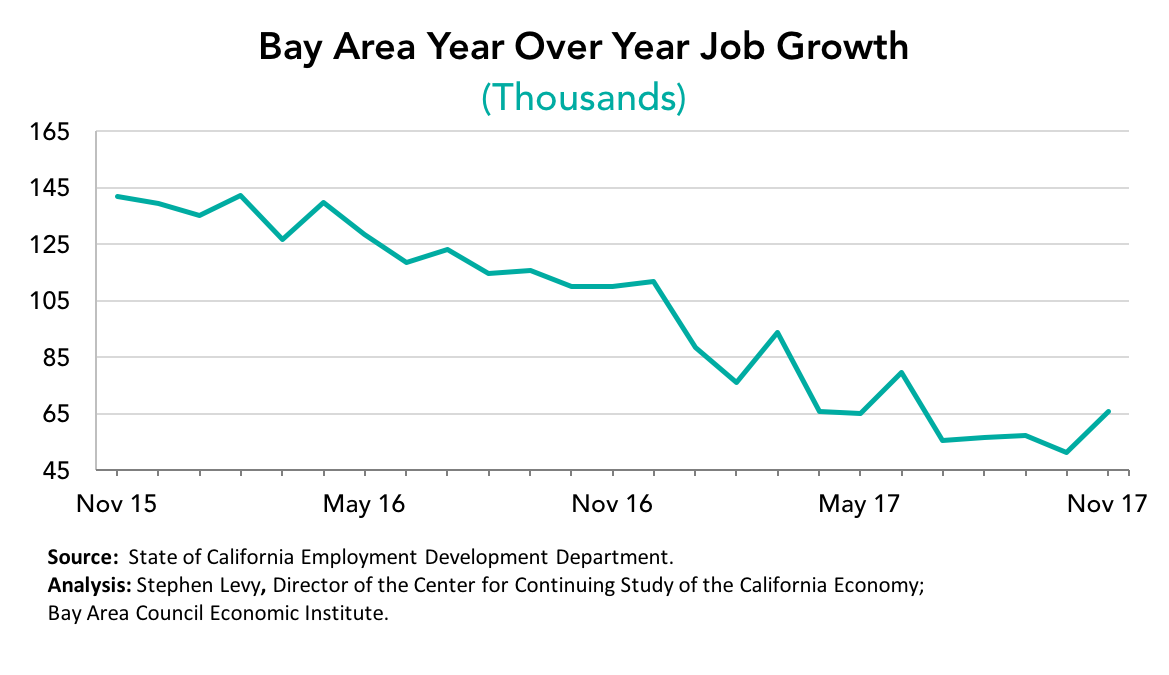

November was a strong month for the regional economy and the past two months have seen a number of major housing proposals move forward. Bay Area job growth in November pushed the year over year growth comparisons upward after a long series of declines. At the same time unemployment rates in November fell to the lowest levels ever while more people joined the workforce. Large tech company expansion plans continue on track with Google making a series of new facility acquisitions.

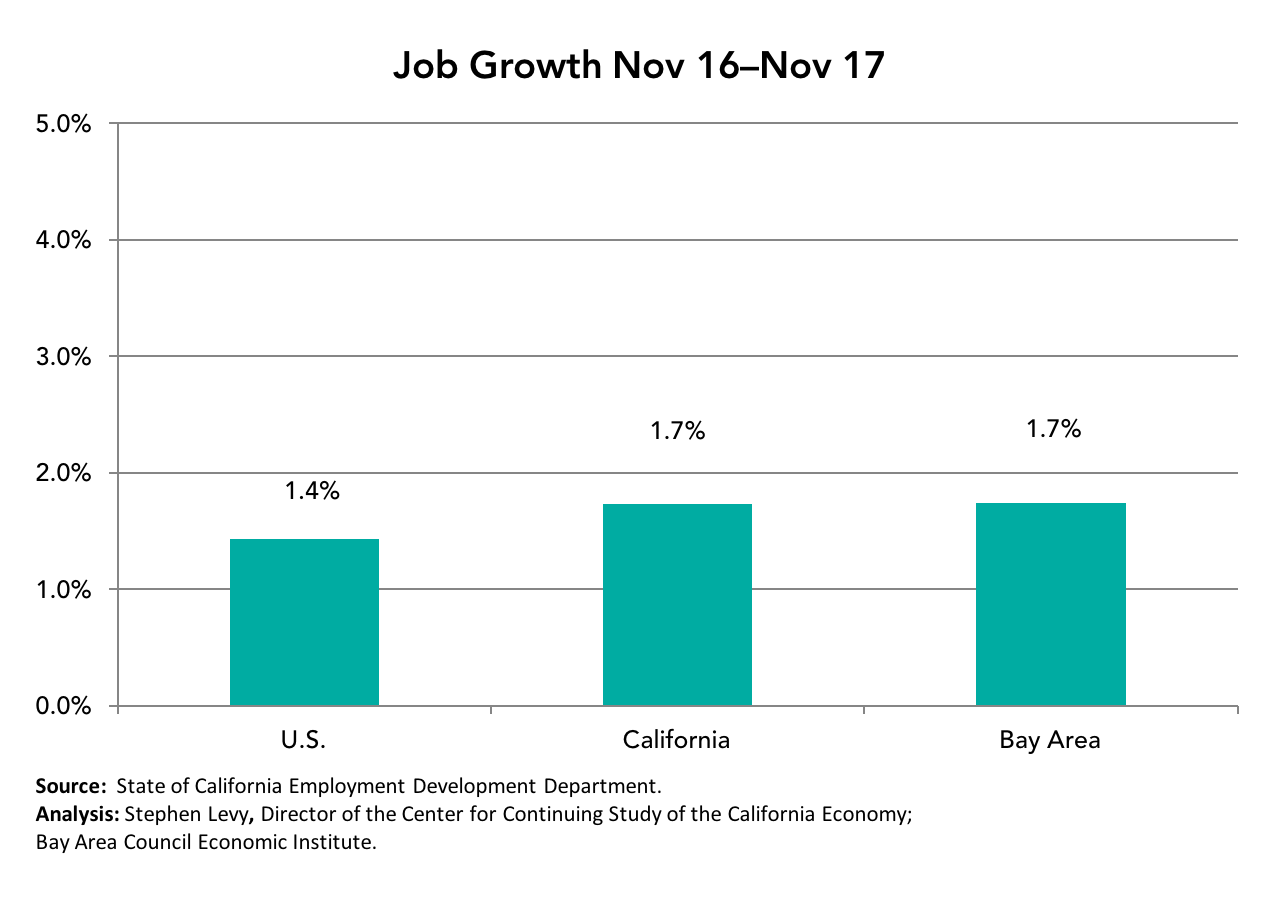

The Bay Area Again Outpaces the Nation in Job Growth

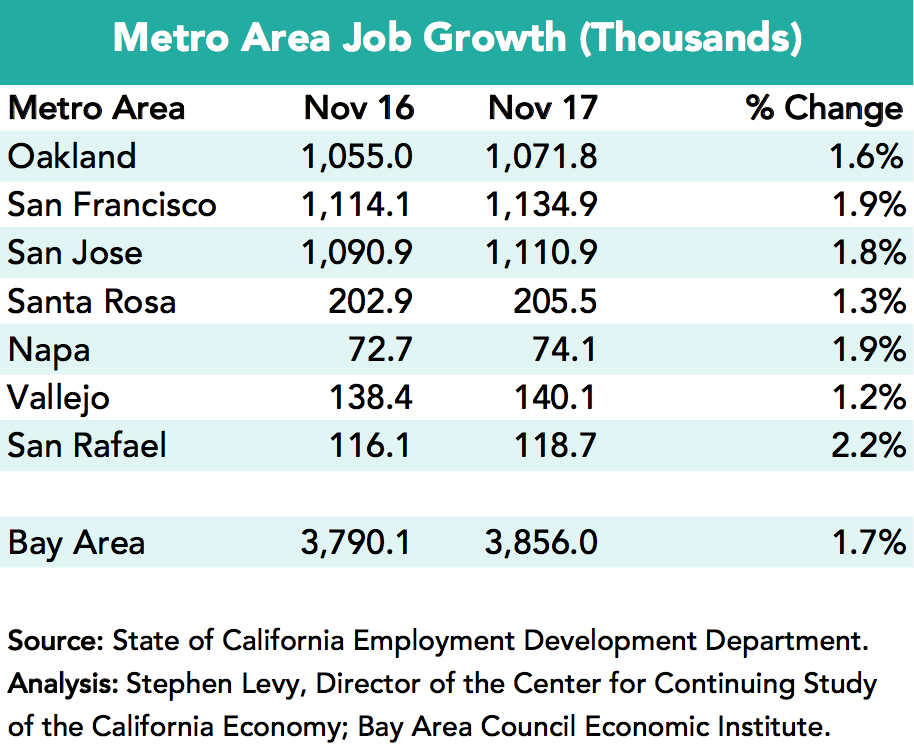

The Bay Area posted a 1.7% job growth rate during the past 12 months that matched the state job growth rate.

Strong job growth in November increased the year over year growth rates for most metro areas with particularly stronger growth in the San Francisco and San Jose metro areas.

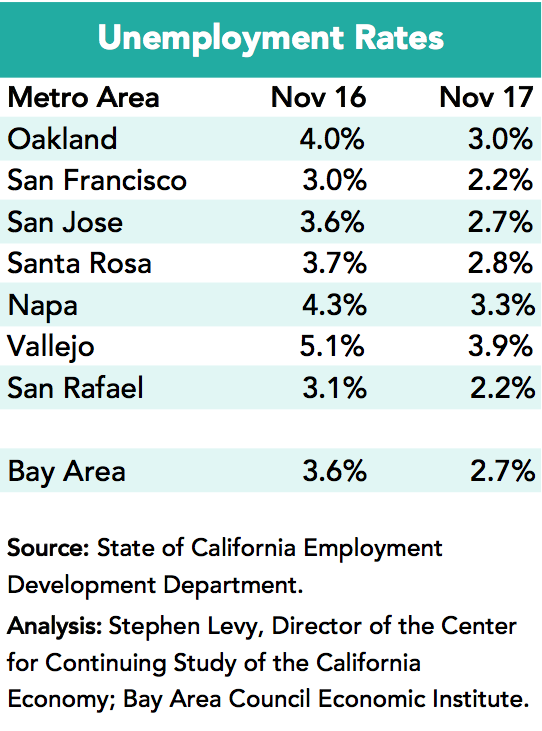

At the same time the November data showed positive trends for labor force growth and unemployment. Unemployment rates are still falling even though rates are already low. The regional unemployment rate of 2.7% in November is the lowest on record. The number of unemployed residents fell from 151,300 a year ago to 114,700 last month.

Labor force growth continued last month and the region has added 40,700 workers (+1.0%) over the past 12 months outpacing population growth. It is too soon to tell if the recent uptick in job growth signals that the period of slower job growth compared to the nation is over. The region’s housing and transportation challenges remain.

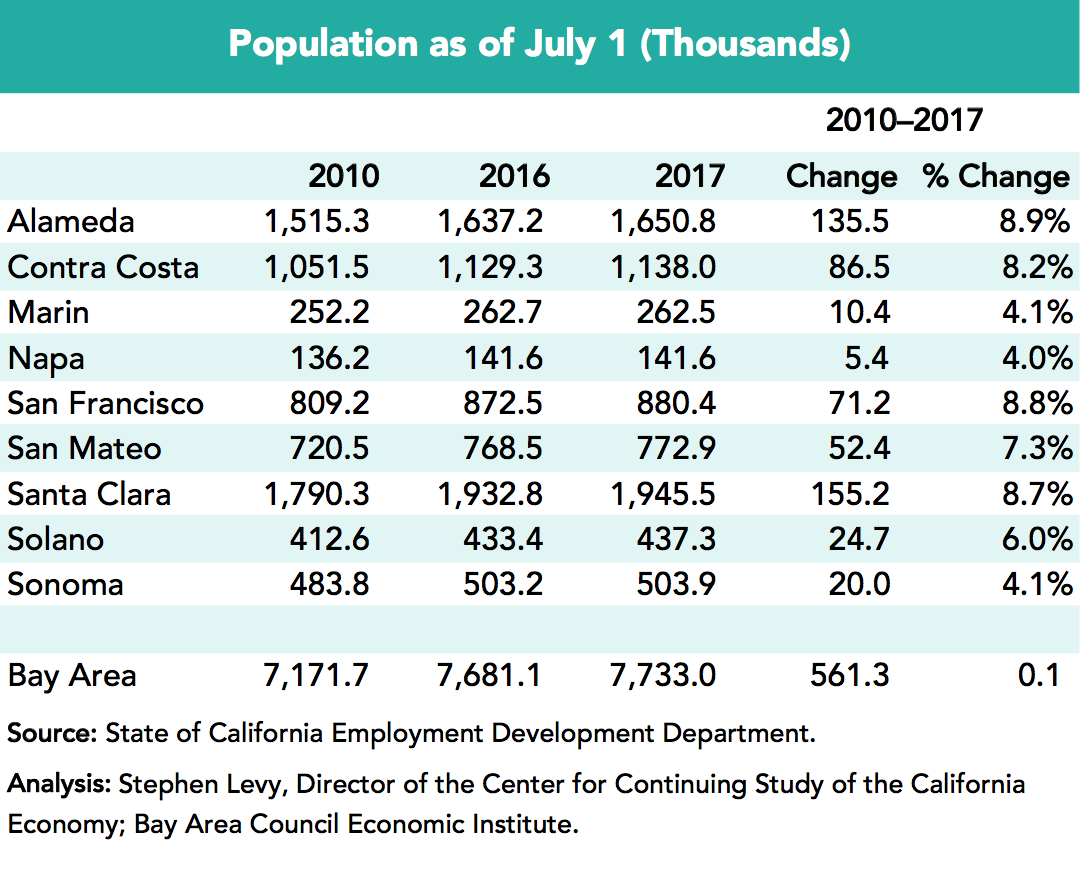

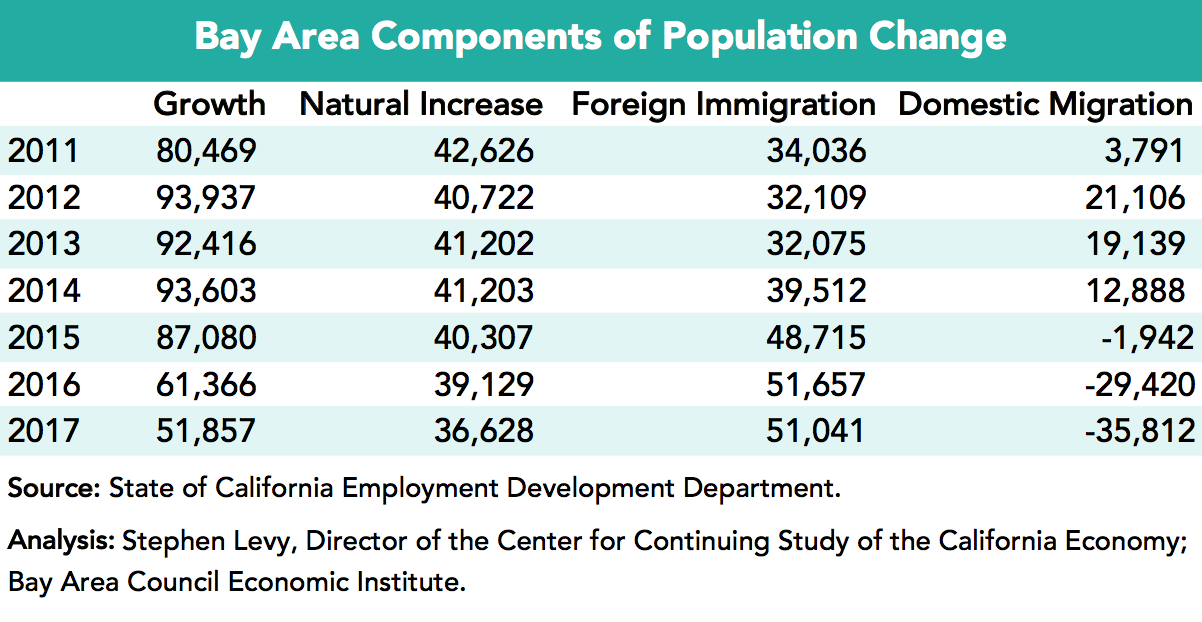

Population estimates from the California Department of Finance (DOF) show that the region’s population growth is slowing. Some residents are likely moving to adjacent counties and some moving out of the area. The region had strong population gains since 2010 outpacing both the state and nation but growth has slowed substantially in the past two years.

Population growth has slowed in the region despite increasing foreign immigration. The major change in the past two years is the growing outmigration from the region. Natural increase (births minus deaths) has decline a bit but outmigration is the major factor in slowing population growth though some migrants appear to have moved to adjacent counties. Domestic migration into San Joaquin, Stanislaus and Merced counties has been slightly positive in the past two years though not as much as the Bay Area’s outmigration.

But there are many indications that companies and communities are responding to growth challenges and planning for the future.

- There is more positive news with regard to expanding our housing supply. Housing permits are up substantially for the first nine months of the year but more are needed. Mountain View has approved plans for nearly 10,000 new housing units at North Bayshore. San Jose has bold housing proposals that coincide with the substantial Google expansions being planned. NASA is adding housing at Moffett Field and recently Google acquired several sites at Moffett Field and announced they hope to provide housing and retail near these job sites.

- The next needed steps involve lowering the cost of building new housing, changing zoning to allow more and less expensive housing to be built and, hopefully, state funding to offset some costs of housing so that cities get the funds but some of the fees and infrastructure costs do not have to be added to the cost and price/rental rate of the new housing. The Committee to House the Bay Area (CASA) is working on these issues and the Bay Area Council has participants in this important effort.

- Housing permit levels are up for the first ten months of 2017 with strong gains in Santa Clara and Alameda counties. These are all good signs for overall housing growth as the region struggles to bring supply into balance with population and job growth.

- And residents have passed and will get a chance in 2018 to approve more major transportation funding measures.

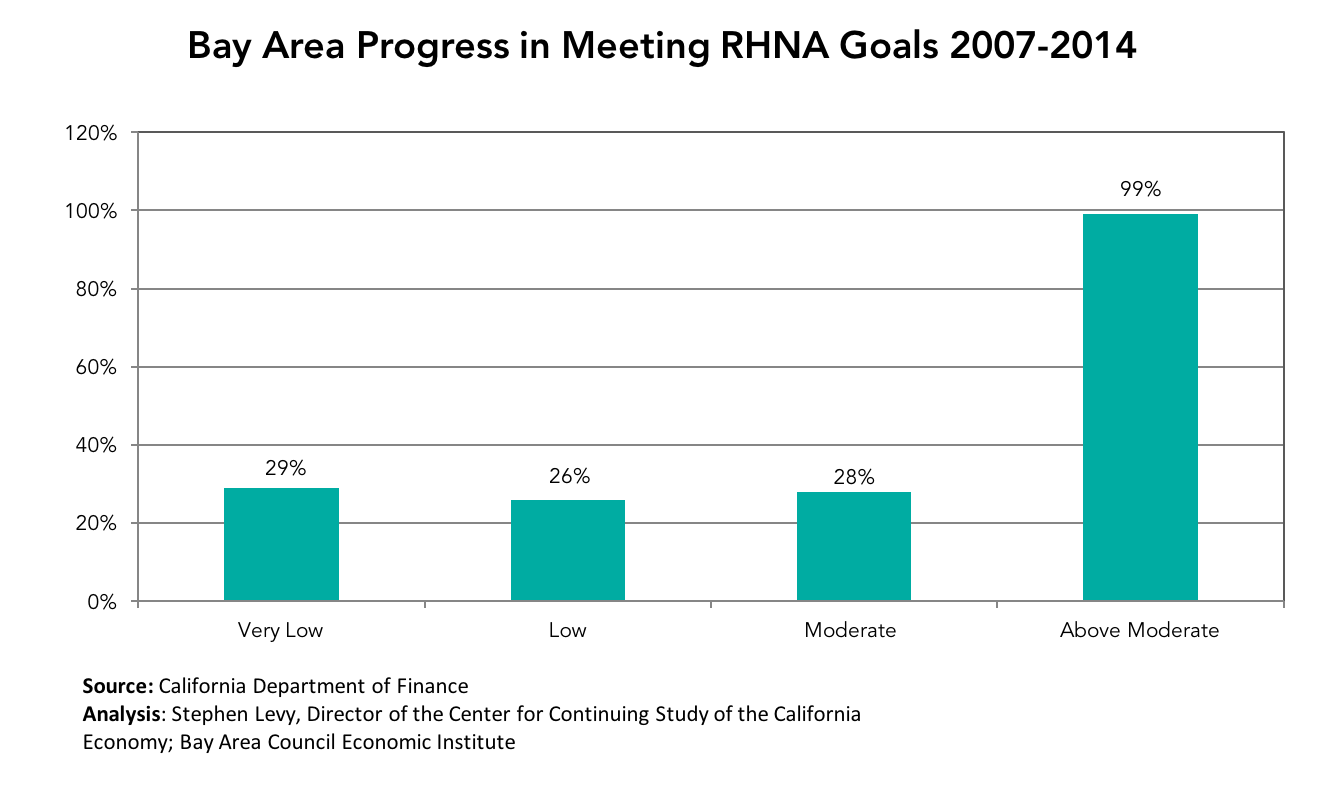

But the overall housing shortage is not evenly distributed among price and rent categories. Very low income households are those making between 0% and 50% if area median income (AMI). Low income ranges from 50% to 80% of AMI and moderate (middle income) ranges from 80% to 120% of AMI. With funding and approval challenges, it is not surprising that the low and very low income targets are not being met. But the shortage for middle income households is virtually the same as that for low and very low income households.

So there is lots of work to be done at most income levels to make housing more affordable in the region.