Dissecting the Downward Revision to Bay Area Job Estimates

March 18, 2021

The highlights:

• The downward revisions occurred after May 2021.In that month the revisions raised, now lowered, the Bay Area job total.

• The downward revisions were largest in the Leisure and Hospitality sector that includes hotels, restaurants, and amusement parks. Tech sector jobs were revised up.

• The downward revisions in the Bay Area were comparable in % terms to those statewide. However, the Bay Area and state have now recovered a much smaller share of jobs lost compared to the nation.

• The number of people in the Bay Area labor force was revised downward. What might that mean?

• Now we are in March. How has the outlook changed?

The Downward Revisions Occurred After May 2020

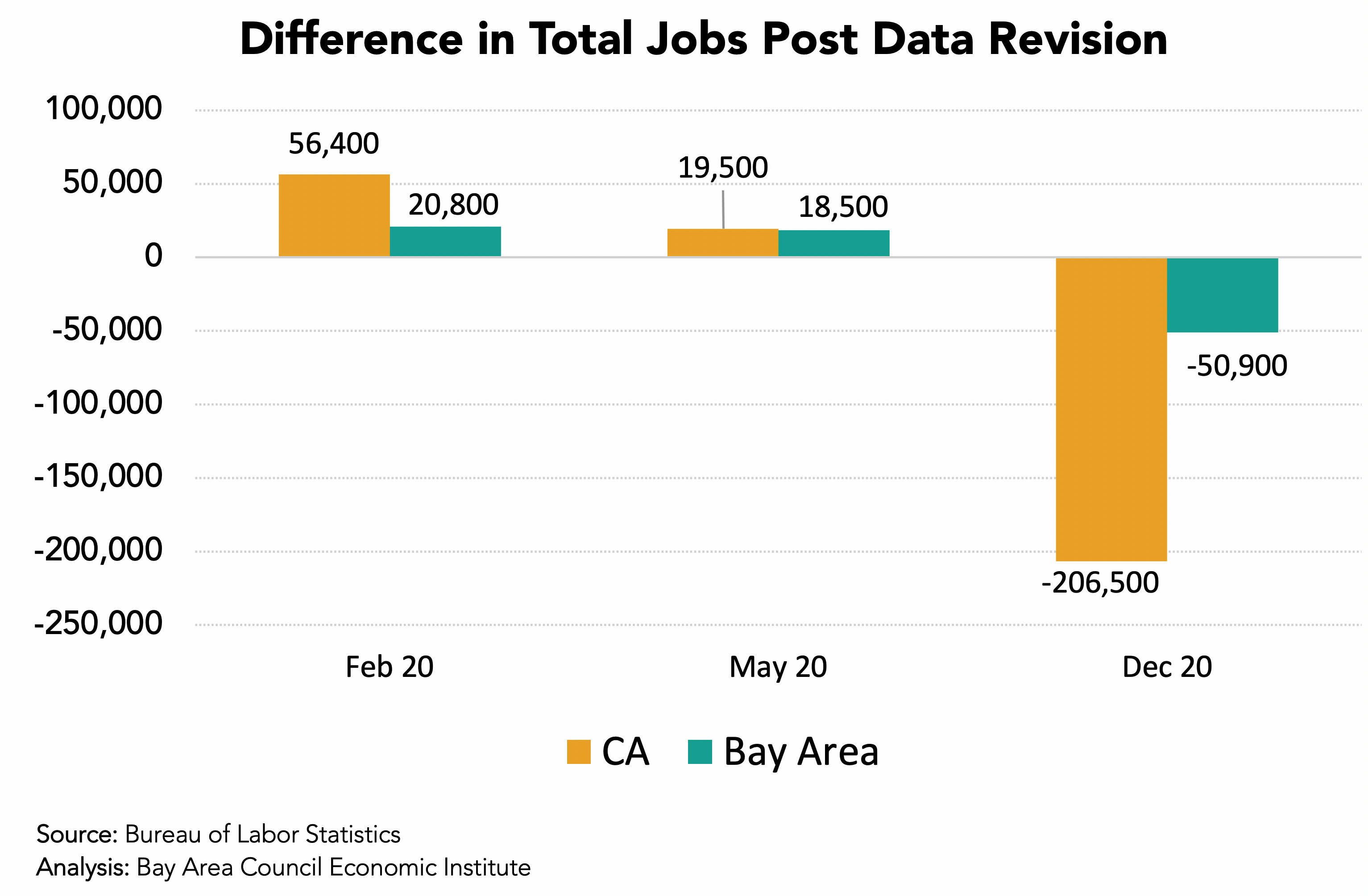

In February 2020 prior to the virus spread, revisions raised job levels in the state and Bay Area. In May 2020 the Bay Area accounted for nearly all the state upward revisions. The downward revisions occurred later in 2020.

In December 2020, the last month of the revisions, the Bay Area accounted for just under 25% of the state revisions, which is in line with the region’s share of state jobs.

Largest Downward Revisions were in Leisure and Hospitality While Tech Jobs were Revised Up Slightly

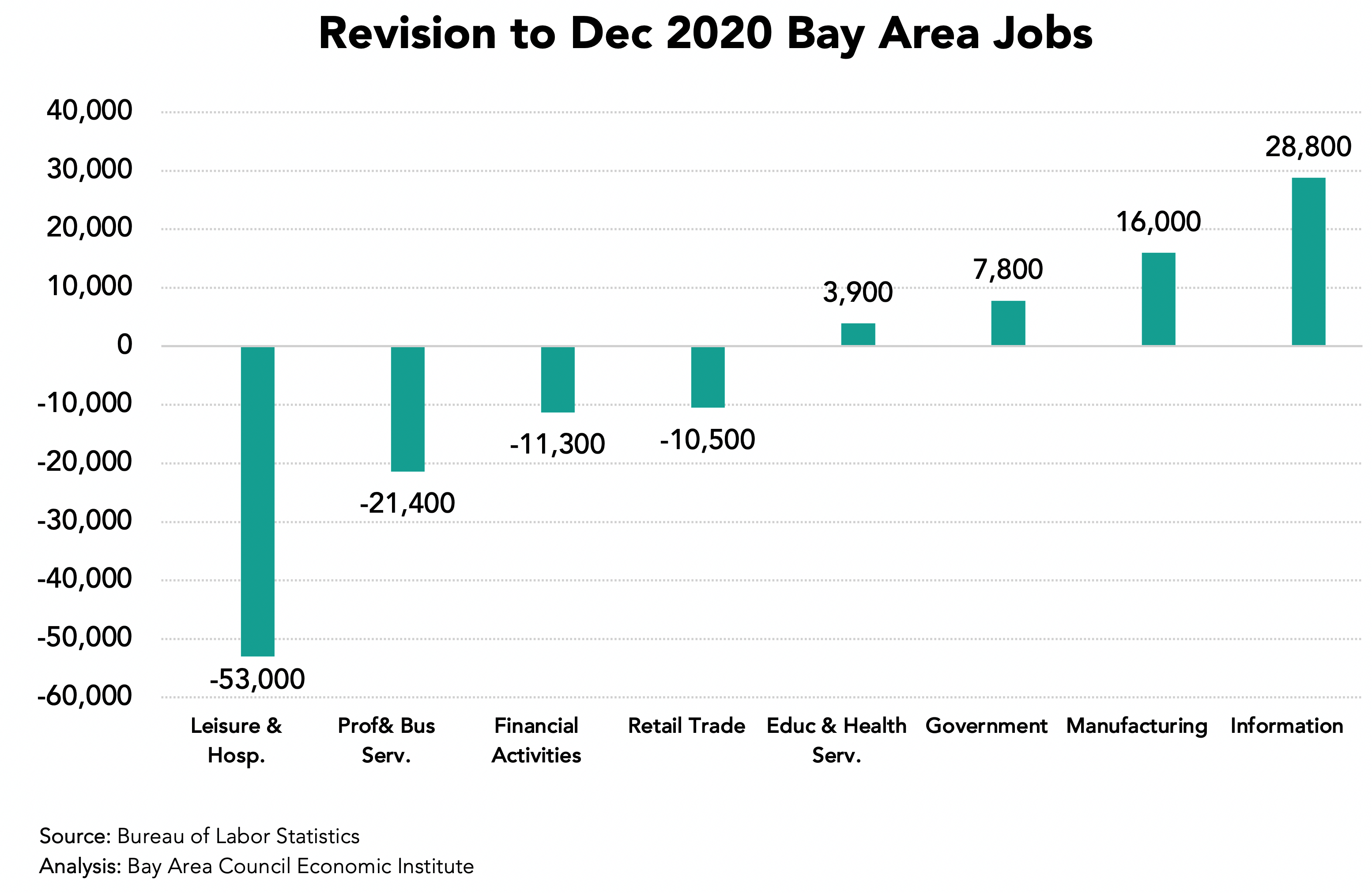

The Leisure and Hospitality sector was revised downward by 53,000 jobs for December 2020 accounting for all the region’s downward revisions. The activity restrictions were still in full force for this sector through the end of 2020. It should be noted that the later months of 2020 may be revised again when full data is available. Job levels in some sectors were revised upward including +28,800 in the Information sector that includes internet related services. Manufacturing jobs were also revised upward so tech broadly defined including the downward revisions to Professional and Business Services jobs, gained in the revisions.

The Bay Area Had Recovered Just 29% of Lost Jobs by January 2021

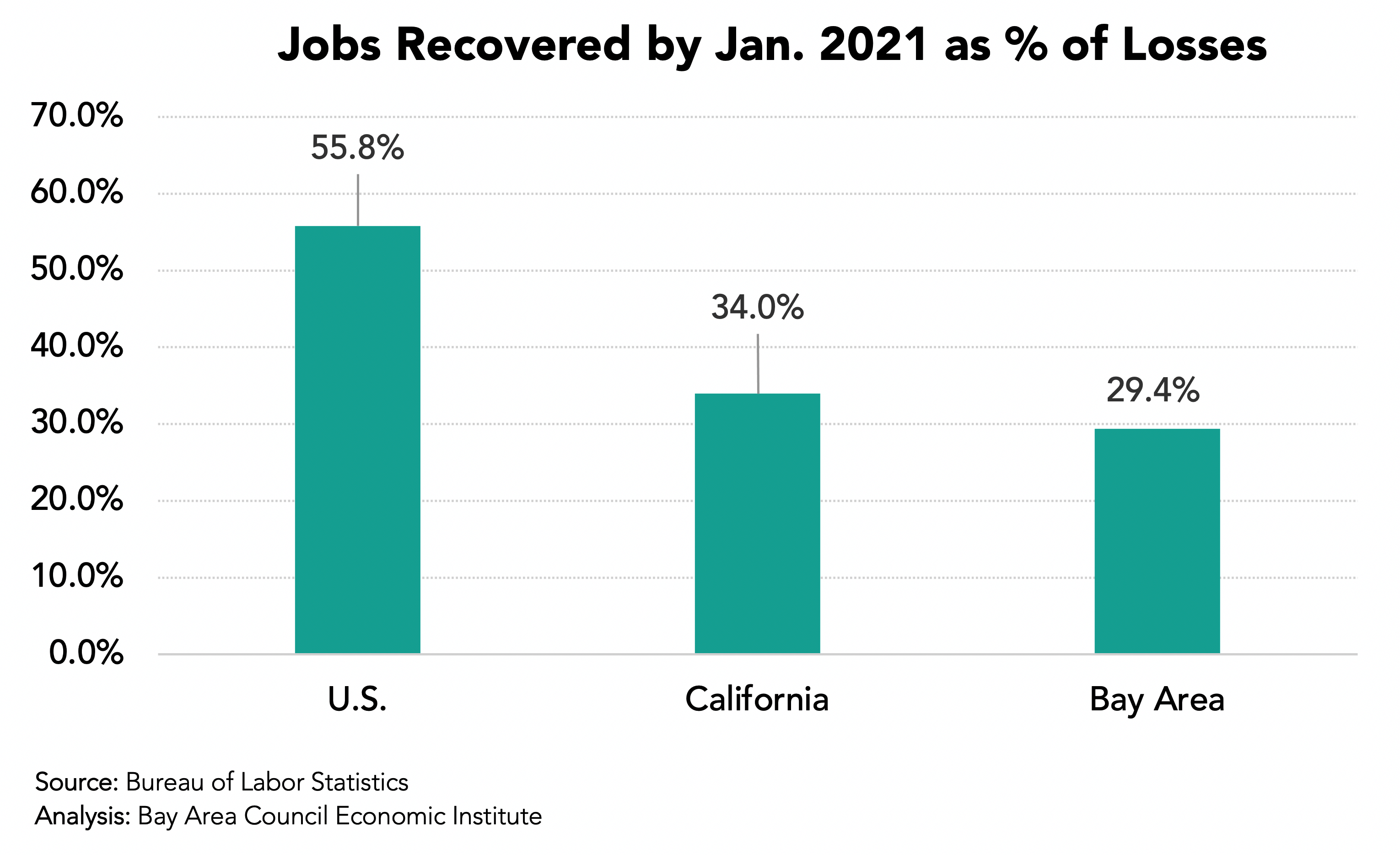

In January 2021 the Bay Area had recovered 29.4% of the jobs lost between February and April 2020. The state had recovered 34.0% while the nation had recovered over half (55.8%) of lost jobs. The probable cause of low job recovery in the region and state was the extent and duration of activity restrictions compared to elsewhere in the nation. Looking at large metro areas in California the recovery share was SF (13.3%), East Bay (39.7%), San Jose (30.7%), LA (25.9%), Orange (27.4%), Riverside-San Bernardino (53.5%) and San Diego (37.5%).

Labor Force Losses Were Added to the Poor Job Performance

The Bay Area labor force was revised down by 24,900 in December 2020 and another 25,700 residents left the labor force in January. It is possible some of these residents left the region either for remote work opportunities or as part of the growing trend of out migration to find less expensive housing.

The extent of out migration related to the pandemic and the future of remote work is unclear at this time. Recent evidence is that most recent movers from the Bay Area sites stayed within the region or moved relatively close by while a smaller share left the state.

The Look from March 2021

All Bay Area counties have moved into the red tier and on March 16th San Mateo County moved into the Orange tier with other counties poised to follow.

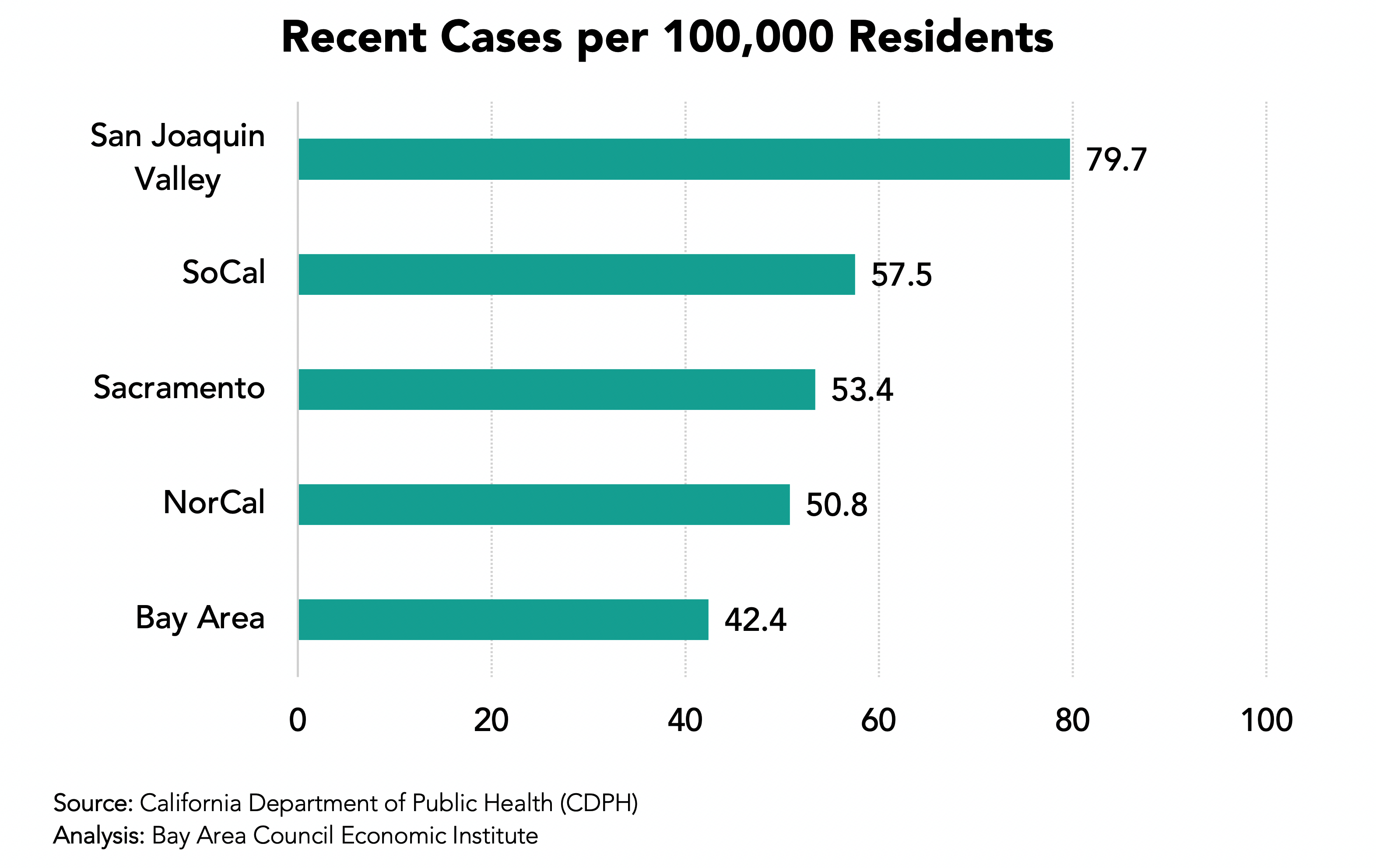

The Bay Area has the lowest case rate among California regions.

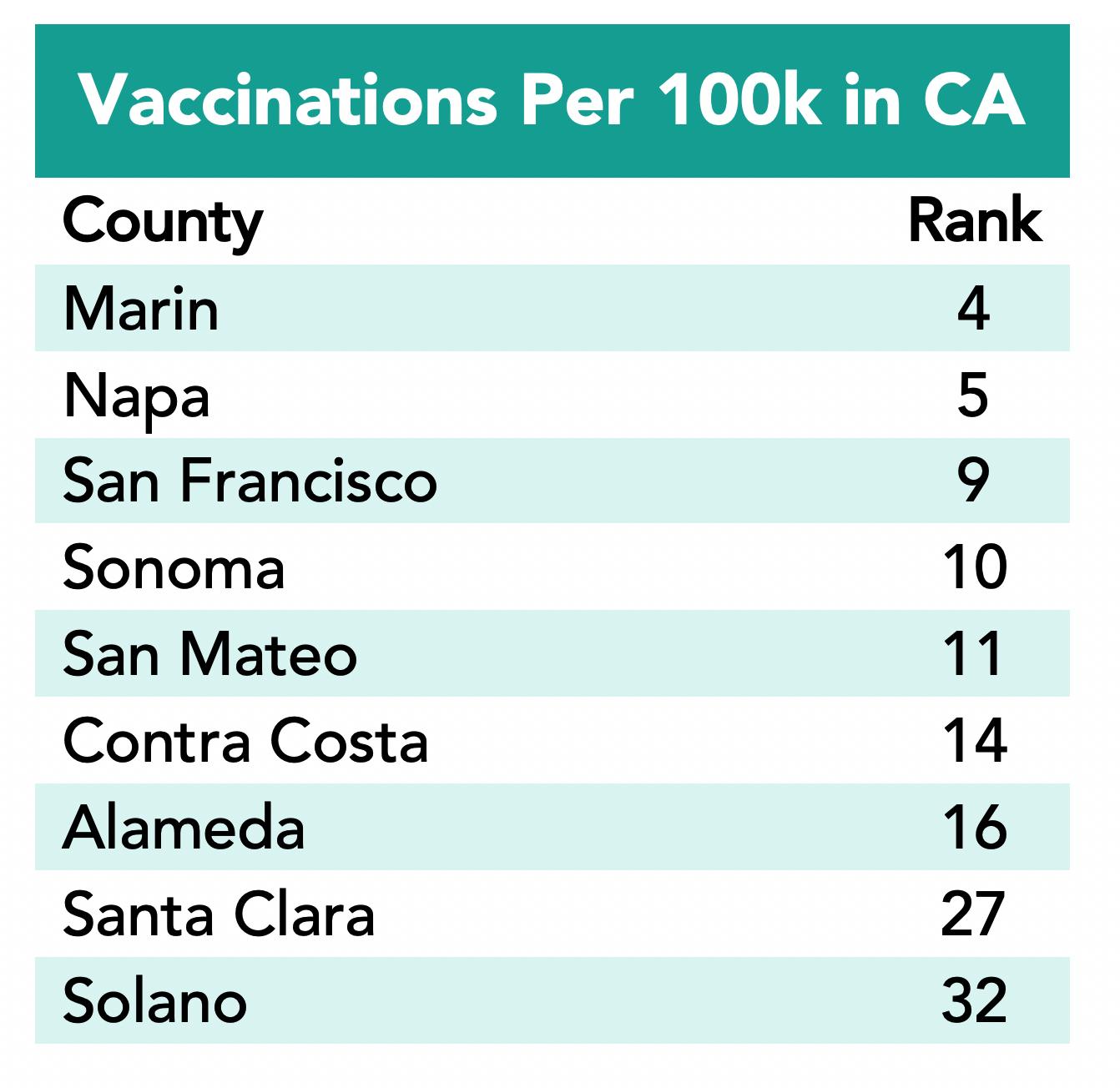

Bay Area counties rank high in vaccinations per 100,000 residents among the state’s 58 counties.

Several additional factors point to a better economic outlook for the Bay Area. The UCLA March 2021 forecast has the state outpacing the nation in job growth for the next three years led by the Bay Area economy. The recently passed COVID relief package ($1.9 trillion), the new policies on immigration, trade and infrastructure all support the region and state economies.

Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

And, finally this alert from a recent BAC email.

Stemming the Tide of Jobs, Investment Leaving California:

With jobs and investment continuing to flee California, identifying the key issues and solutions to the state’s worsening business climate is imperative. Bay Area Council CEO Jim Wunderman today joined a virtual town hall hosted by Chapman University and including a panel of many of the state’s leading business and academic leaders to discuss the disastrous consequences of failing to take seriously the threat to California’s economy. The discussion comes as the Council launches a new statewide initiative focused on reversing the exodus of talent, companies and investment over concerns about high taxes, onerous regulations and the multiple threats of a historic housing crisis, growing homelessness and escalating impacts—wildfires, drought, extreme weather—of climate change. As well, how COVID is dramatically altering the considerations of businesses in deciding where they need to locate.

The Council will circulate a link to watch the recorded town hall next week. To learn more about the Council’s Repair California initiative and how you can participate and support the work, please contact Chief Operating Officer John Grubb.