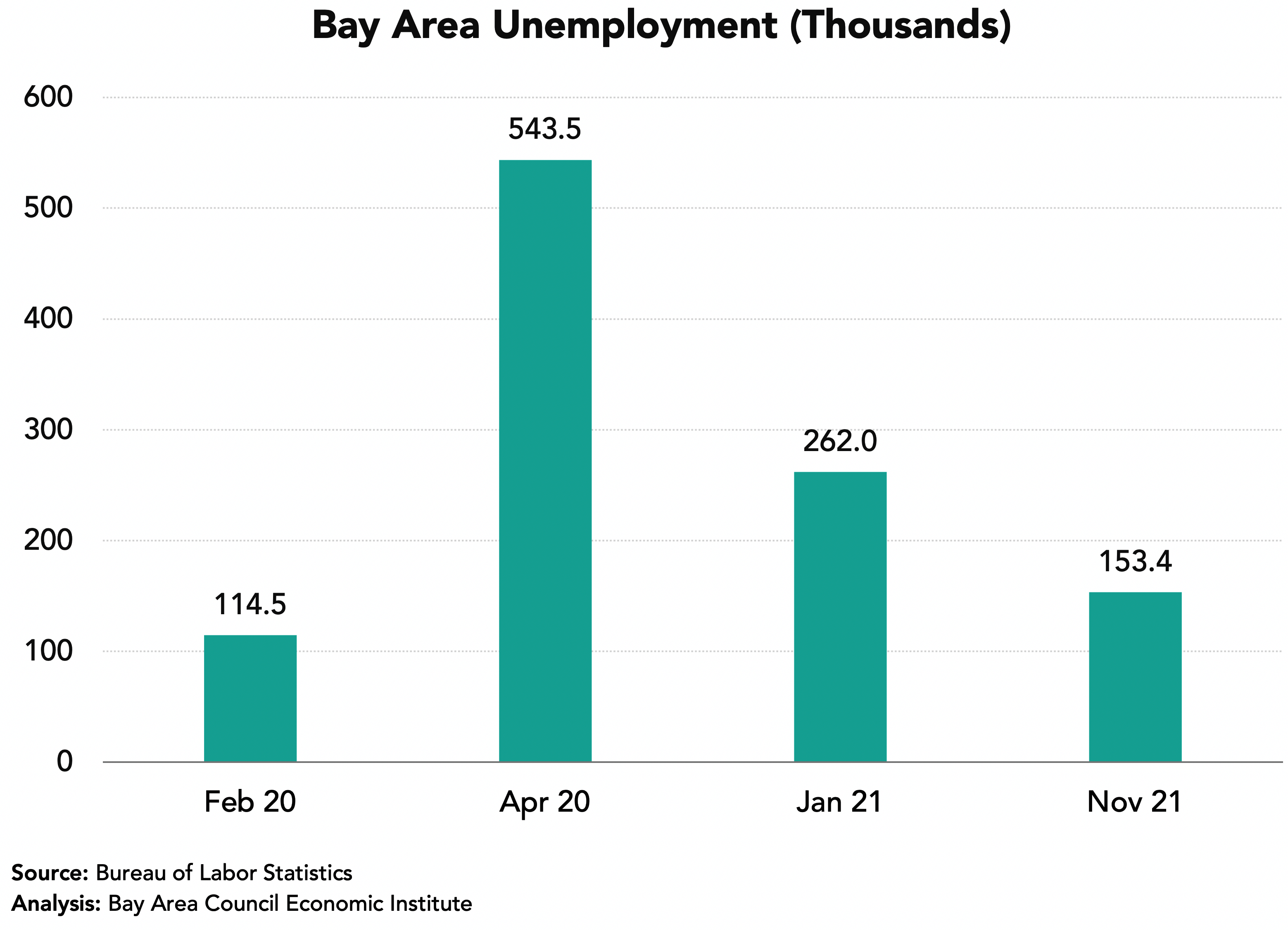

The number of unemployed residents has fallen sharply from the April 2020 high and from January 2021.

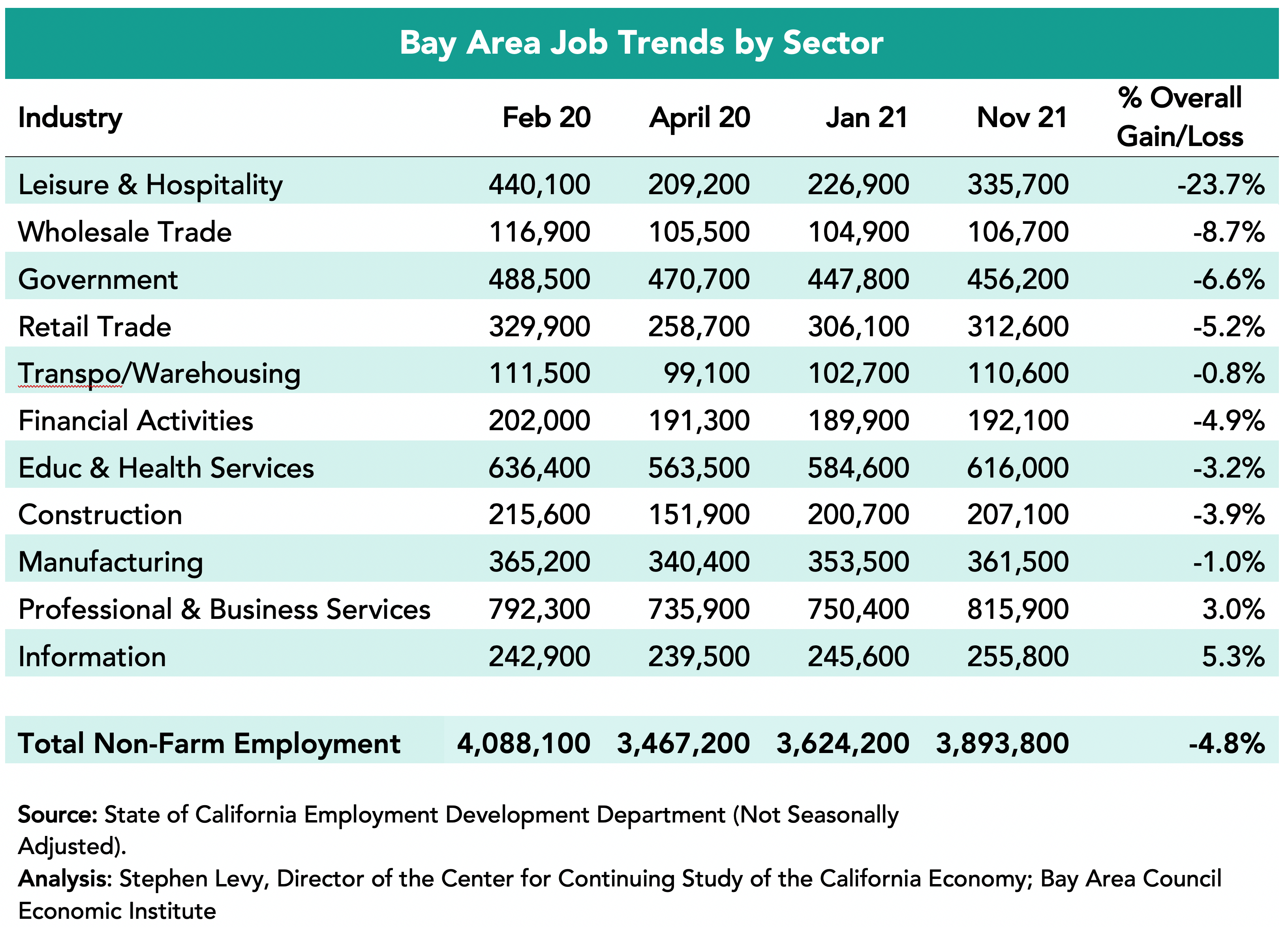

Industries Were Affected Differently

The Information sector added jobs in comparison to before the pandemic hit. And the Professional & Business Services sector is also above pre-pandemic job levels. On the other hand, the Leisure and Hospitality sector recovered only 54.8% of lost jobs by November 2021 though travel and tourism are now picking up again. The Government sector has fewer jobs now than in April 2020 though many jobs are returning as schools and colleges reopen. The Construction and Manufacturing sectors have recovered most of the jobs between February and April 2020.

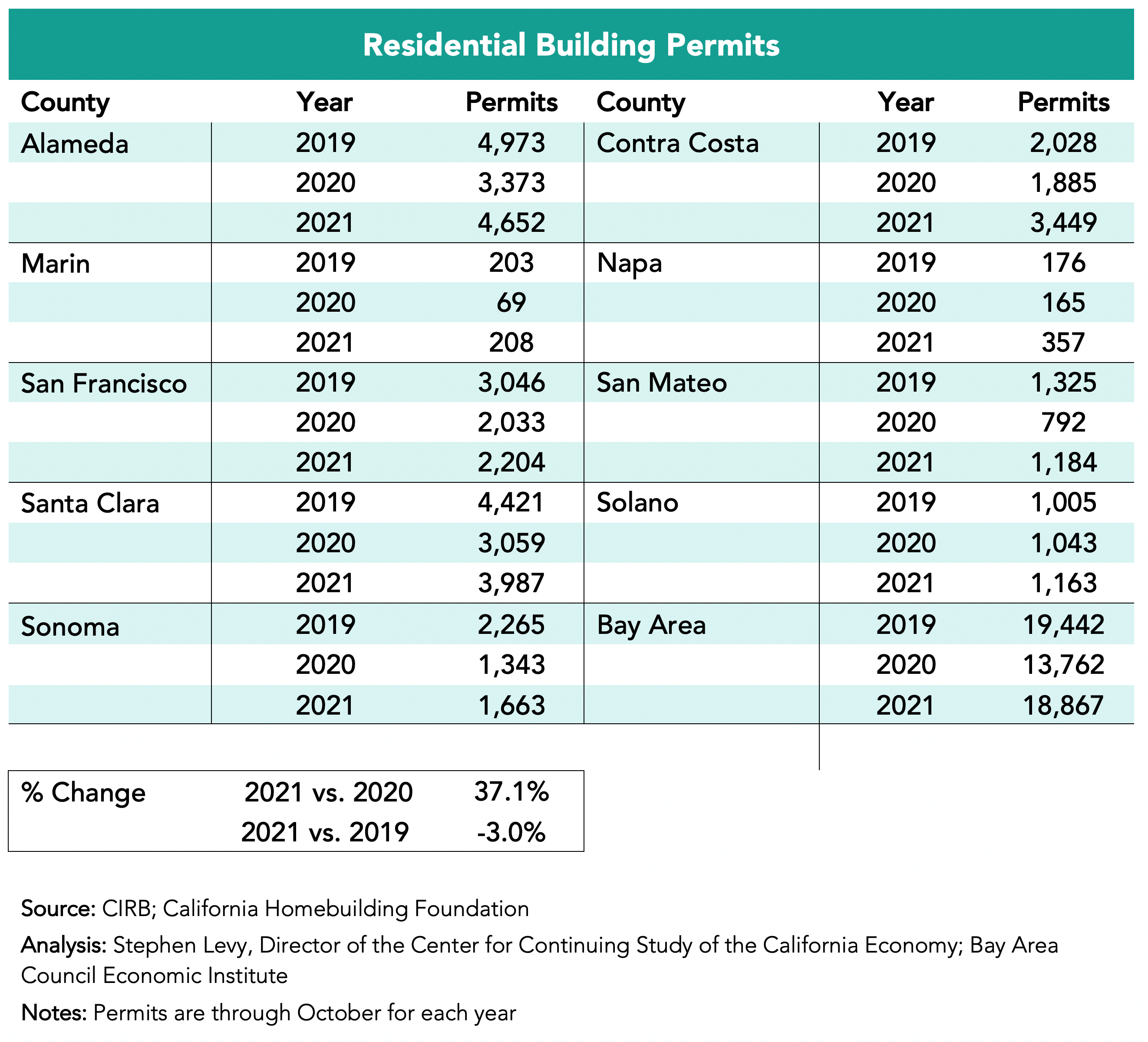

Housing Permits Up Over 2020 Levels, Trail 2019 Slightly

Housing permit levels are up over 2020 in the first ten months of 2021 but still slightly trail 2019 comparable months. But recently many new developments have been approved or proposed in places like Oakland and San Jose and in other cities as well as new developments being proposed.

Bay Area COVID Stats

The top eight counties in terms of vaccination percentages (all but Solano) are from the Bay Area with all having more than 80% first doses and six having more than 75% fully vaccinated.

Large Challenges Remain:

We have the paradox of continuing reports of headquarters’ relocations outside of the region at the same the region is capturing record VC funding levels and tech jobs are slightly above pre-pandemic levels. Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

The rebound from pandemic related economic losses will continue but new policies are needed to maintain and improve the long-term competitiveness of the Bay Area economy. There is now increased movement to integrate our many transportation systems and agencies and pursue fare integration in an effort both to improve but to maintain the solvency of our main public transit options.

2022 is the year all Bay Area communities must update their Housing Elements to 1) identify sites attract and approve their allocation of new housing units affordable to major income groups, 2) develop programs and policies to overcome constraints and make the sites attractive to non-profit and market-rate developers and 3) comply with the state’s fair housing guidelines.

This is both a great opportunity and a challenge to combine meeting our equity, environmental and economic goals.