The Recovery Strengthens

June 21, 2021

The Bay Area posted modest job gains in March, April and May. The outlook for stronger near-term economic gains is positive though long-term challenges remain. The U.S. economic outlook has improved with positive implications for our region. The Bay Area success in battling the pandemic with declining case and hospitalization levels and high rates of vaccination has led to many reopenings with more to come that will be reflected in this and July jobs reports.

The highlights:

• The Bay Area added 89,500 jobs between January and May 2021 and the regional unemployment rate fell from 6.6% to 5.4%. Job gains were led by the San Francisco and San Jose metro areas and a rebound in the restaurant and tourist sectors.

• The U.S, and Bay Area economic outlook has been upgraded by the $1.9 billion COVID relief package that has so far resulted in growth in retail sales and the ISM manufacturing and services indices.

• Bay Area growth should accelerate now with more businesses reopening including some in-person capacity at sports and tourist venues.

• The long-term Bay Area economic challenges remain with only slow progress on housing, transportation and economic competitiveness, challenges at the front of the Bay Area Council policy agenda.

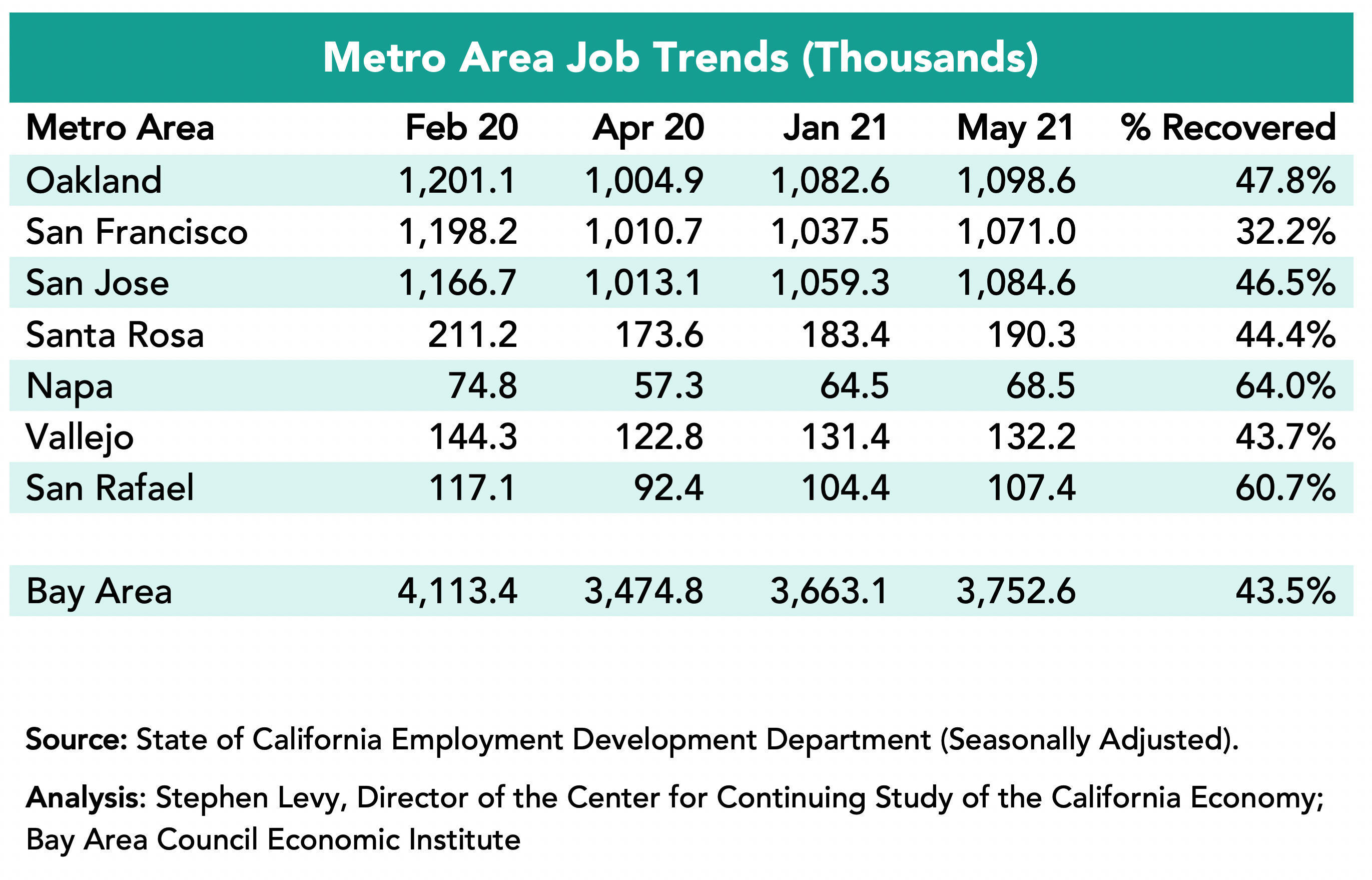

Job Growth is Steady but Unspectacular

The Bay Area added 89,500 jobs in the past four months led by a gain of 33,500 in the San Francisco metro area though SF has recovered just 32.2% of the jobs lost between February and April 2020 as job gains are offset by companies moving jobs out of SF. The San Jose metro area added 25,300 jobs. but by May had recovered only 46.5% of the jobs lost between February and April 2020. The Napa and San Rafael metro areas had the largest % job recovery by May 2021.

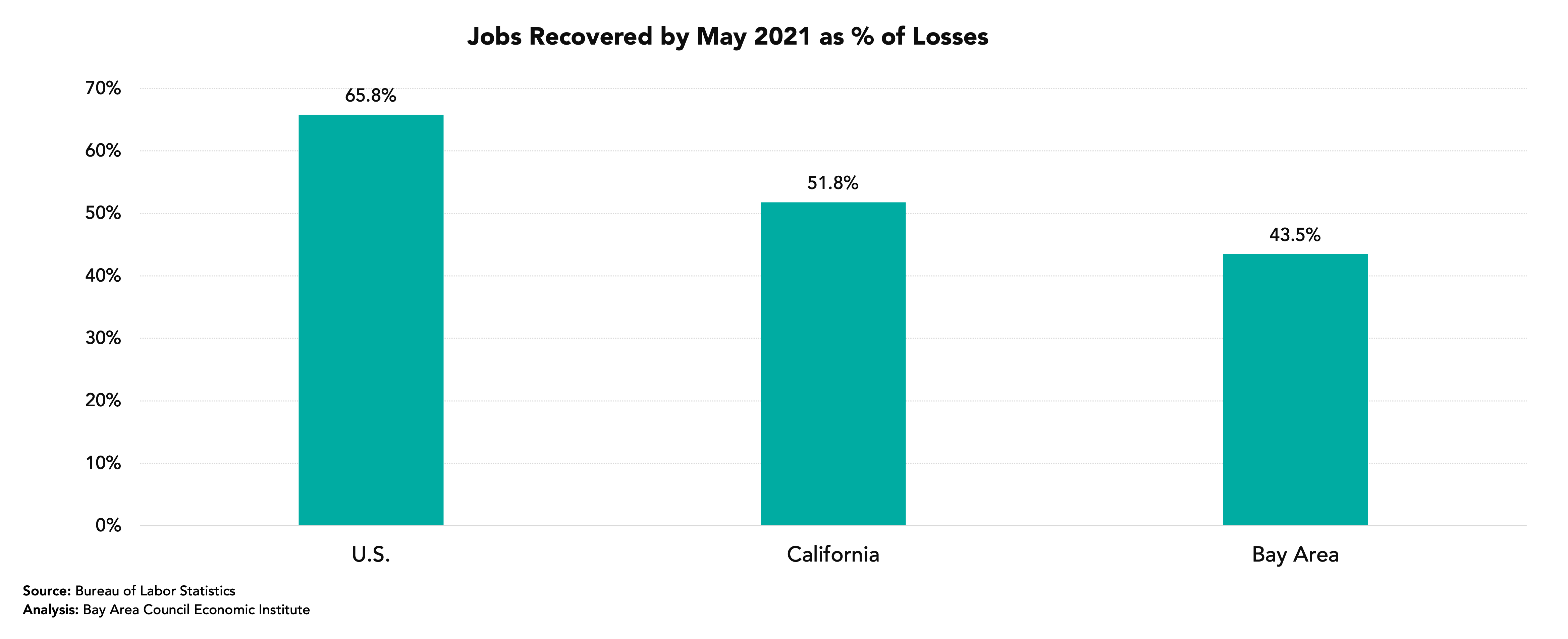

The Bay Area Had Recovered Just 43.5% of Lost Jobs by May 2021

In May 2021 the Bay Area had recovered 43.5% of the jobs lost between February and April 2020 up from 29.4% in January. The state had recovered 51.8% up from 34.0% while the nation had recovered over half (65.8%) of lost jobs up from 55.4%. The cause of low job recovery in the region and state was the extent and duration of activity restrictions compared to elsewhere in the nation. In the past three months the Bay Area and California have begun to catch up and that should continue with the good vaccination news and continued reopenings.

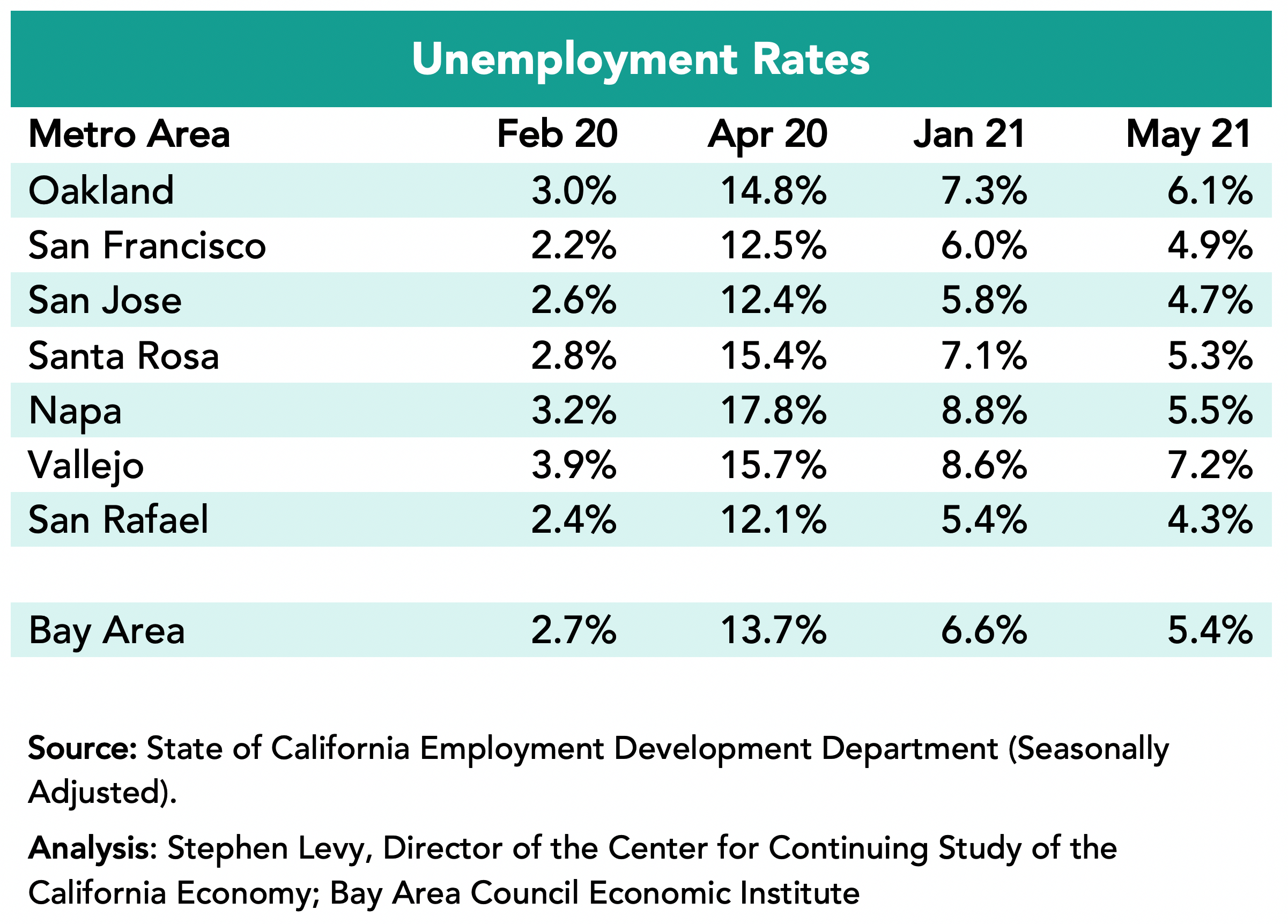

Unemployment Rates Fell to 5.4% in the Region in May 2021

The lowest rates were in the San Rafael metro area (4.3%) followed by the San Francisco and San Jose metro areas in May 2021. Unemployment rates fell at the same time that some workers returned to the labor force, which is a positive sign. The number of unemployed residents is down 47,400 since January 2021 though the level is still nearly twice the pre-pandemic low.

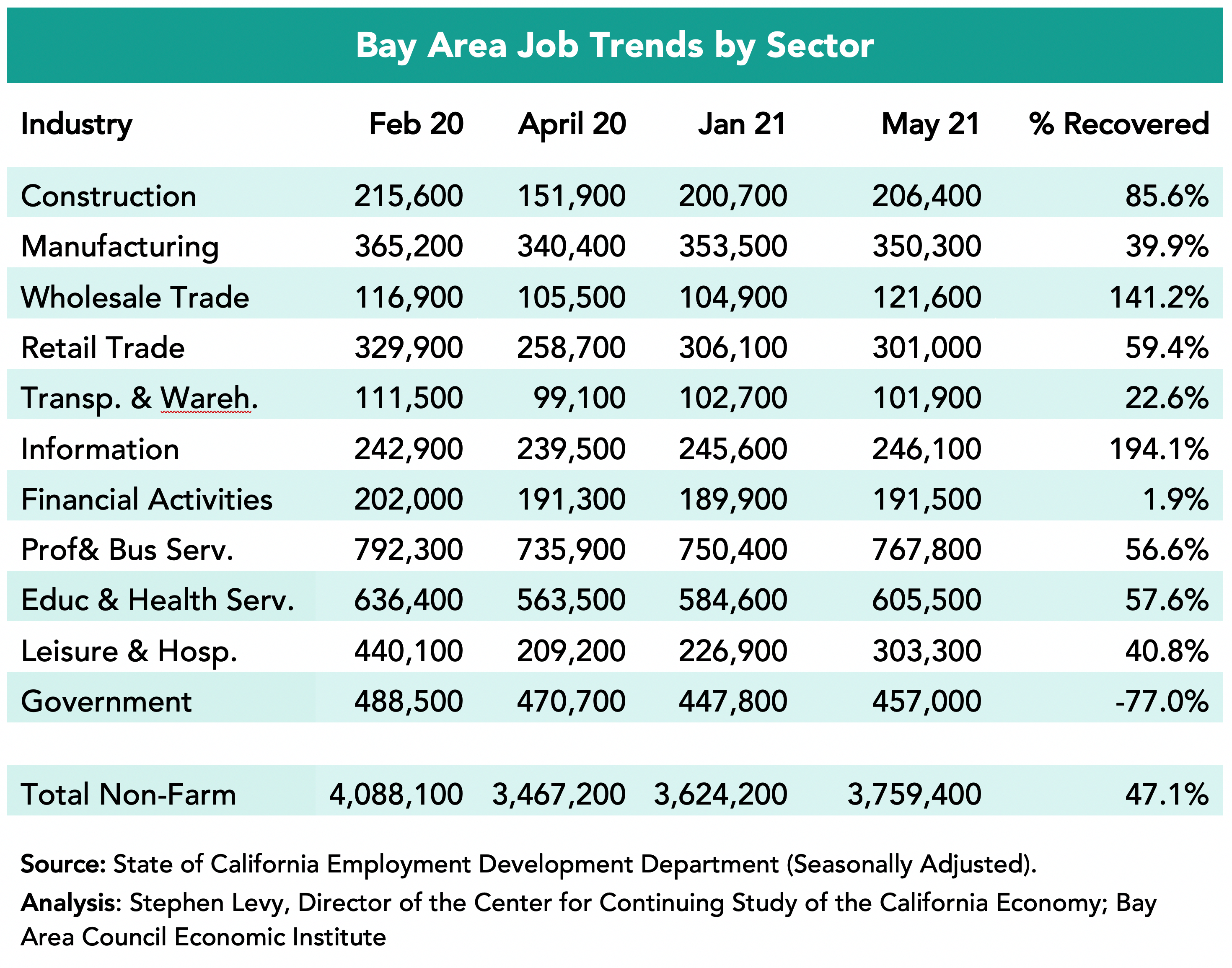

Industries Were Affected Differently

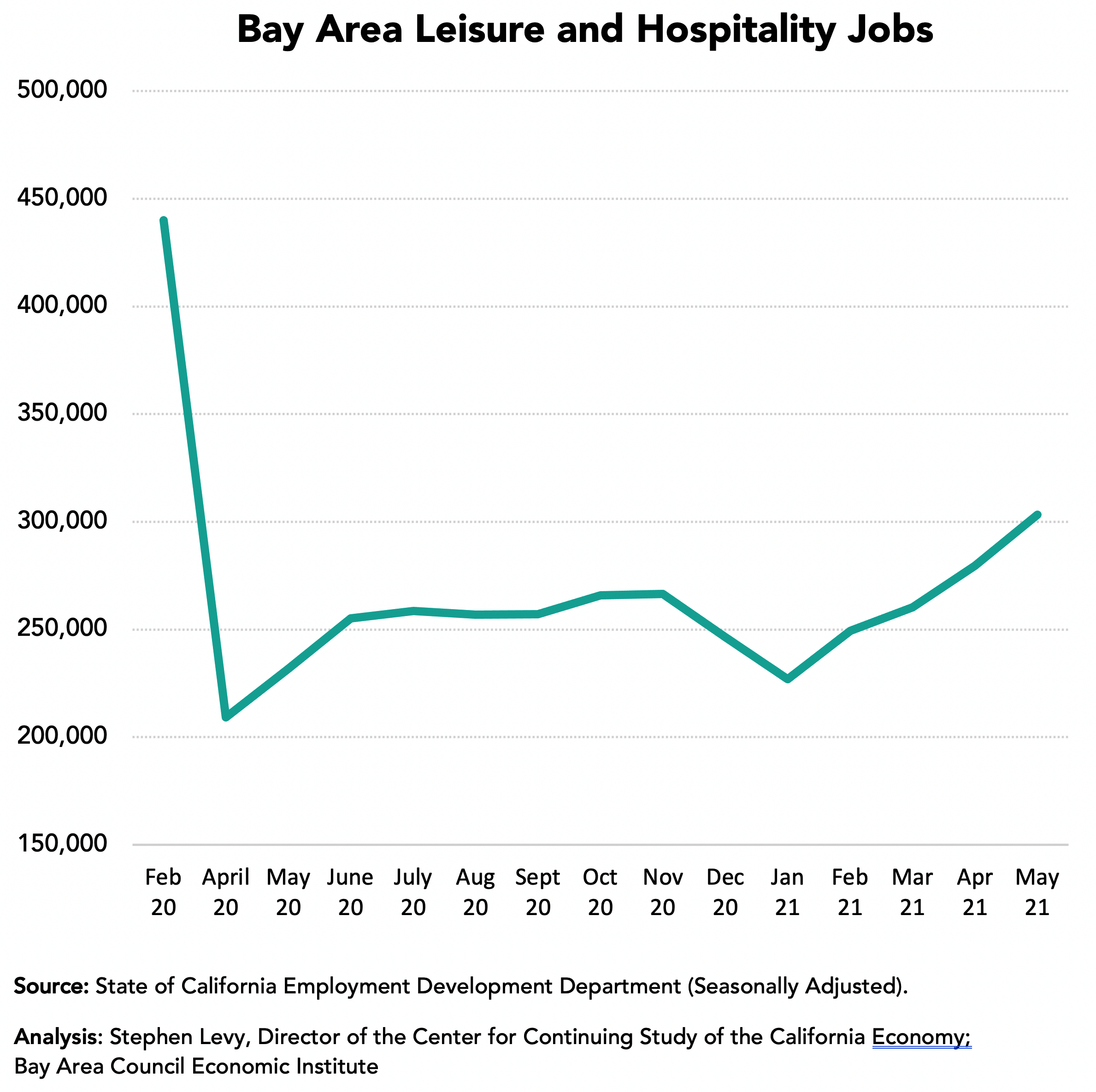

The Information sector actually added a small number of jobs compared to before the pandemic hit. On the other hand, the Leisure and Hospitality sector recovered only 40.8% of lost jobs by May 2021 and much of these in the past four months. The Government sector has fewer jobs now than in April 2020. The Construction sector has recovered most of the jobs between February and April 2020.

The Leisure and Hospitality Sector Took the Biggest Hit but is Now Recovering

Restaurant job gains have fueled recent regional job growth and now tourist and sports activities are reopening, which should lead to further job recovery if enough workers can be found.

The Look from June 2021

Several factors point to a better economic outlook for the Bay Area. The UCLA June 2021 forecast has the state outpacing the nation in job growth for the next two years led by the Bay Area economy. The recently passed COVID relief package ($1.9 trillion), the new policies on immigration, trade and infrastructure all support the region and state economies.

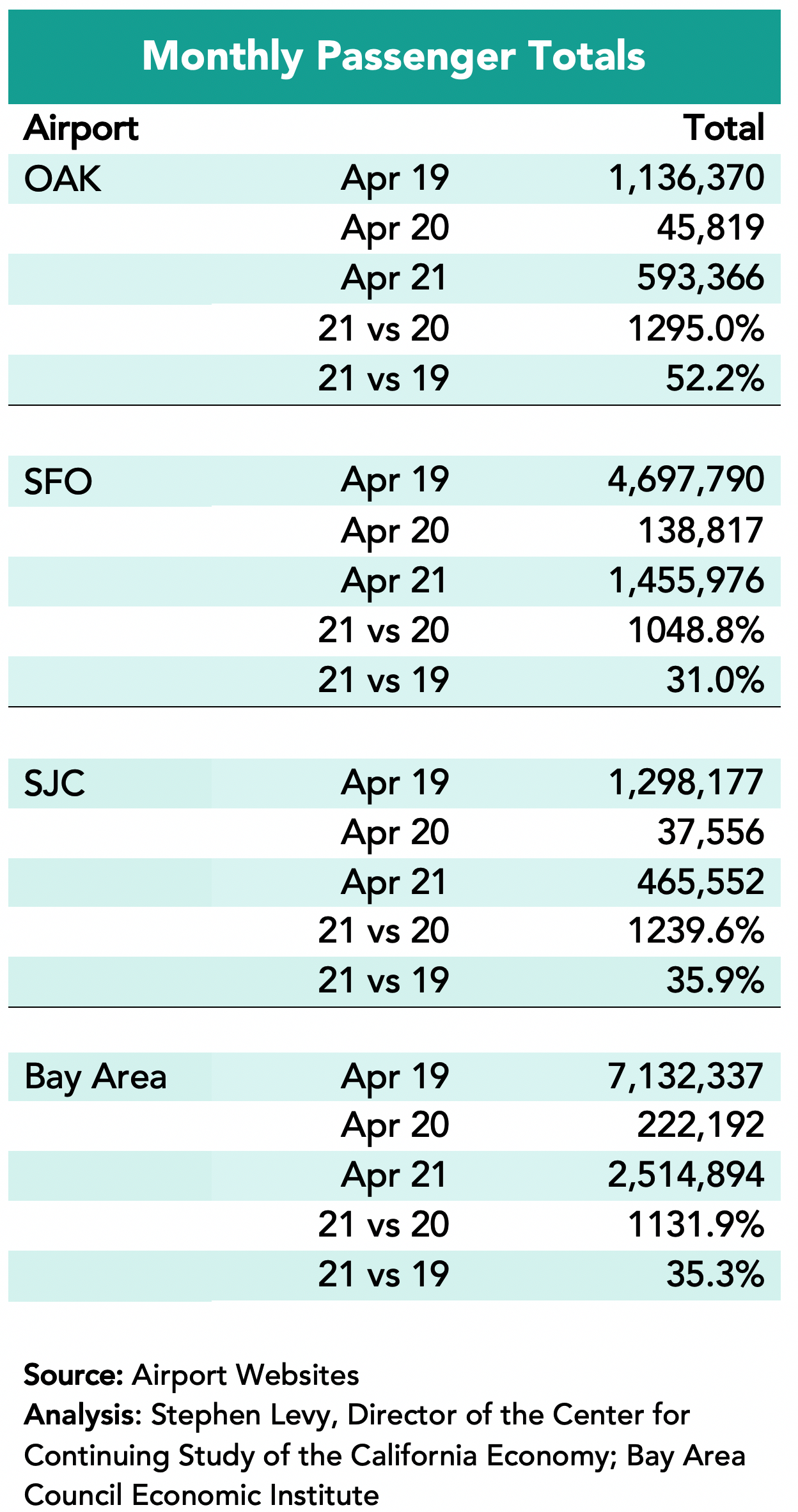

Airline Passenger Count Up, But Still Far Behind 2019 Levels>

Airline passenger counts picked up in April at all Bay Area airports. However, Bay Area passenger counts in April 2021 were just over 1/3 of comparable month 2019 totals.

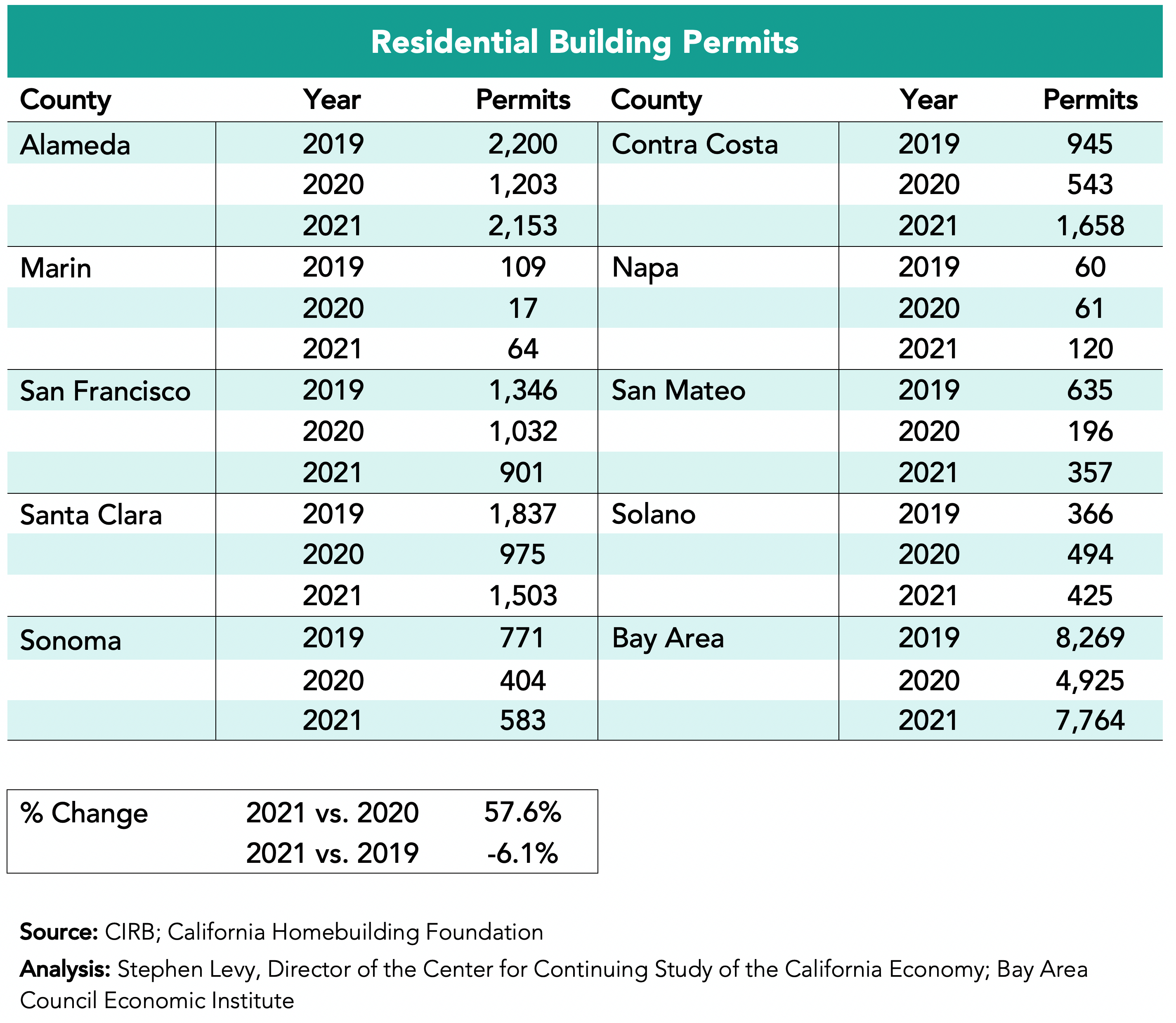

Housing Permits Up Over 2020 Levels, Trail 2019 Slightly

Housing permit levels are up over 2002 in the first four months of 2021 but still slightly trail 2019 comparables.

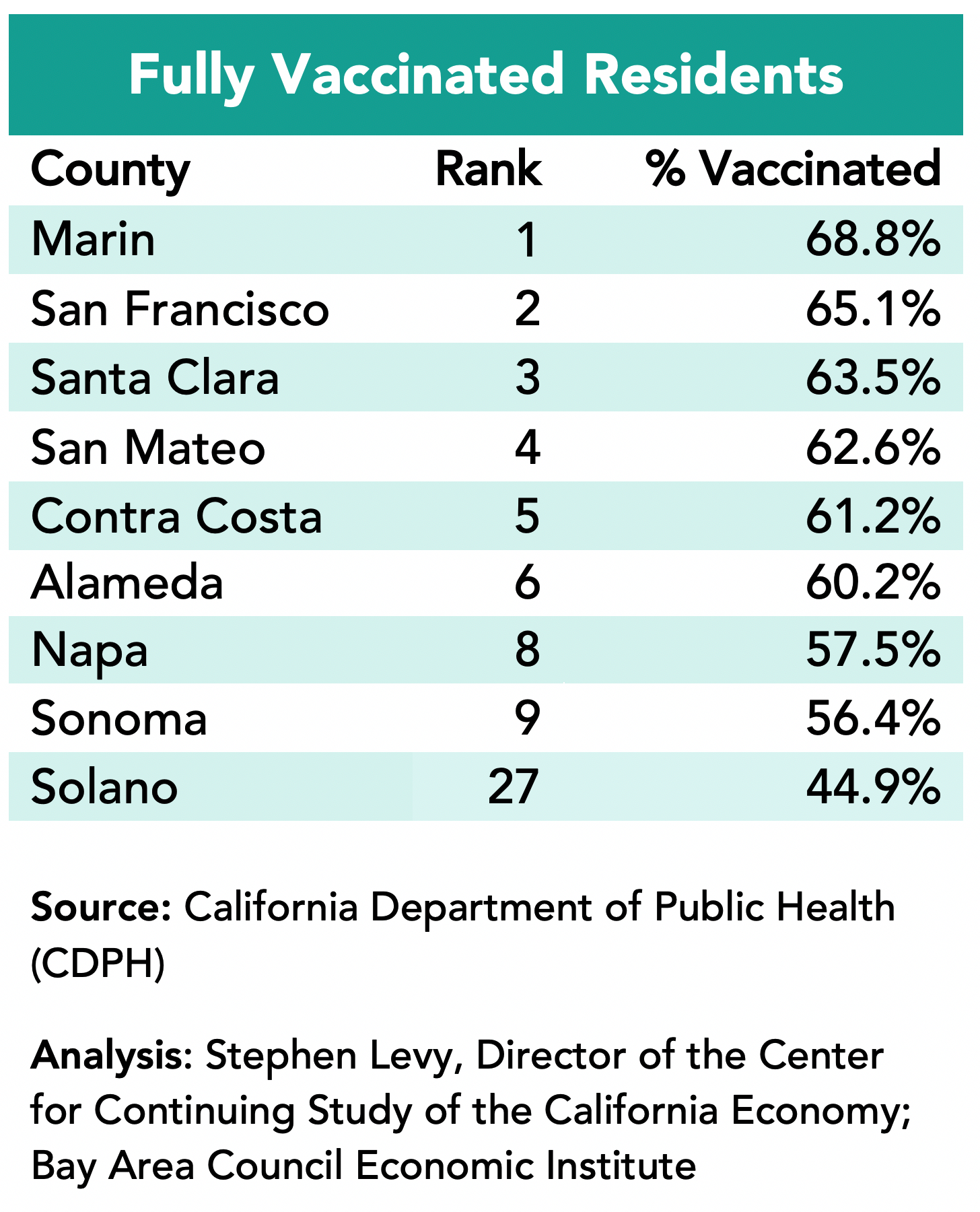

Bay Area counties rank high in fully vaccinated residents among the state’s 58 counties though vaccination rates have been rising more slowly in recent weeks as many residents are already fully vaccinated.

Large Challenges Remain:

Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

The rebound from pandemic related economic losses will continue but new policies are needed to maintain and improve the long-term competitiveness of the Bay Area economy.