Bay Area job growth surged in November supported by strong labor force growth and continuing low unemployment rates. The surge in labor force growth was the result of higher participation rates from existing residents. Population growth in the region is falling as birth rates fall and out migration increases. But very low unemployment rates and record levels of labor force participation rates raise questions as to where the workers will be found to fill planned future job growth.

The Bay Area Again Outpaces the Nation in Job Growth

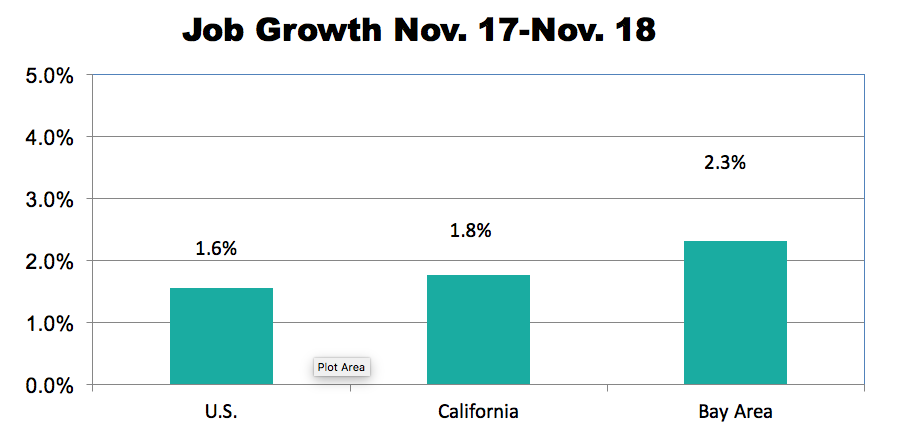

Though year over year job growth fell to 2.2% from 2.4% the month earlier, the region outpaced the 1.7% growth for the nation and 1.8 for California.

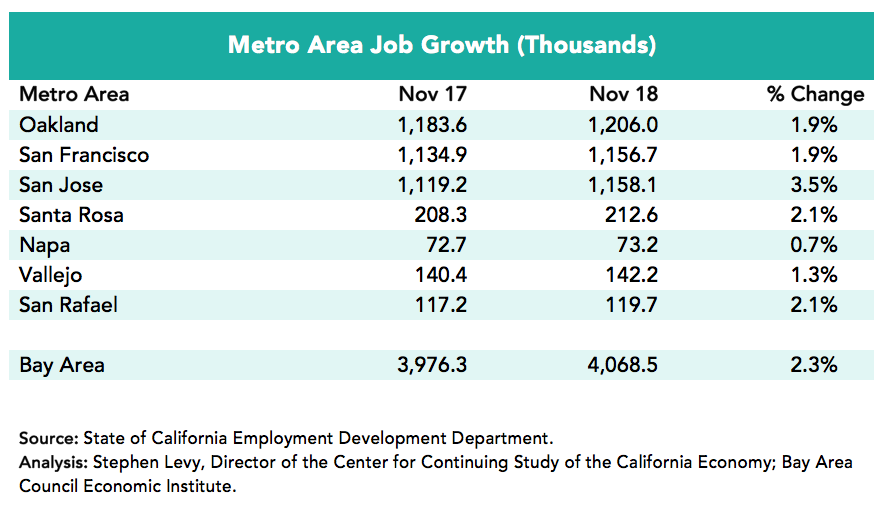

The San Jose and Santa Rosa metro areas led the region in job growth over the past 12 months.

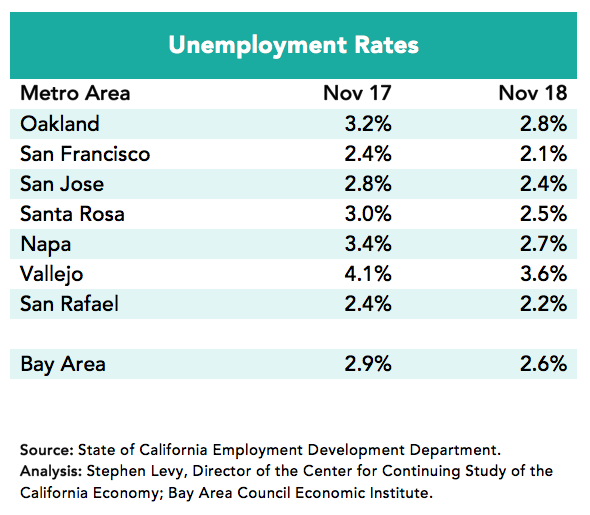

Unemployment rates remained low in November 2018 throughout the region with a 2.6% regional rate the same as in October. Labor force growth surged to nearly 1000,000 for the past 12 months driven by record levels of participation by all age groups over 25.

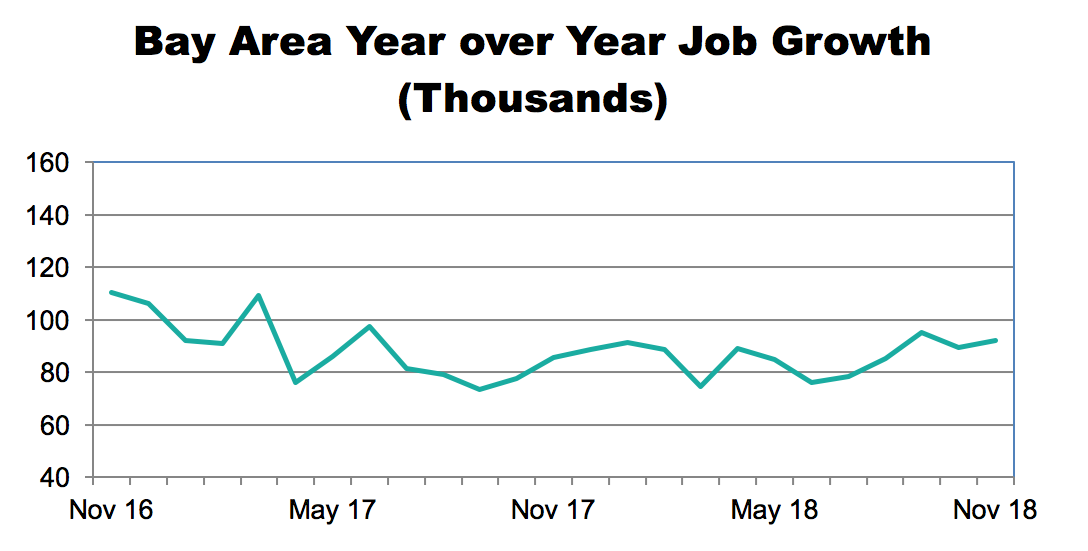

Year over year job growth rose in November to 92,200 and has remained in a narrow range since early in 2017. Slowing labor force growth from boomer retirements will probably push job growth levels lower over the coming years.

Surging Job Growth Amidst Slowing Population Growth—How did it Happen, How Long Can it Last

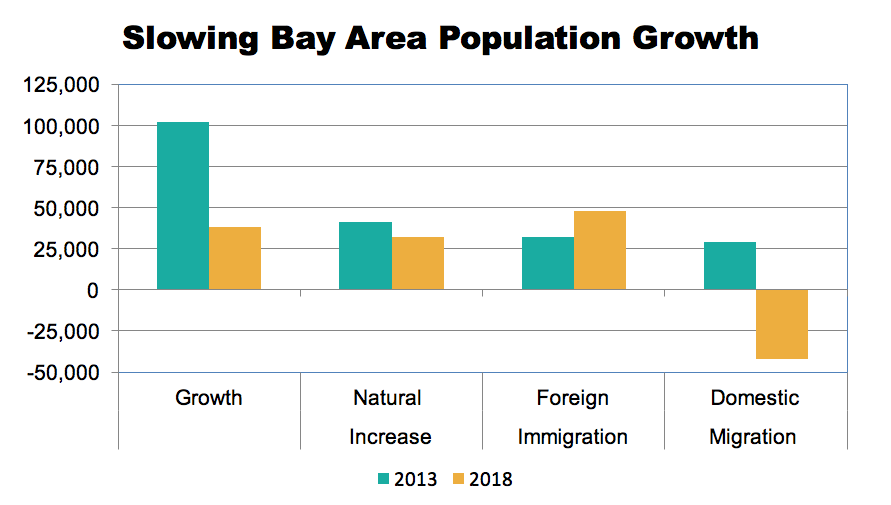

Bay Area population growth has slowed as a result of lower levels of natural increase and rising levels of domestic out migration. Total growth fell from above 100,000 in 2013 to 37,000 in 2018. Domestic migration moved from plus 29,000 to minus 42,000 in 2018 as a growing number of residents moved out as a result of rising housing costs. Foreign migration increased in 2018 and was higher than the region’s total population growth. A separate memo is being prepared on population trends in the Bay Area.

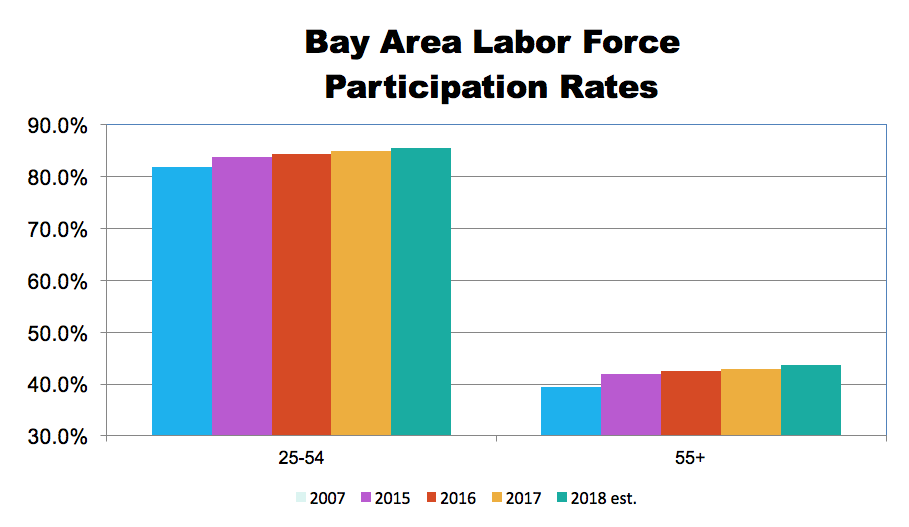

Recent job growth was made possible primarily from reentry into the workforce of existing residents as the tight labor market encouraged employers to consider applicants they previously looked past. Bay Area labor force participation rates are at record levels as residents who dropped out of the workforce now find eager employers.

While participation rates could rise further, at the same time the aging of baby boomers will move many into the 55+ age groups, which have much lower rates compared to residents aged 25-54.

So the region will continue to struggle to find new workers as increasingly they will come from people moving to the region, which has become difficult given the housing shortage and high housing costs.

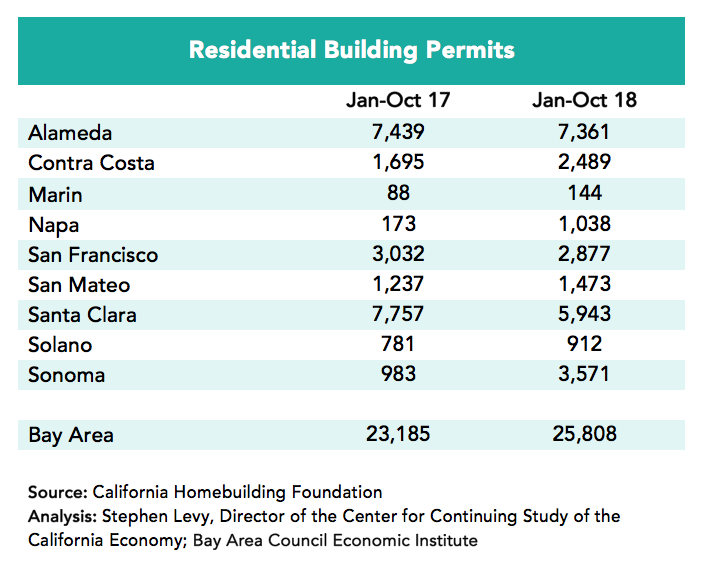

Housing permit levels continued an upward trend in 2018 though most of the gains came in the first six months of the year. Permit levels are up 11% in the first ten months of 2018 led by strong gains in Contra Costa, Napa and Sonoma counties. And project approvals and plans are also rising throughout much of the region from Oakland, Emeryville, eastern Contra Costa County and San Francisco to Redwood City, Mountain View, Cupertino and San Jose. And projects started in prior years are now reaching completion.

The next needed steps involve lowering the cost of building new housing, changing zoning to allow more and less expensive housing to be built and, hopefully, state funding to offset some costs of housing. Perhaps the hardest challenge to overcome is the lack of affordable housing for middle income residents who are not eligible for subsidized housing even if it were available in sufficient quantity.

The bottom line, which should be understandable to Bay Area Council members, is that it is really hard if not impossible under current rules to build housing that is affordable to middle income residents yet pencils out for developers.

For readers who want to follow the recommendations of the Committee to House the Bay Area (CASA), look at the recent meeting packets for December at https://mtc.ca.gov/our-work/plans-projects/casa-committee-house-bay-area/casa-meeting-schedule.