The Recovery Strengthens

June 14, 2021

The Bay Area posted modest job gains in March and April. The outlook for stronger near-term economic gains is positive though long-term challenges remain. The U.S. economic outlook has improved with positive implications for our region. The Bay Area success in battling the pandemic with declining case and hospitalization levels and high rates of vaccination has led to many reopenings with more to come that will be reflected in the May, June and July jobs reports.

The highlights:

• The Bay Area added 50,100 jobs between January and March 2021 .and the regional unemployment rate fell from 6.6% to 5.9%. Job gains were led by the San Francisco and San Jose metro areas.

• The U.S, and Bay Area economic outlook has been upgraded by the $1.9 billion COVID relief package that has so far resulted in growth in retail sales and the ISM manufacturing and services indices.

• The downward revisions in the Bay Area were comparable in % terms to those statewide. However, the Bay Area and state have now recovered a much smaller share of jobs lost compared to the nation.

• Bay Area growth should accelerate now with more businesses reopening including some in-person capacity at sports and tourist venues.

• The long-term Bay Area economic challenges remain with only slow progress on housing, transportation and economic competitiveness, challenges at the front of the Bay Area Council policy agenda.

Job Growth is Continuing

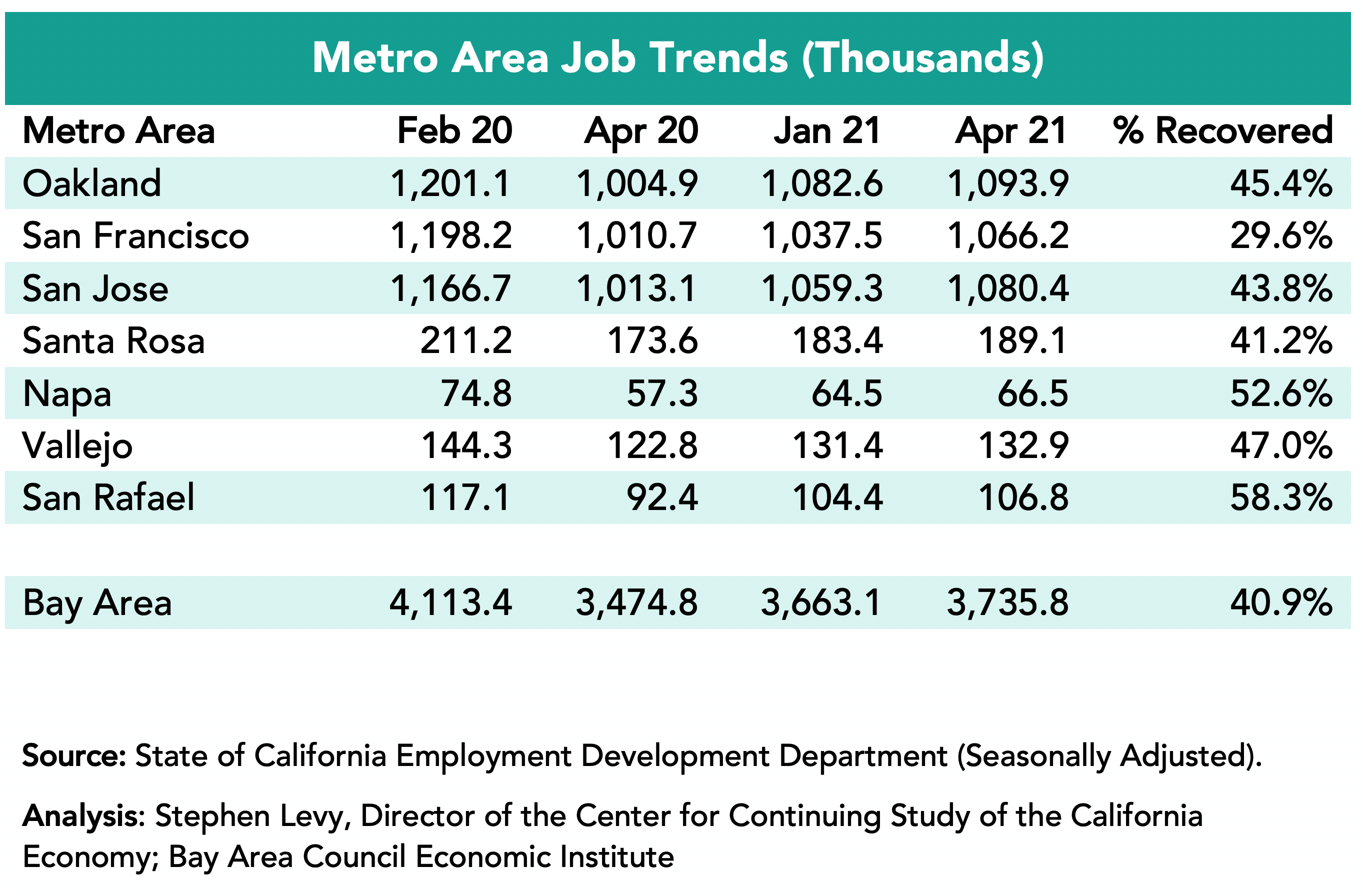

The Bay Area added 72,700 jobs in the past three months led by a gain of 28,700 in the San Francisco metro area though SF has recovered just 29.6% of the jobs lost between February and April 2020. The San Jose metro area added 21,100 jobs. but by March had recovered only 22.9% of the jobs lost between February and April 2020. The Napa, Vallejo and San Rafael metro areas had the largest % job recovery by April 2021.

The Bay Area Had Recovered Just 41% of Lost Jobs by April 2021

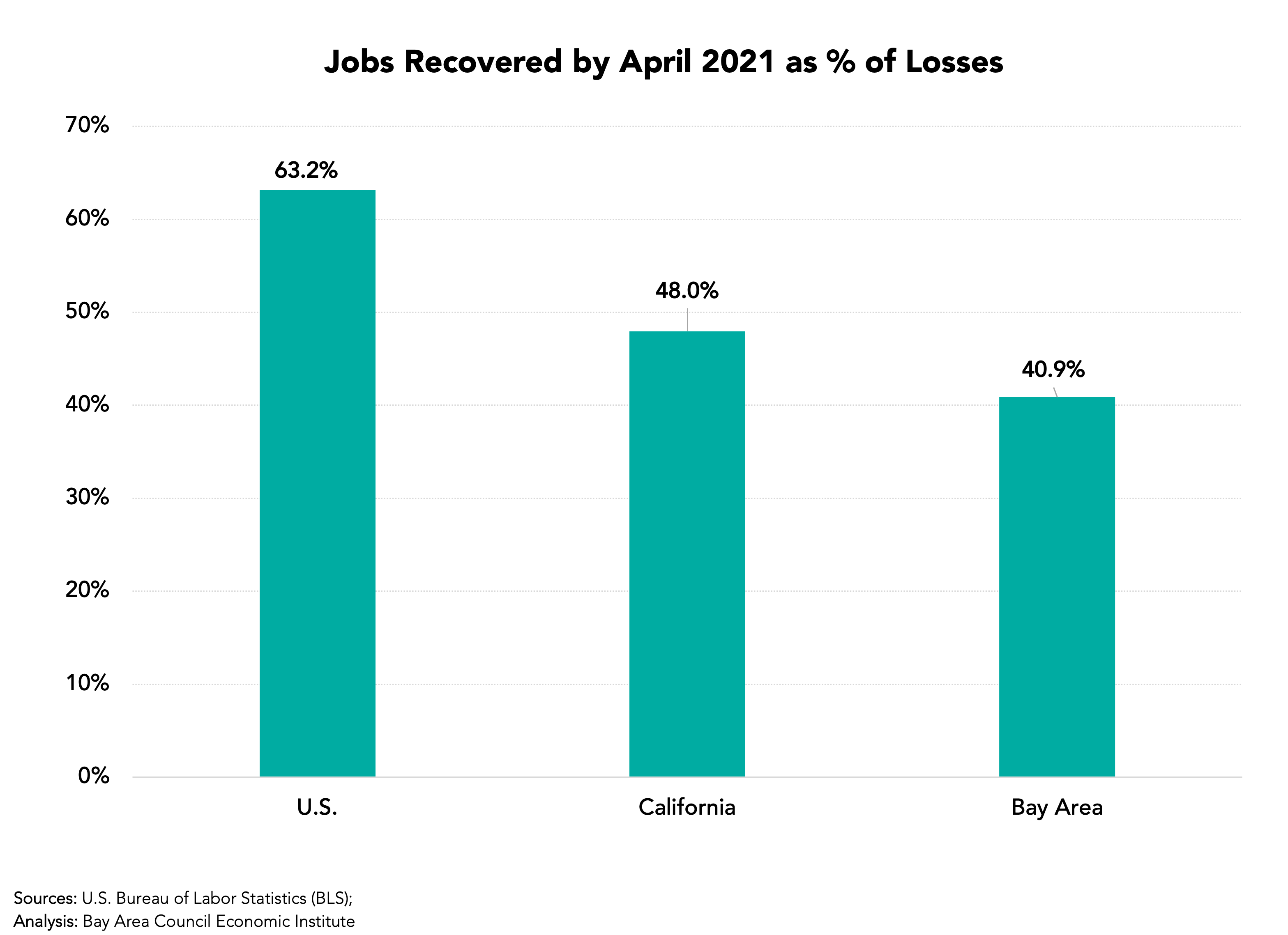

In April 2021 the Bay Area had recovered 40.9 of the jobs lost between February and April 2020 up from 29.4% in January. The state had recovered 48.0% up from 34.0% while the nation had recovered over half (63.2%) of lost jobs up from 55.4%. The cause of low job recovery in the region and state was the extent and duration of activity restrictions compared to elsewhere in the nation. In the past two months the Bay Area and California have begun to catch up and that should continue with the good vaccination news and continued reopenings.

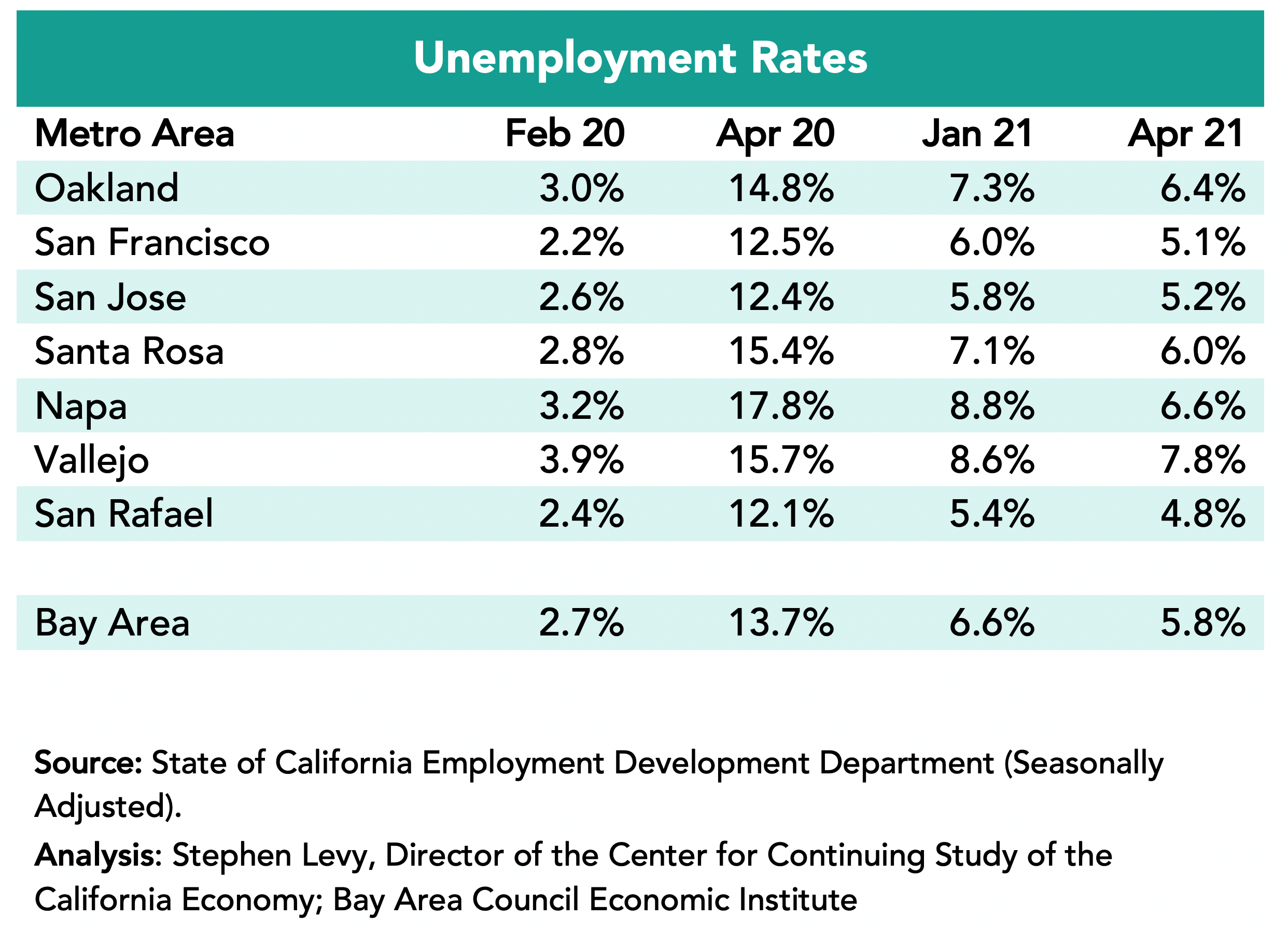

Unemployment Rates Fell to Below 6% in the Region

The lowest rates were in the San Rafael metro area (4.8%) followed by the San Francisco and San Jose metro areas in April 2021.

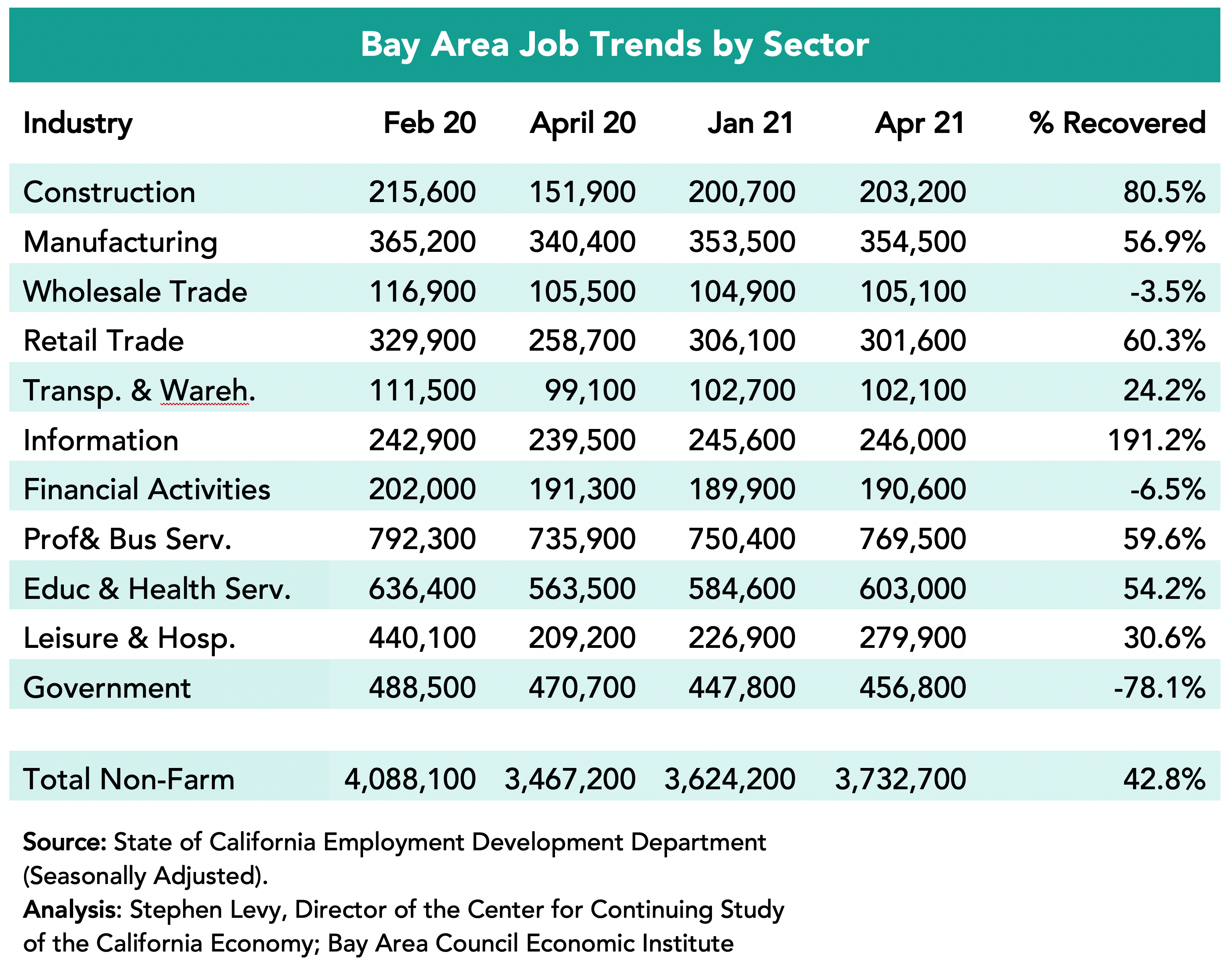

Industries Were Affected Differently

The Information sector actually added a small number of jobs compared to before the pandemic hit. On the other hand, the Leisure and Hospitality sector recovered only 30.6% of lost jobs by April 2021 and much of these in the past three months. The Government, Wholesale Trade and Financial Activities sectors have fewer jobs now than in April 2020.

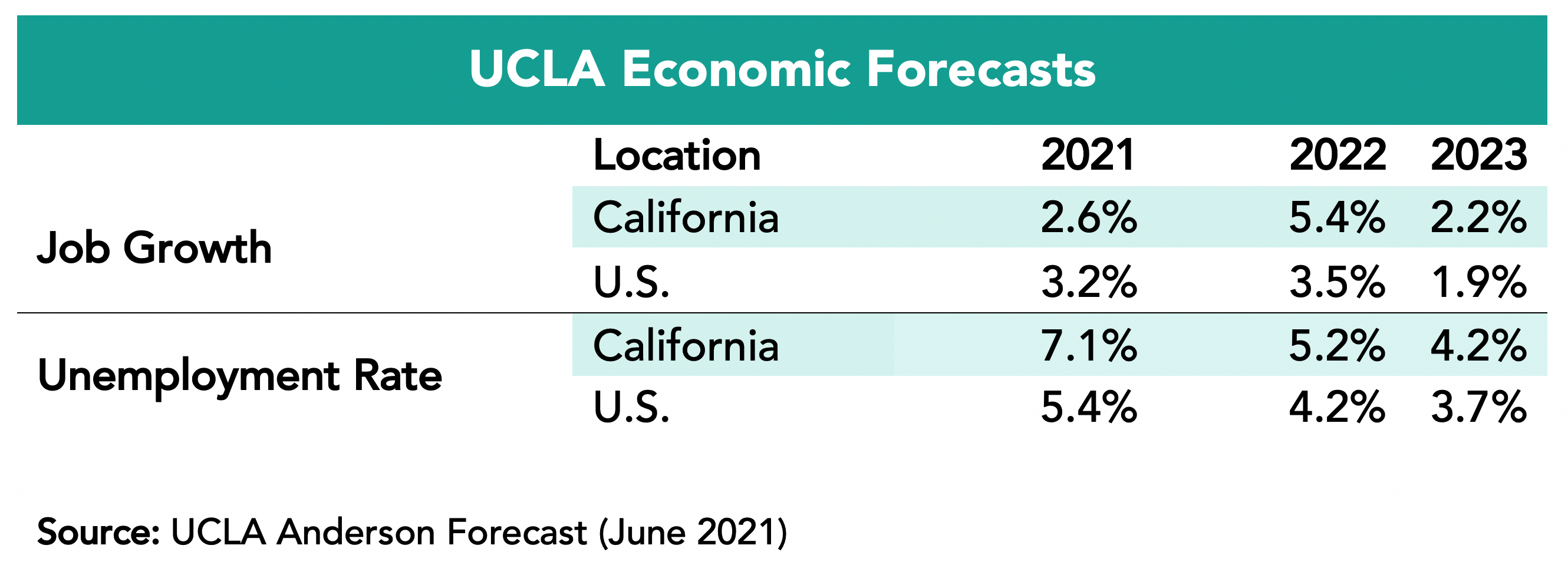

The Look from June 2021

Several factors point to a better economic outlook for the Bay Area. The UCLA June 2021 forecast has the state outpacing the nation in job growth for the next two years led by the Bay Area economy. The recently passed COVID relief package ($1.9 trillion), the new policies on immigration, trade and infrastructure all support the region and state economies.

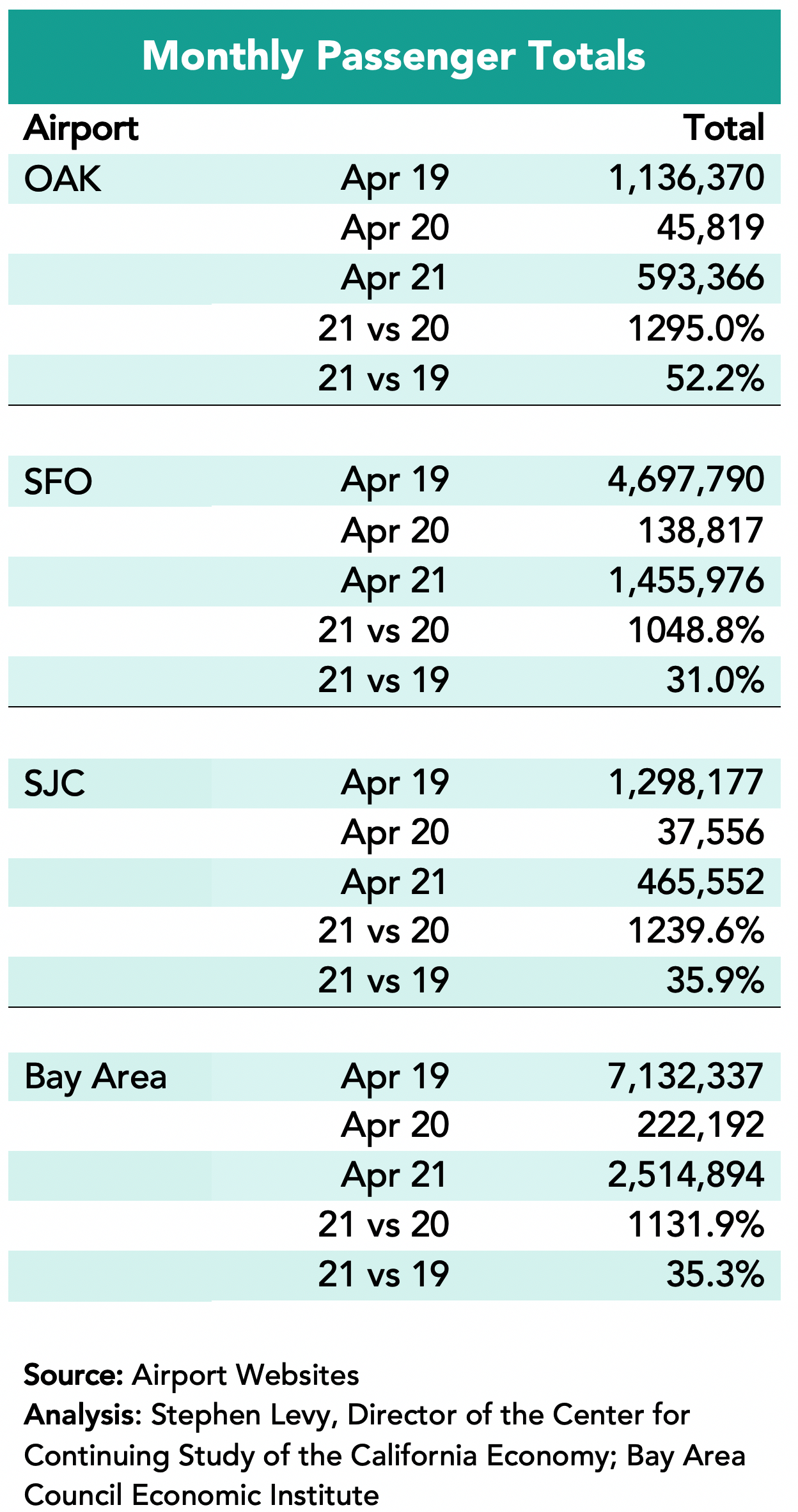

Airline Passenger Count Up, But Still Far Behind 2019 Levels>

Airline passenger counts picked up in April at all Bay Area airports. However, Bay Area passenger counts in April 2021 were just over 1/3 of comparable month 2019 totals.

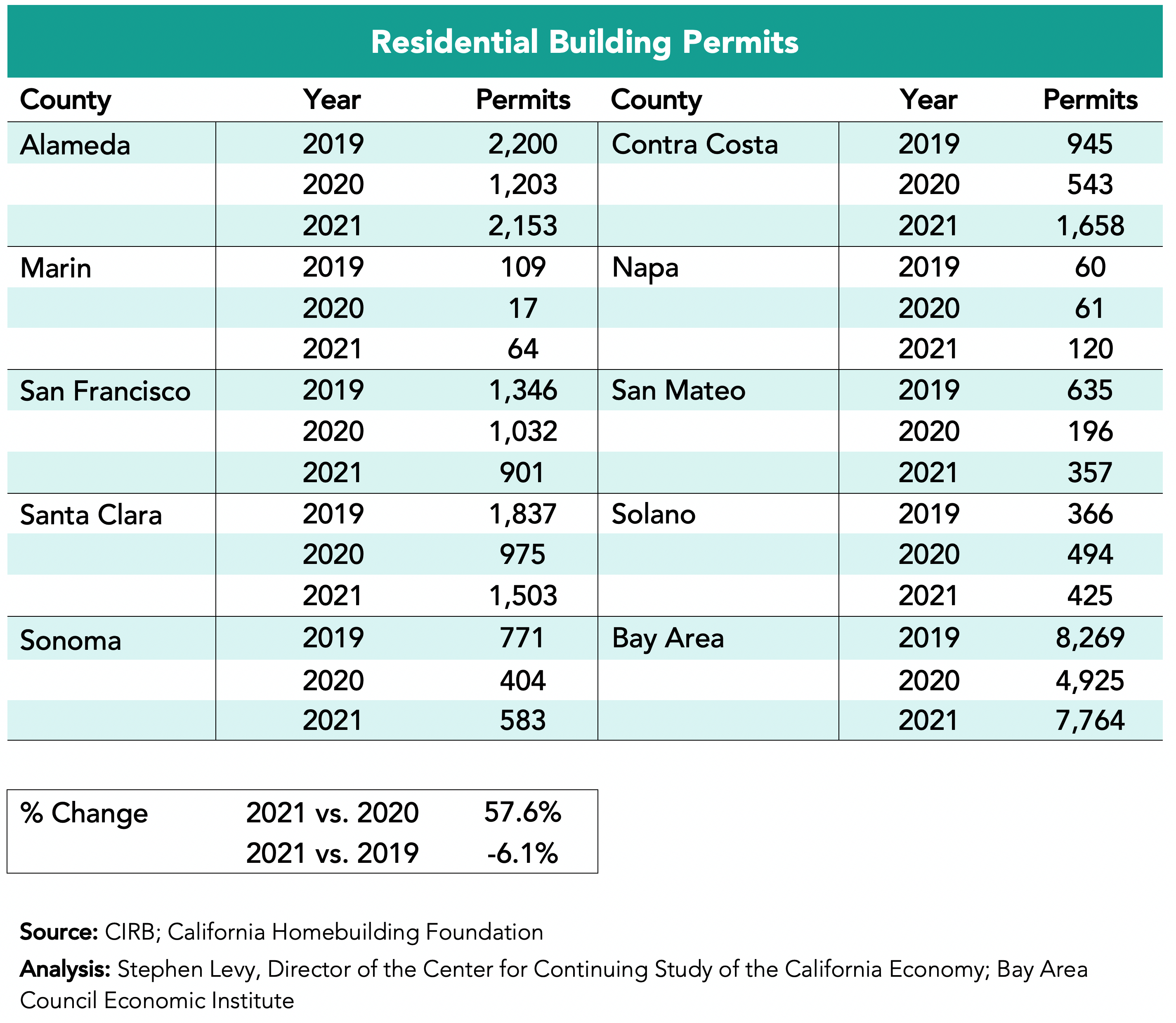

Housing Permits Up Over 2020 Levels, Trail 2019 Slightly

Housing permit levels are up over 2002 in the first four months of 2021 but still slightly trail 2019 comparables.

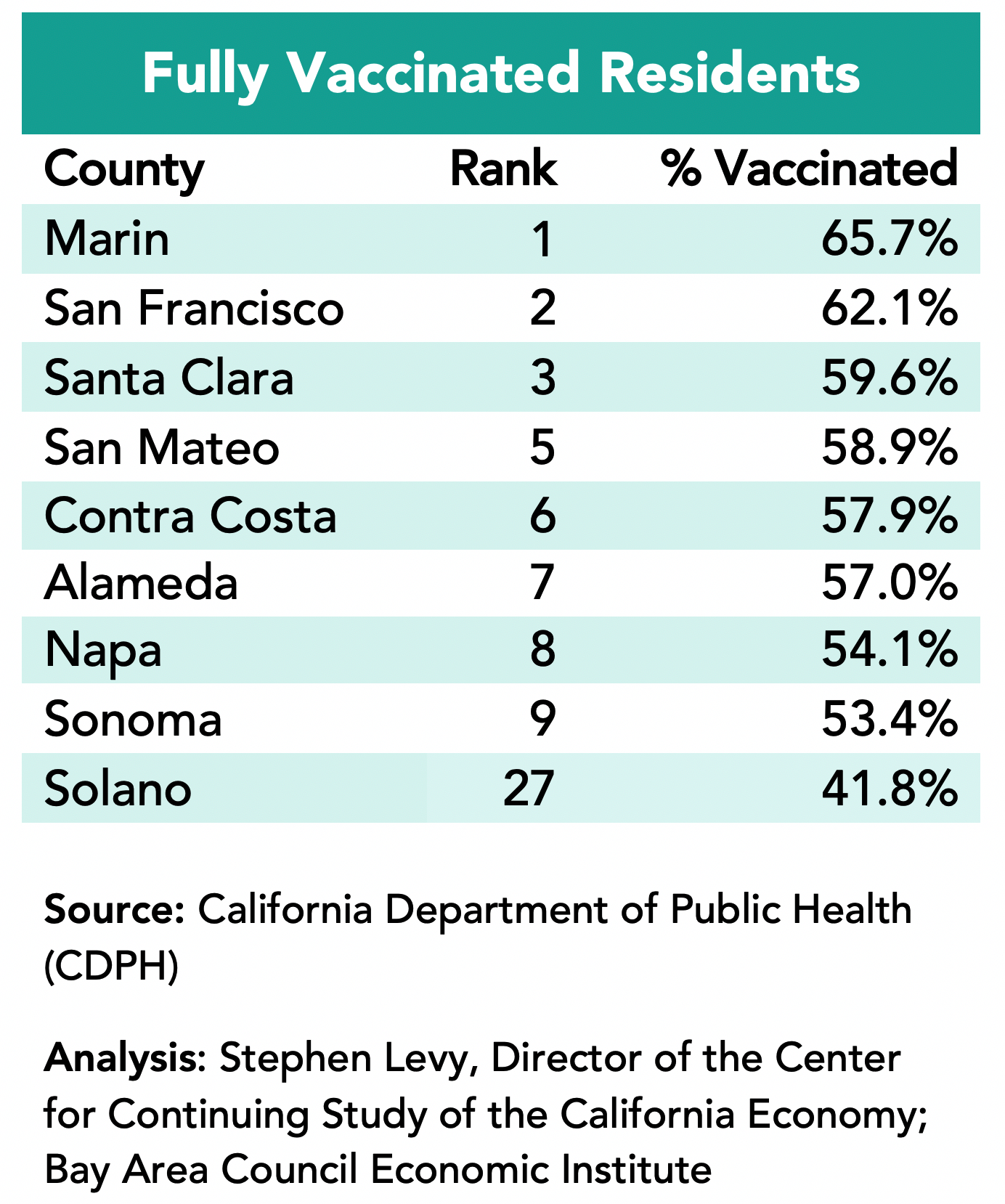

The Bay Area has the 2nd lowest case rate among California regions well below the state and national averages. The Bay Area had 16.6 cases per 100,000 residents in the most recent period and that is down substantially from the 52.5 cases per 100,000 residents in the last economic update report.

Bay Area counties rank high in fully vaccinated residents among the state’s 58 counties and the vaccination share has been rising by 3% or more in recent weeks.

Large Challenges Remain:

Yet, the Bay Area Council warnings about losing our competitiveness remain as housing and mobility challenges are far from solved—the major causes of recent movements of companies and residents.

The rebound from pandemic related economic losses will continue but new policies are needed to maintain and improve the long-term competitiveness of the Bay Area economy.