Modest Job Growth, Good News on Housing and COVID

Sept 22, 2021

The Bay Area has posted modest but disappointing job gains since March. At the same time VC funding is strong, housing permits have begun to rebound, the Governor signed several housing bills and the region is a leader in vaccinations and lowering COVID cases. The U.S. economic outlook and federal policies have improved with positive implications for our region. The Bay Area still faces challenges in housing, transportation and other areas that affect our economic competitiveness and, in doing so, reduce our ability to meet equity and environmental goals.

The highlights:

• The Bay Area added 141,500 jobs between January and August 2021 and the regional unemployment rate fell from 6.6% to 5.5%. Job gains were led by the San Francisco and San Jose metro areas and a rebound in the restaurant and tourist sectors.

• The U.S, and Bay Area economic outlook has been upgraded by the $1.9 billion COVID relief package, the likely passage of a major infrastructure package, and positive movement on the safety net and environmental investments and the possibility of more favorable immigration policies that all play to Bay Area strengths.

• The region is a state and national leader in vaccinations and reducing COVID cases that is allowing a return to more normal living here

• The long-term Bay Area economic challenges remain with only slow progress on housing, transportation and economic competitiveness, challenges at the front of the Bay Area Council policy agenda.

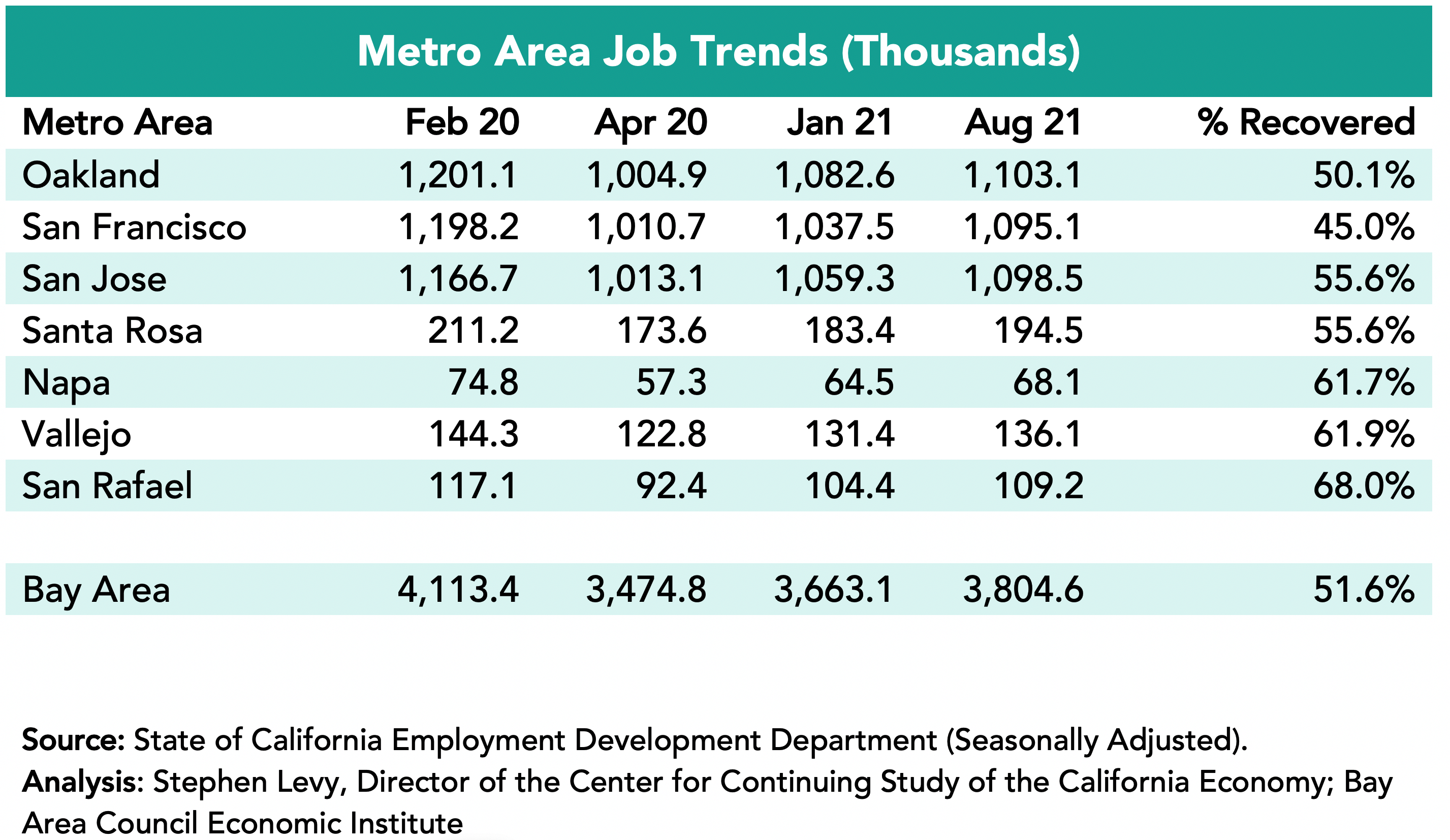

Job Growth is Steady but Disappointing Compared to the Nation

The Bay Area added 141,500 jobs since January 2021 led by a gain of 57,600 in the San Francisco metro area though SF has recovered just 45.0% of the jobs lost between February and April 2020 as job gains are offset by companies moving jobs out of SF. The San Jose metro area added 39,200 jobs but by August had recovered only 55.6% of the jobs lost between February and April 2020. The Napa, Vallejo and San Rafael metro areas had the largest % job recovery by August 2021.

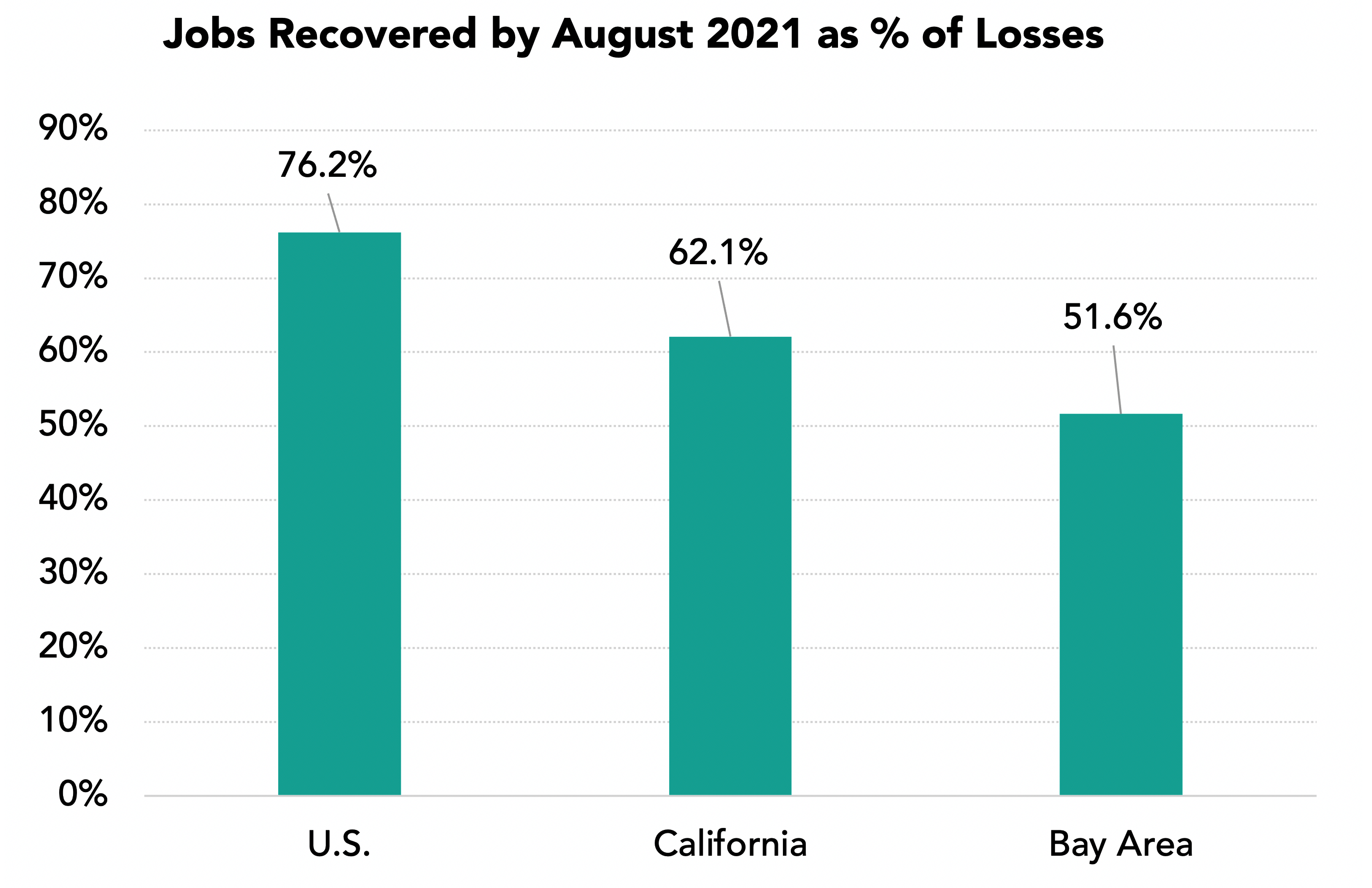

The Bay Area Had Recovered Just 51.6% of Lost Jobs by August 2021 Yet VC Funding is Surging and Tech Jobs Are Above Pre-Pandemic Levels

In August 2021 the Bay Area had recovered 51.6% of the jobs lost between February and April 2020 up from 29.4% in January. The state had recovered 62.1% up from 34.0% while the nation had recovered 76.2% of lost jobs up from 55.4%. At the same time VC funding in the first half of 2021 was $48.1 billion, the highest first half on record and 35% of a record $139 billion nationally.

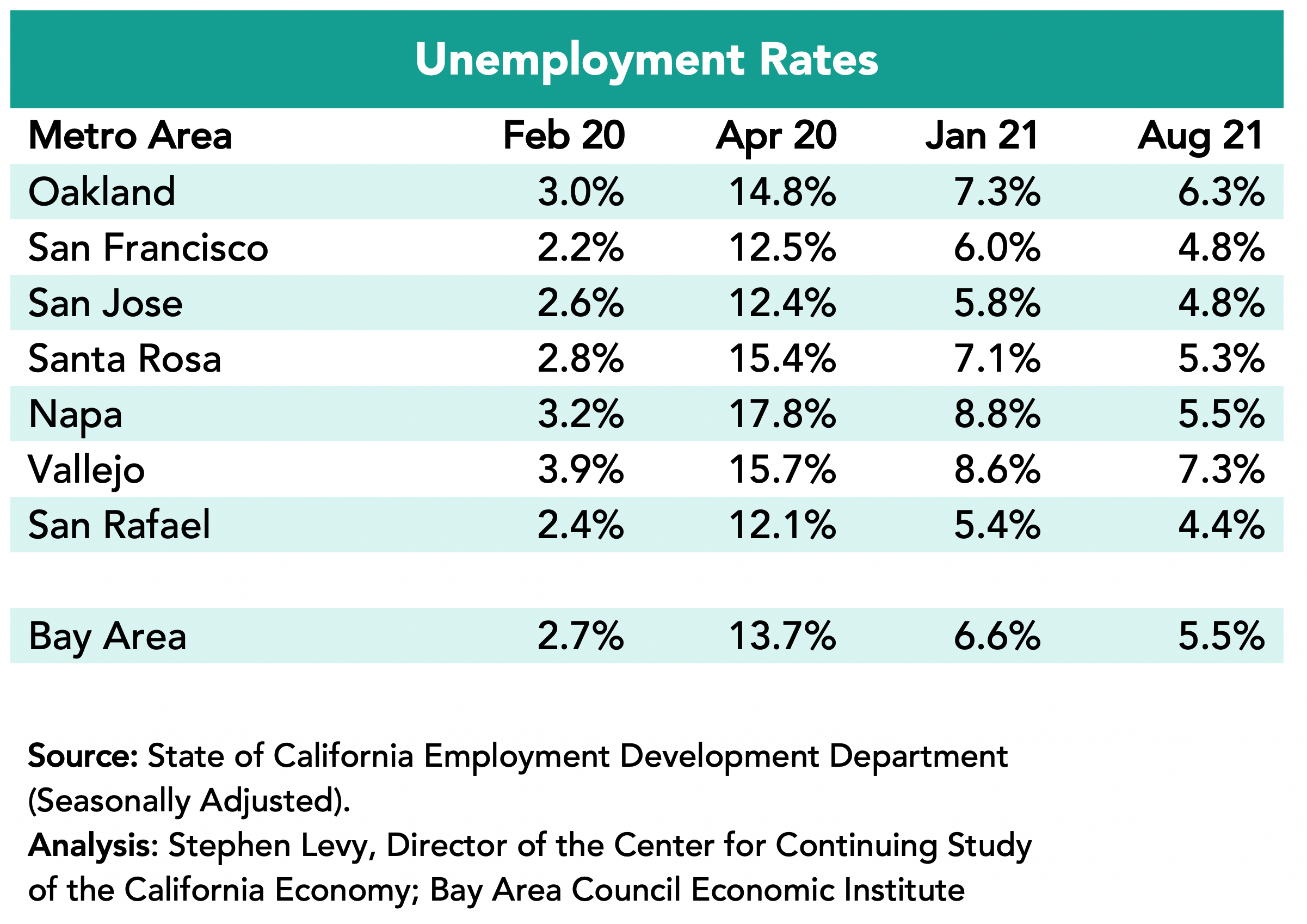

Unemployment Rates Fell to 5.5% in the Region in August 2021 from 6.6% in January 2021.

The lowest rates were in the San Rafael metro area (4.4%) followed by the San Francisco and San Jose metro areas (4.8%) in August 2021. Unemployment rates jump in the summer months and then fall in September normally. Bay area rates are well below the state 7.5% unemployment rate.

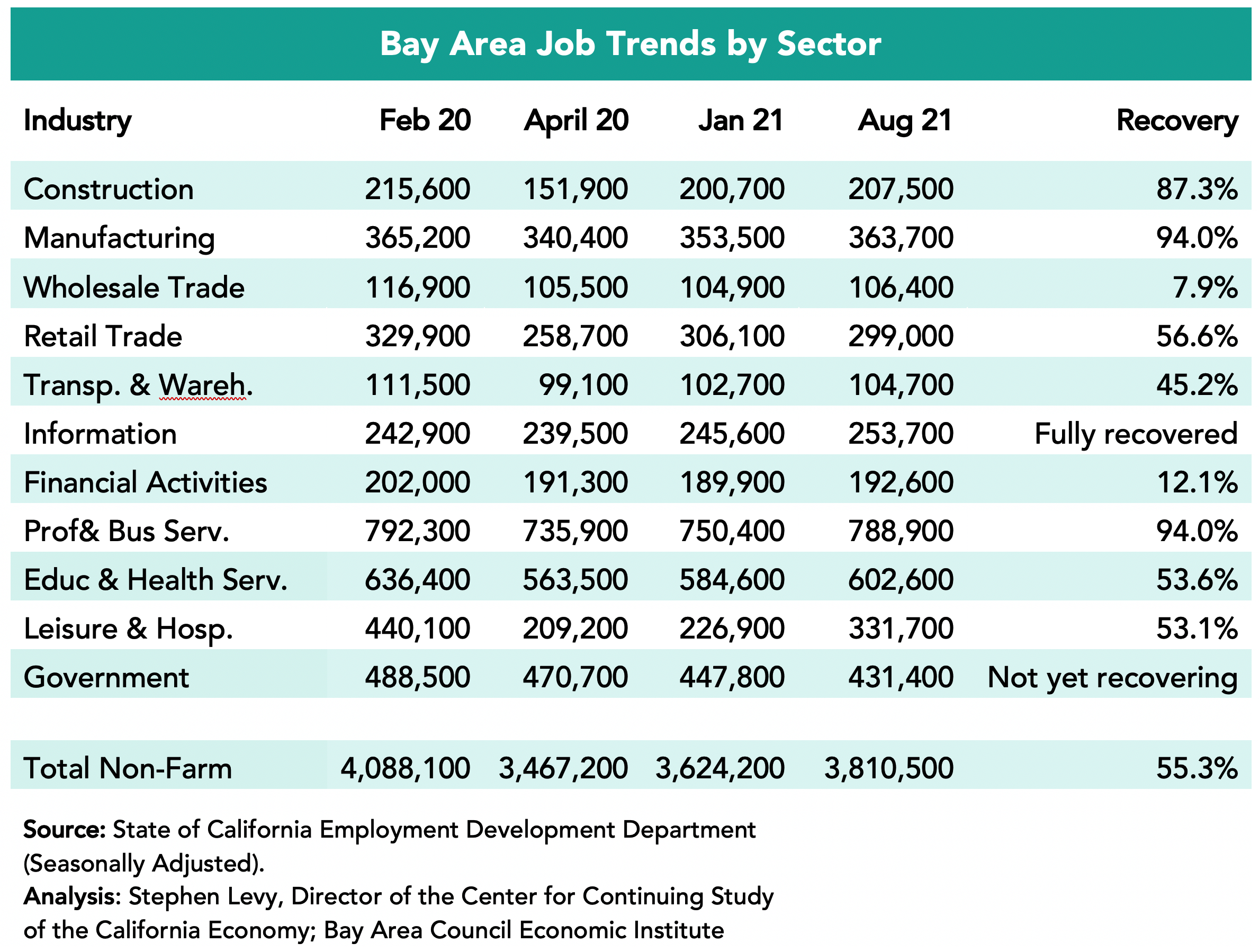

Industries Were Affected Differently

The Information sector actually added a small number of jobs compared to before the pandemic hit. And the Professional & Business Services sector has regained 94% of the lost jobs. On the other hand, the Leisure and Hospitality sector recovered only 53.1% of lost jobs by August 2021 though strong gains were posted these in the past six months. The Government sector has fewer jobs now than in April 2020 though many jobs may be returning as schools and colleges reopen. The Construction and Manufacturing sectors have recovered most of the jobs between February and April 2020.

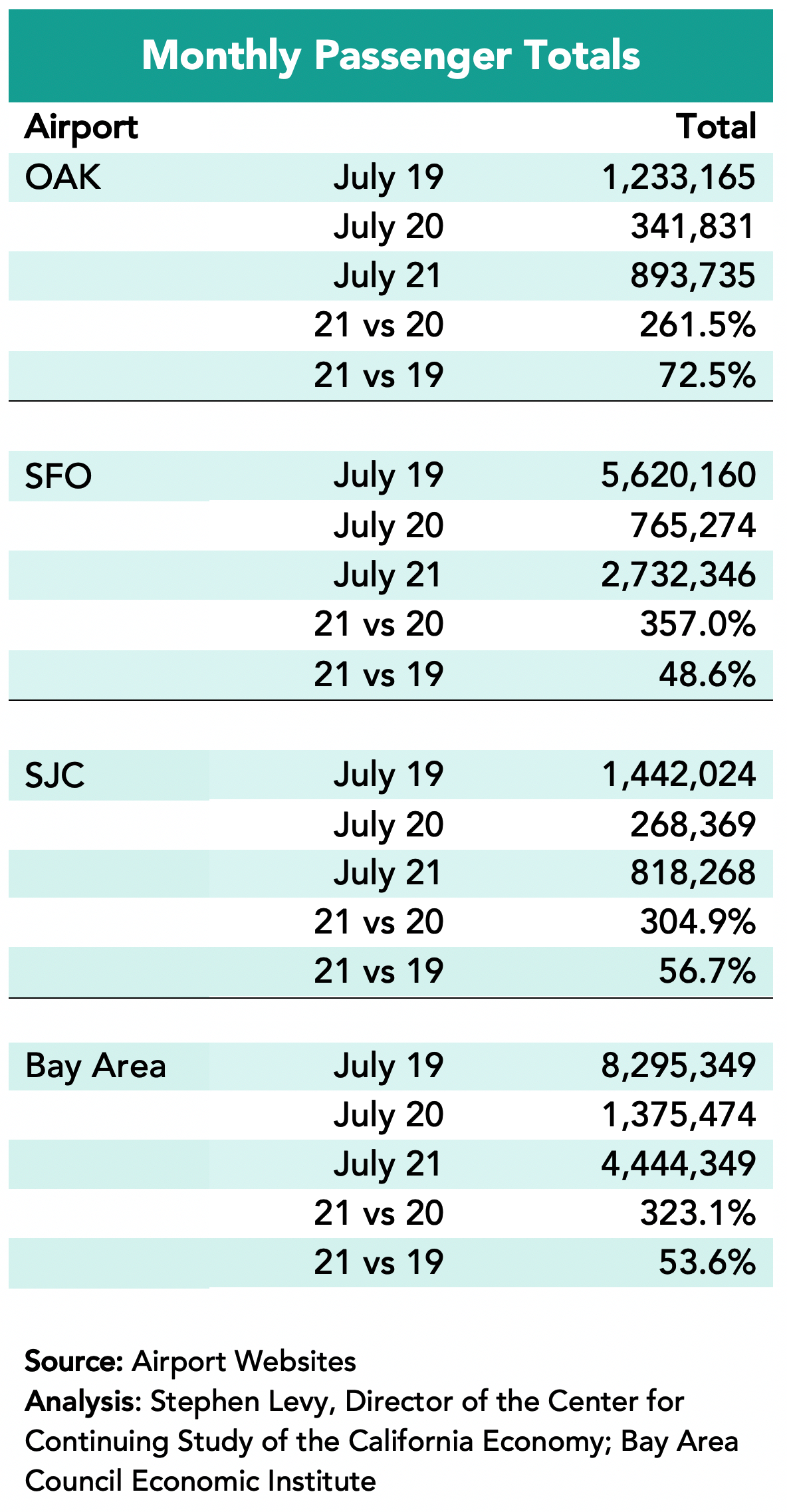

Airline Passenger Count Up, But Still Far Behind 2019 Levels

Airline passenger counts picked up in July at all Bay Area airports. However, Bay Area passenger counts in July 2021 were just over 1/2 of comparable month 2019 totals.

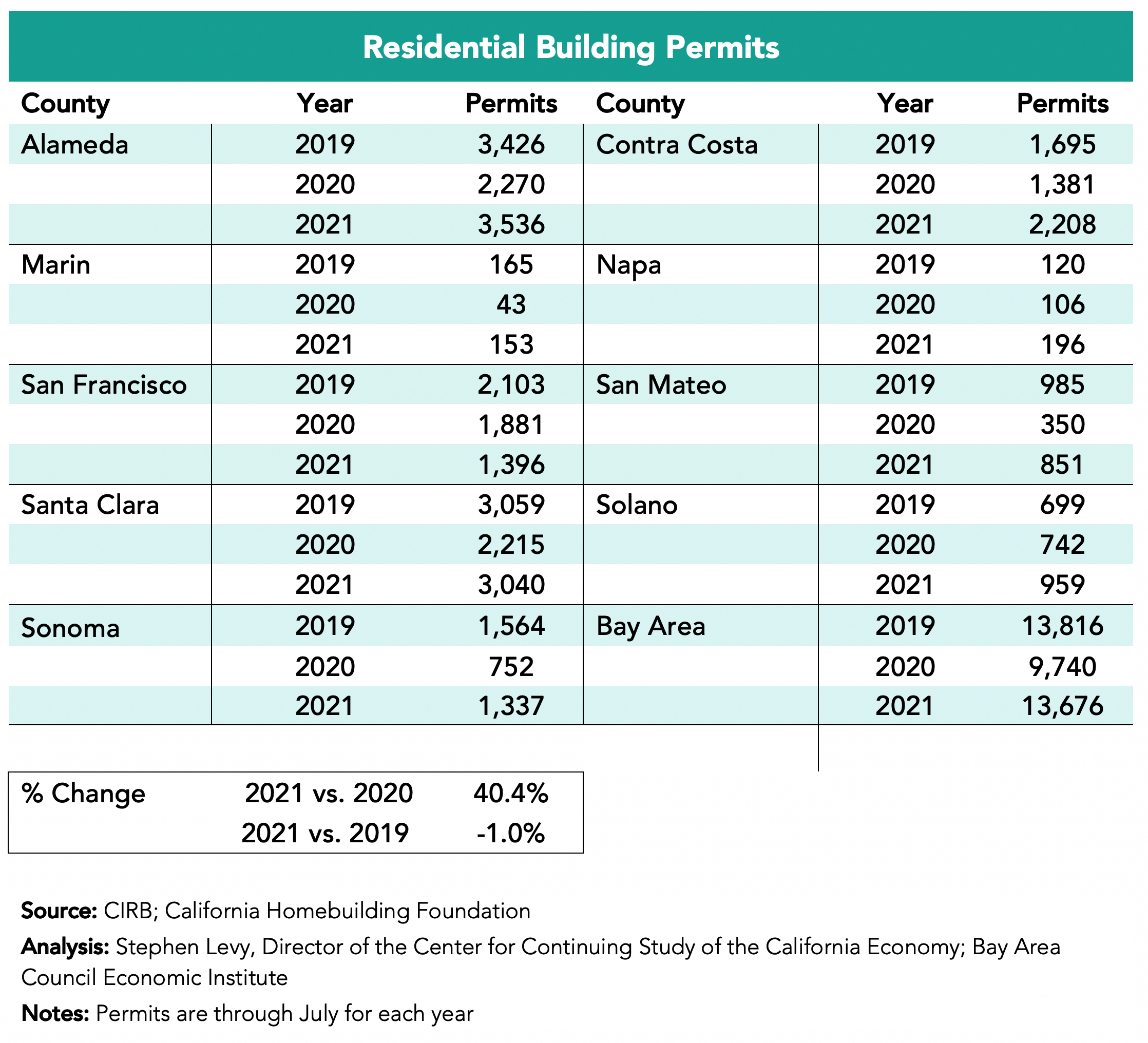

Housing Permits Up Over 2020 Levels, Trail 2019 Slightly

Housing permit levels are up over 2020 in the first seven months of 2021 but still slightly trail 2019 comparable months. But this month many new developments have been approved or proposed in places like Oakland and San Jose and in my neighborhood Menlo Park approved an 800-unit project and a developer proposed 500 units in Palo Alto this week.

Bay Area COVID Stats

The top eight counties in terms of vaccination percentages (all but Solano) are from the Bay Area with all having more than 70% first doses and six having more than 70% fully vaccinated. The Bay Area has by far the lowest number of new cases per capita and 8 of the 12 counties with the lowest recent per capita cases are in the Bay Area.

Large Challenges Remain:

We have the paradox of continuing reports of headquarters’ relocations outside of the region at the same the region is capturing record VC funding levels and tech jobs are slightly above pre-pandemic levels. Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

The rebound from pandemic related economic losses will continue but new policies are needed to maintain and improve the long-term competitiveness of the Bay Area economy. There is now increased movement to integrate our many transportation systems and agencies and pursue fare integration in an effort both to improve but to maintain the solvency of our main public transit options.