Another Solid Month, Is Job Growth Finally Slowing?

The highlights:

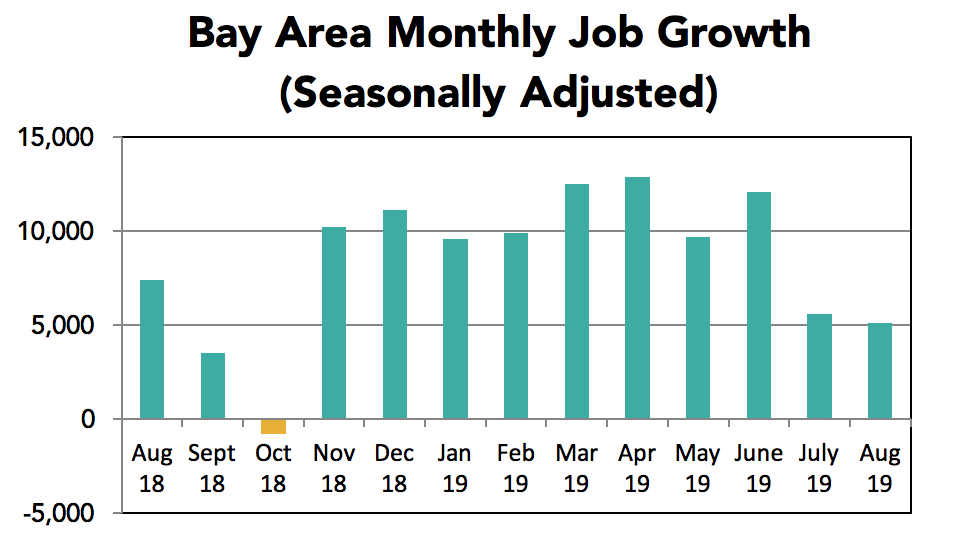

• The Bay Area added 5,100 jobs in August (seasonally adjusted), following gains of 5,600 jobs in July and 12,100 in June. State job growth has rebounded in recent months and CA job growth now outpaces the nation.

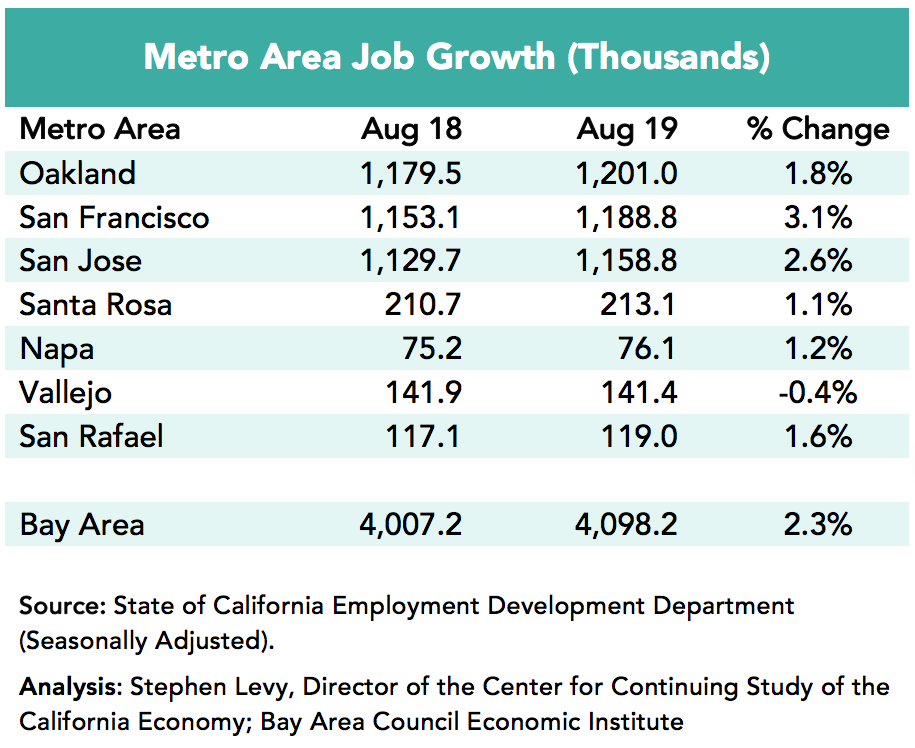

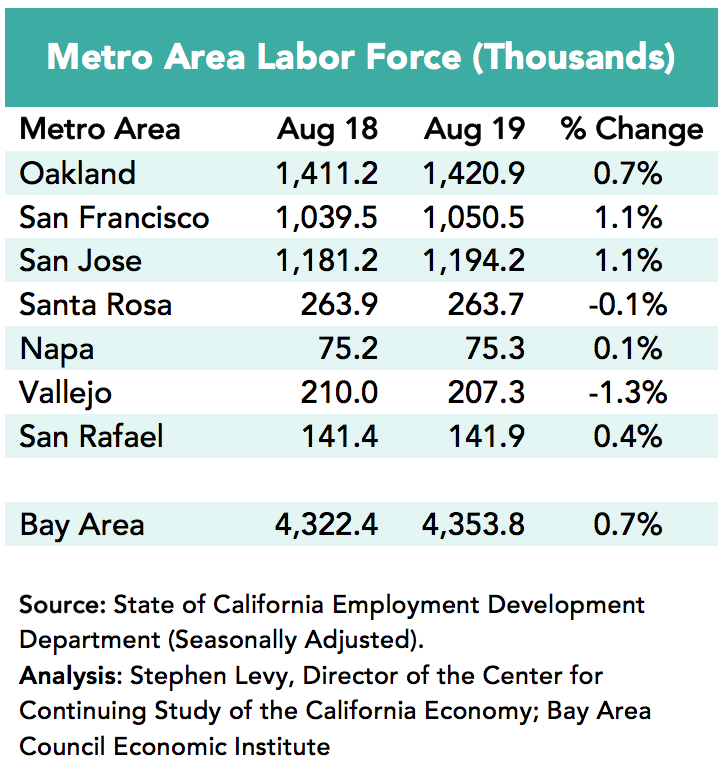

• The job growth in August was accounted for by gains in the Oakland, San Francisco and San Jose metro areas with no overall growth in the other metro areas.

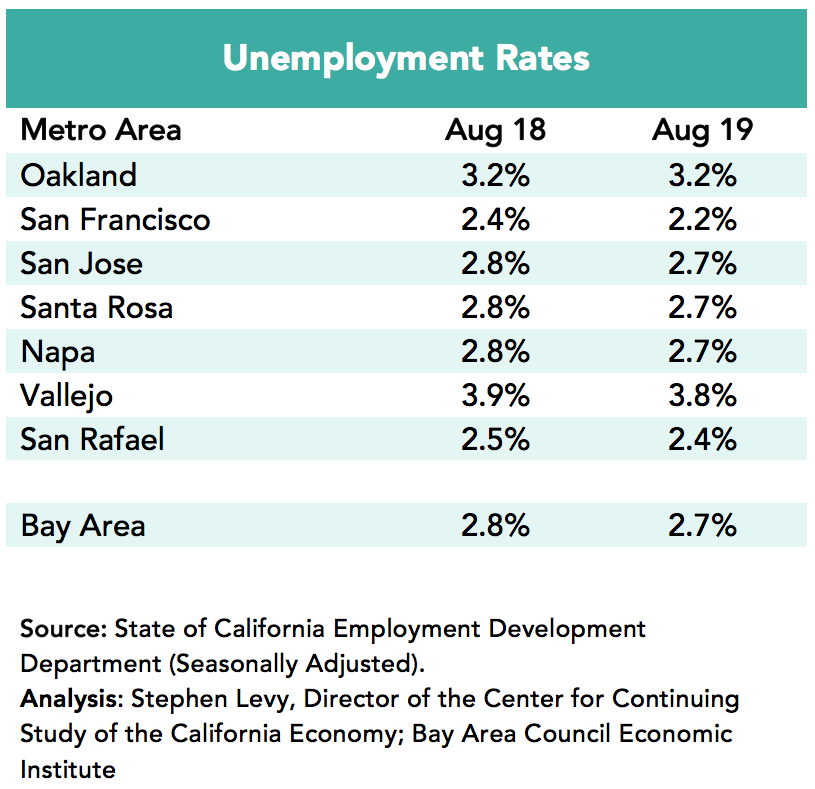

• The regional unemployment rate was 2.7% in August down from 2.8% a year ago.

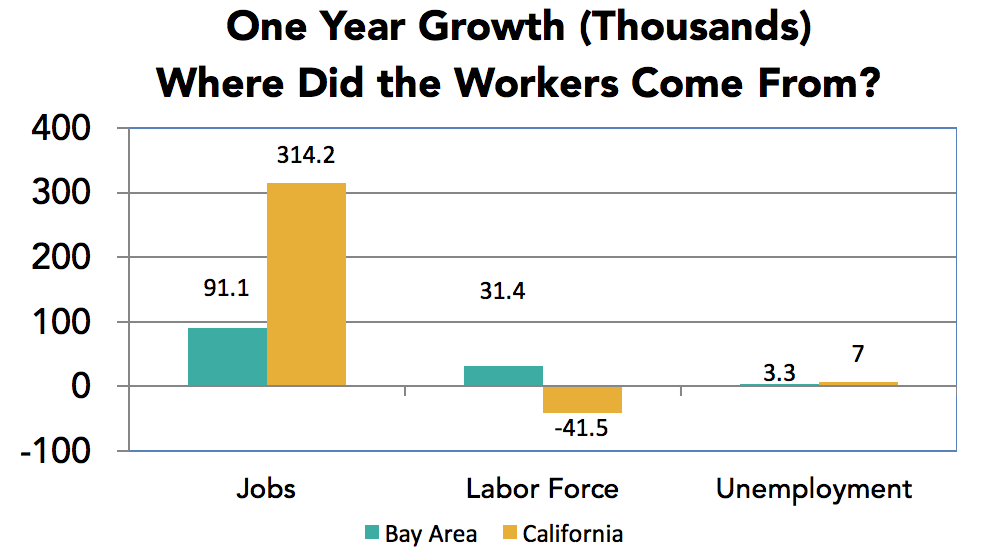

• With job growth far outpacing population and labor force growth, where are the workers coming from and can it continue?

The Bay Area Continues to Outpace the State and Nation in Job Growth

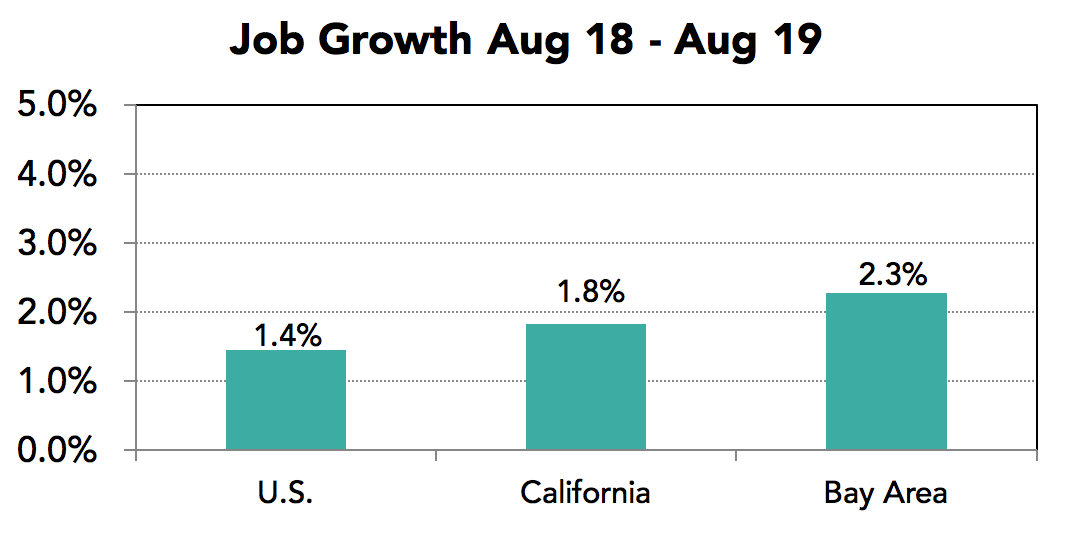

Year over year job growth of 2.3% (down from 2.4% last month) far outpaced the 1.4% growth for the nation and 1.8% gain in the state. The state once again is outpacing the nation.

The San Francisco metro area led the region in job growth over the past year followed by the San Jose metro area with slower growth in other metro areas.

Unemployment rates in August 2019 were slightly below year earlier rates indicating that the decline in rates may be nearing an end. Unemployment rates in summer months are higher than in other months so the year over year trend is important.

Regional labor force growth returned in August up 0.7% from the year earlier and is far below the 2.3% regional job growth.

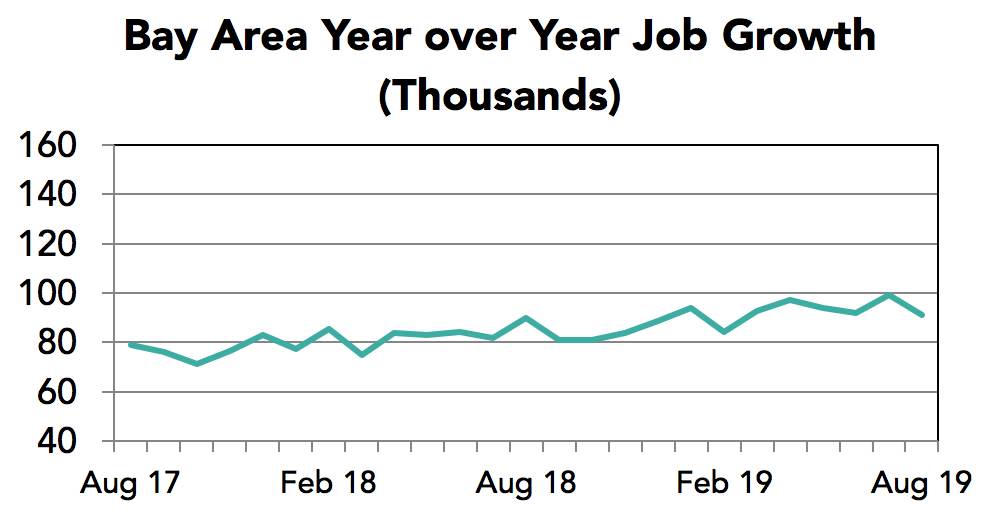

Year over year job growth has remained in a narrow range since early in 2017. This occurred despite slowing population growth and rising outmigration in the face of high housing costs. In August 2019 year over year job gains remained near the top of the recent range.

Monthly job gains declined in July and August. Is this the beginning of a slowdown tied to slowing U.S. and world growth and labor shortages?

Bay Area job growth is far higher than population and labor force growth and the year over year decline in unemployment was small. For the state, August data showed increasing job growth even as the labor force shrank over the past year

If these numbers are real, the implication is a large increase in commuting into the region and/or a large increase with workers holding multiple jobs. Currently data does not exist to confirm or refute this possibility. Future months and possible data revisions will shed more light on where the workers came from to support the large regional job growth. It is an important question to answer.

The state numbers are harder to understand as commuting is not a factor at the state level.

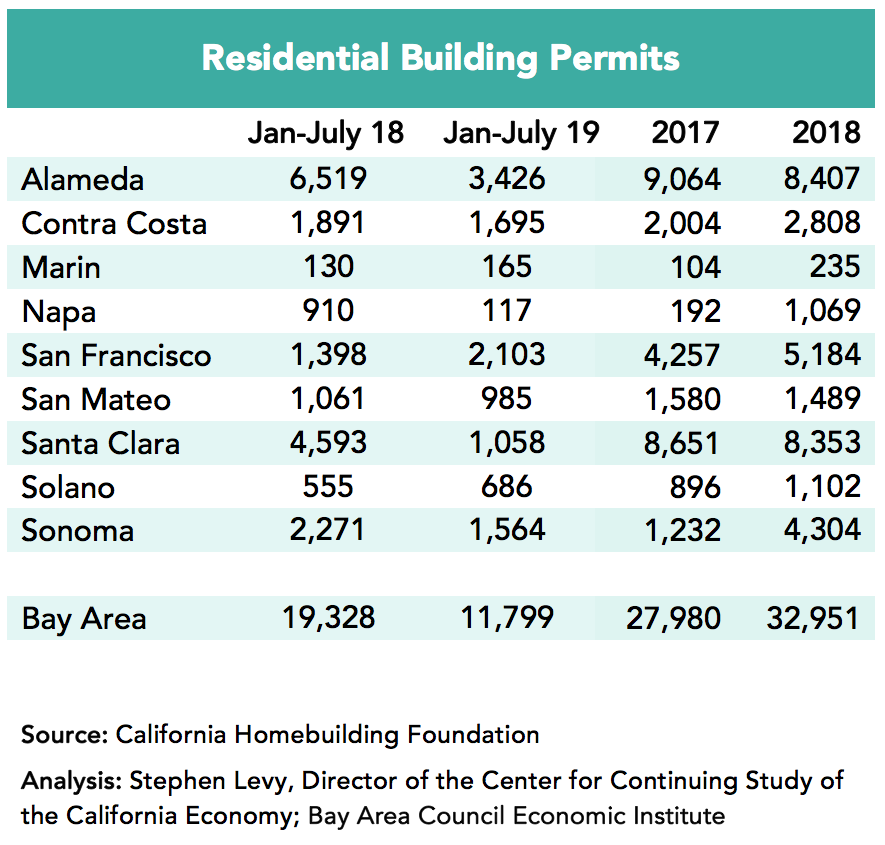

Housing permit levels declined in the first seven months of 2019. The probable causes are increasing construction costs and a shortage of labor. In most cases fees are due when the permit is approved giving another reason to delay taking out the permit even though the project is already approved. On the other hand there seem to be a large number of projects openings and new projects in the pipeline but far yet from seeking permits.

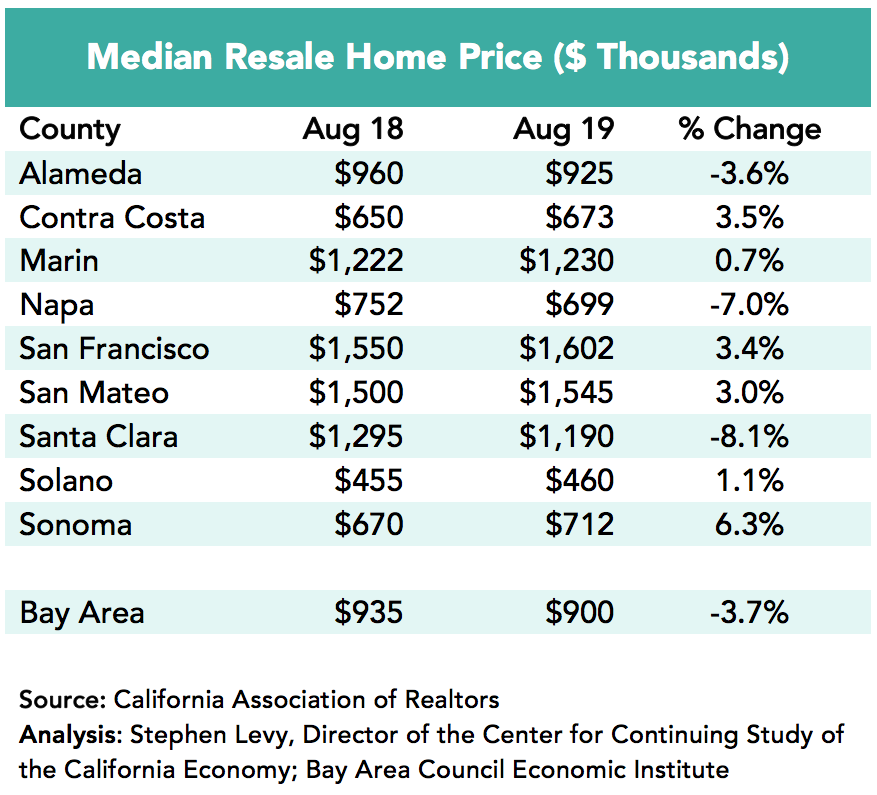

There is some evidence that the surge in resale home prices has peaked though that is a separate market from the rental market and even more separate from funding and approval for BMR units. Median resale prices continue to be slightly below year earlier levels. The Case Shiller price index, which matches comparable homes, has the Bay Area index up 0.7% for the year ending June 2019.

There have been a number of analyses of cost pressures and the need for projects to pencil out for equity and debt partners as well as developers. Here is one https://sf.streetsblog.org/2019/09/04/spur-talk-housing-development-by-the-numbers/. Here is another. https://ternercenter.berkeley.edu/blog/demystifying-development-math. This concept is well understood by Council members but seems hard to find acceptance among more general resident audiences.