Job Growth Continues, Unemployment Continues to Decline

The highlights:

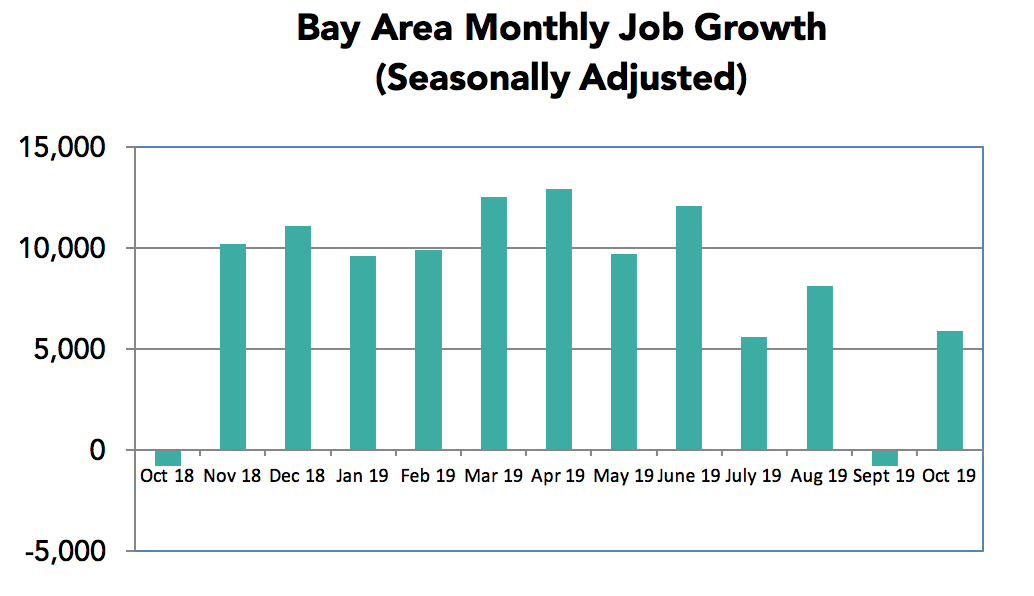

• The Bay Area added 5,900 jobs in October seasonally adjusted), following a loss of 800 jobs in September (revised down and 104,000 in the past 12 months. State job growth has rebounded in recent months and CA job growth now well outpaces the nation.

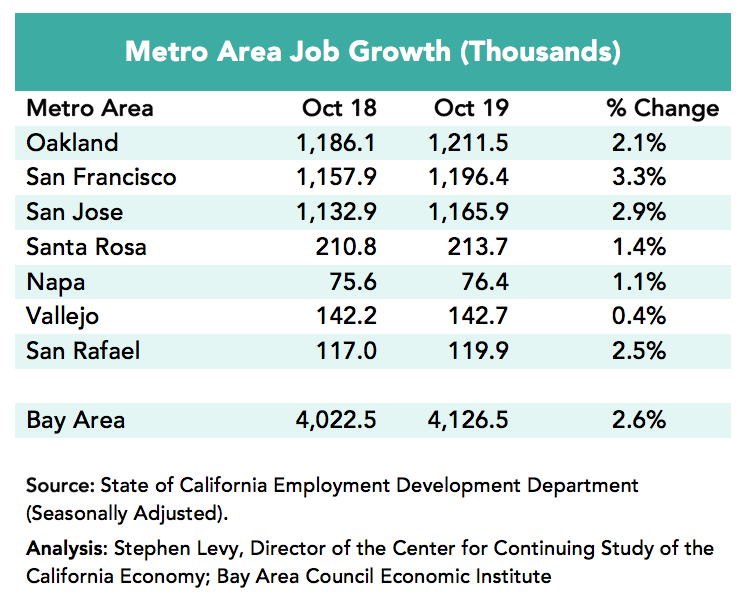

•The job growth in for the past year was primarily accounted for by gains in the Oakland, San Francisco and San Jose metro areas.

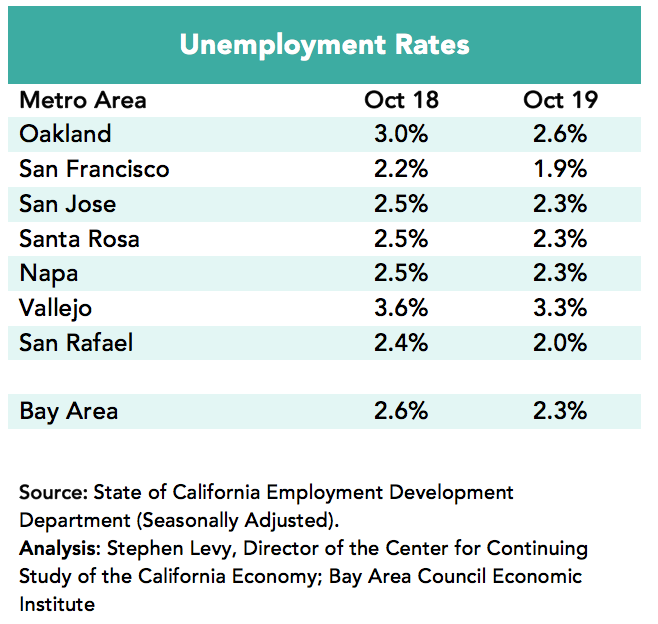

• The regional unemployment rate was 2.3% in October down from 2.6% a year ago.

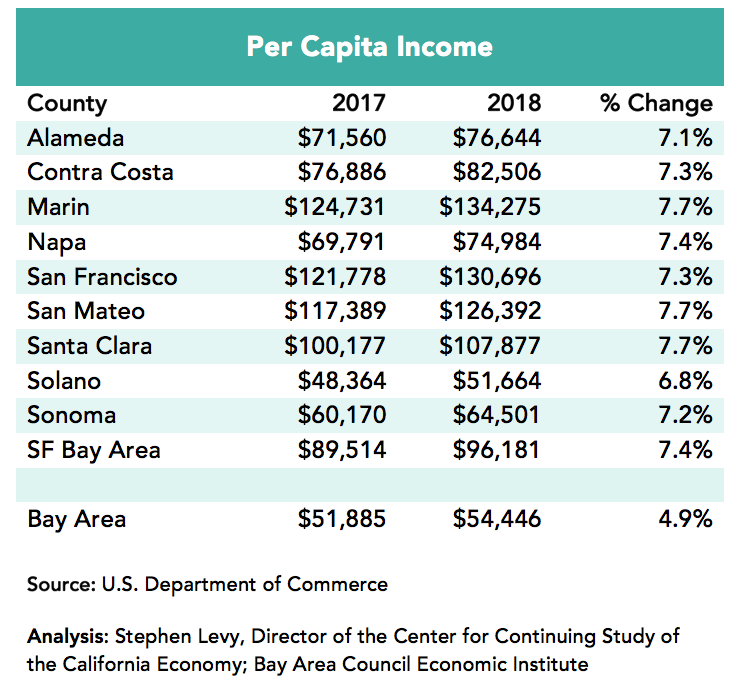

• There was strong growth in total and per capita income throughout the region in 2018.

The Bay Area Continues to Outpace the State and Nation in Job Growth

Year over year job growth of 2.6% (up from 2.5% last month) far outpaced the 1.4% growth for the nation and 1.8% gain in the state. The state once again is outpacing the nation.

The San Francisco metro area led the region in job growth over the past year followed by the San Jose metro area. The Oakland and San Rafael metro areas also posted strong growth.

Unemployment rates (2.3% for the region) in October 2019 were well below year earlier rates and at levels not seen in almost 20 years at the height of the dot.com boom.

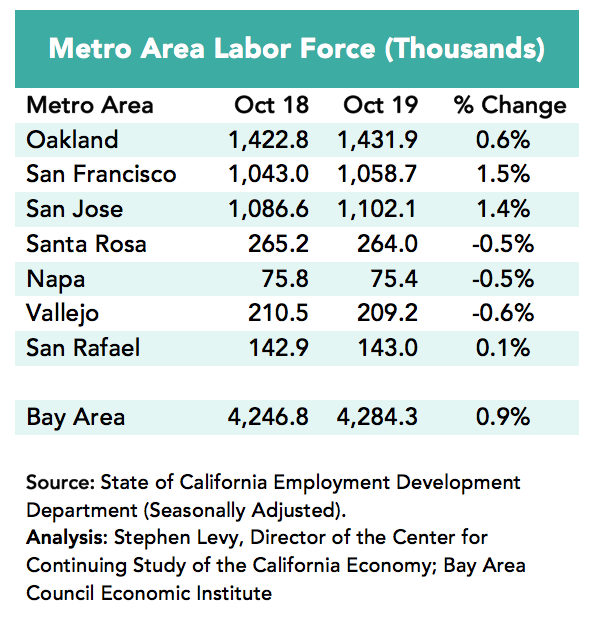

Regional labor force growth continued in October up 0.9% (37,500) from the year earlier levels.

Year over year job growth has remained in a narrow range since early in 2017. This occurred despite slowing population growth and rising outmigration in the face of high housing costs. In October 2019 year over year job gains were at the top of the recent range.

Monthly job gains have fluctuated in recent months. Is this the beginning of a slowdown tied to slowing U.S. and world growth and labor shortages? Future months will clarify if this is the beginning of a trend. Job growth over the full past 12 months remains strong.

Per capita income grew by 7.4% in the Bay Area in 2018 far outpacing the national gain of 4.9%. Per capita income is above the national average in all counties except Solano in 2018.

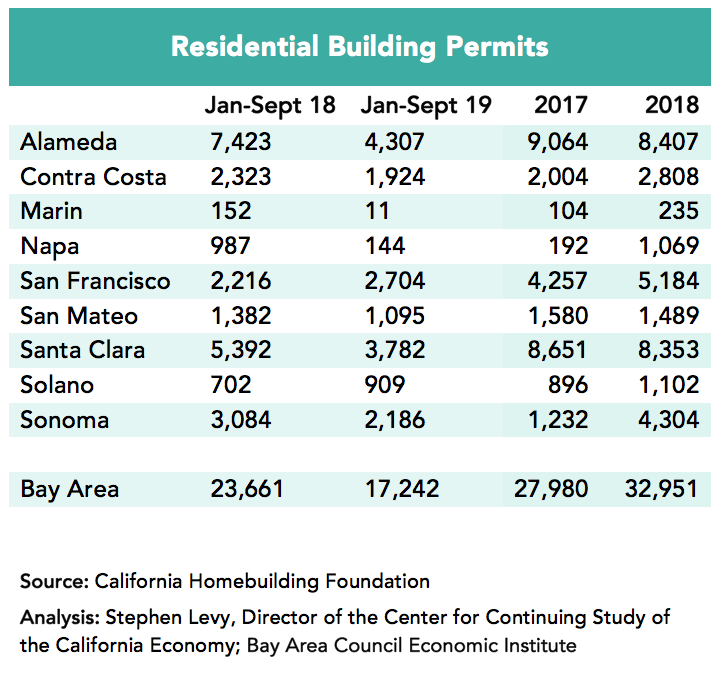

Housing permit levels declined in the first nine months of 2019. The probable causes are increasing construction costs and a shortage of labor. In most cases fees are due when the permit is approved giving another reason to delay taking out the permit even though the project is already approved. On the other hand there has been a recent surge in new housing approvals and projects previously approved being completed.

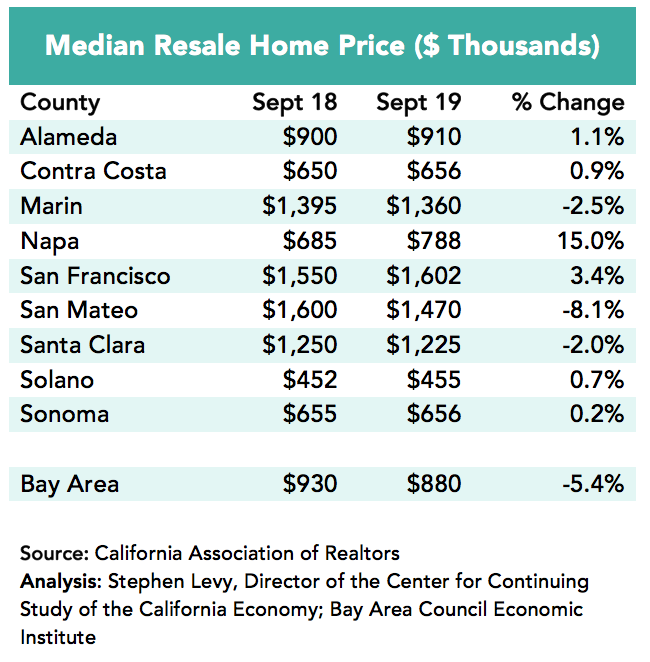

There is some evidence that the surge in resale home prices has peaked though that is a separate market from the rental market and even more separate from funding and approval for BMR units. Median resale prices continue to be slightly below year earlier levels. The Case Shiller price index, which matches comparable homes, has the Bay Area index down 0.1% for the year ending August 2019.

There have been a number of analyses of cost pressures and the need for projects to pencil out for equity and debt partners as well as developers. Here is one https://sf.streetsblog.org/2019/09/04/spur-talk-housing-development-by-the-numbers/. Here is another. https://ternercenter.berkeley.edu/blog/demystifying-development-math. This concept is well understood by Council members but seems hard to find acceptance among more general resident audiences.

The next round of the state-mandated Regional Housing Needs Assessment (RHNA) is approaching for the Bay Area. State law has added two new categories of need: 1) reducing overcrowding and 2) reducing the number of cost-burdened households. This will increase the new regional housing target substantially and tilt it more towards building housing for low and moderate income residents. Stay tuned for updates as the process unfolds.